Contents

With Aave, you can access a loan in your preferred cryptocurrency. You can also lend your crypto and earn interest.

Aave explained—the DeFi Lending Protocol. Aave acts as an online bank. Lending and loaning as its main activities, using crypto, a decentralized protocol, and ERC20 tokens under the Ethereum blockchain. Ethereum acts as the barebone where all this activity occurs, implemented as Smart Contracts. In this post, we will try to ensure Aave is well understood.

Aave History

Aave was born initially under the name of ETHLend. It had the same concept used today: Decentralized Finance (DeFi) platform for loans under the P2P idea (person to person). Launched in 2017, ETHLend was one of the DeFi category’s precursors in credits with crypto assets. They even offered the possibility of requesting and guaranteeing loans directly with Bitcoin. This is a rather peculiar feature since we are discussing a platform that works under the Ethereum network.

In September 2018, ETHLend evolved to Aave. It changed the loan operation and implemented liquidity pools. They are nothing more than a tokens-locked pool by a Smart Contract. In a Liquidity pool, lenders could deposit their cryptocurrencies, and others can request loans. The supply and demand laws set the interest rates.

The change from ETHLend to Aave is also a result of the fierce competition seen in the DeFi sector with the Compound or Maker platforms. Aave began to offer services beyond the P2P scheme. All this paid off because, by August 2020, Aave had the most blocked value (money given as collateral) than its closest competitors, being the leading DeFi platform in liquidity.

What are collateralized loans?

Imagine going to the bank and saying that you want to apply for a loan of 1 million dollars. The bank will require some conditions before you can use the money. They’ll ask you to put in some collateral to cover their risk if you can’t return their money. But how is this possible in the digital world? Anonymity or pseudo-anonymity is king in the world of cryptocurrencies. Well, for this, there are deposits in guarantee or collateral value.

If you request a loan within Aave, you must give another crypto asset as collateral. If you need DAI, you can provide ETH (or any other available coin) as collateral and receive the equivalent DAI for a fraction of the given value.

The advantages of this type of guarantee loan are usually a bit abstract since, if you already have $100 in ETH, why take out a loan in DAI, for example, for a fraction of the deposited value, such as $70, in Instead of just selling the ETH? The answer is that by applying for this type of loan, you do not lose your original position and have access to a less volatile currency against the dollar.

For example, let’s assume that you put $100 in ETH you put for collateral for $70 in DAI has now turned into $200 in ETH because of a rise in the Ethereum price. To recover your original ETH, you will only have to pay the $70 in DAI, plus commissions, and voila, your guarantee is released, and you have just a $130 value in ETH on hand. Another advantage, in this case for lenders, is that it allows you to earn interest with low risk for your savings by depositing them in Aave’s liquidity pools.

How do loans work at Aave?

One of the innovations that brought Aave was the concept of the “Liquidity Pool,” which allows the creation of a single fund so that other users can request loans. This method is now also used by its competitors, Maker and Compound.

The loans are requested directly from your Metamask wallet or any other compatible wallet. These loans are approved instantly, and you must wait for them to be confirmed within a block of the Ethereum network to see the available funds.

The final value you can withdraw is the percentage of the collateral’s total value, which the platform defines based on the liquidity of the requested cryptocurrency pool. Generally, the net worth you receive is around 75%, with a liquidation threshold of 80%. Imagine the same example exposed before. If the price of ETH falls, cause the value of the ETH you deposited to be $90. The 75 DAI in your hands is no longer 75% of the value but 83%, which would liquidate your position.

When your loan reaches the threshold, it is closed without the opportunity to recover it. You will be returned part of the value in the currency given as collateral, less a penalty percentage of around 5%.

One of the novelties that Aave implements is the ability to move between fixed and variable interest rates, according to your convenience and not only when applying for the loan, allowing users to plan their strategies better about how long they plan to apply for a loan.

The supply and demand of the liquidity pool cryptocurrency set the interest rates. The lower the availability, the higher the interest rate, implying that the interest rate variations can be remarkably abrupt when the liquidity is low.

Available cryptocurrencies in Aave

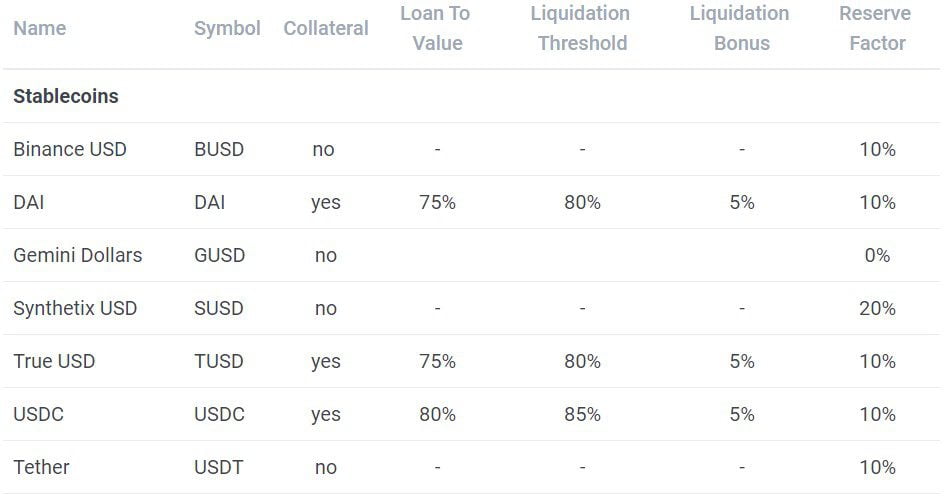

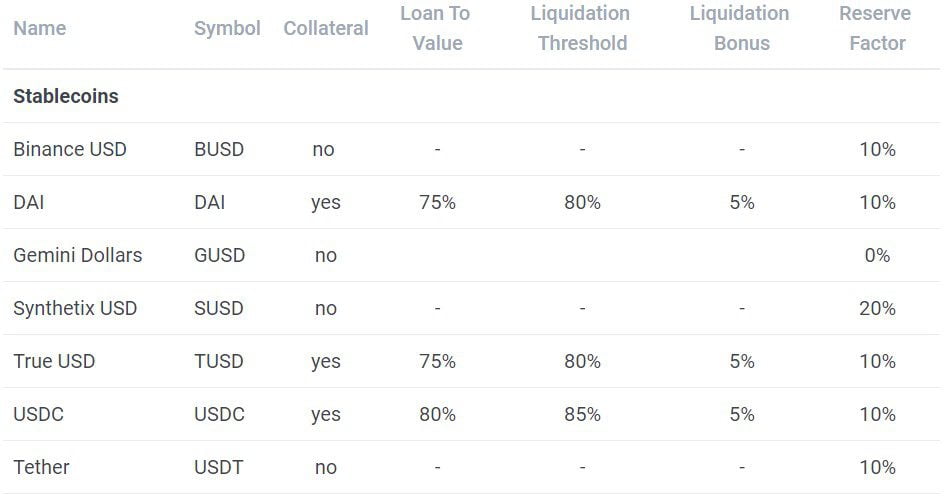

Compared to its competition, one of Aave’s strengths is its catalog of available cryptocurrencies. Aave currently has 20 listed crypto assets, among which you can find ETH (Ether), BAT, WBTC (Wrapped Bitcoin), and stablecoins such as BUSD (Binance USD), SUSD (Synthetix USD), TUSD (Trust USD), DAI, and USDT (Tether).

The exciting thing is not only in the number of assets available but also in listing them. Aave has developed a whole methodology available in its documentation, with which it evaluates the different risk patterns of a cryptocurrency. Centralization is a rather particular risk factor, where, for example, USDT (Tether) is rated C in this category, with A+ being the highest and D- being the lowest.

This methodology allows Aave to set the thresholds for opening a loan: how much you would receive if you give that cryptocurrency as collateral and settlement.

Aave secondary markets

Aave defines itself as an “ecosystem of money markets” that develops around the loan concept. This ecosystem allows, within its protocol, to include external markets that work under the same Ethereum network, as is the case with Uniswap.

Uniswap is a decentralized exchange market that works on the Ethereum network. It manages liquidity pools, such as those used by Aave, for other users to carry out trades. By giving liquidity to these pools, that is, depositing some coin, you receive a 1: 1 equivalent token named UniToken. For example: if you deposit 12 DAI, you’ll receive 10 UniDAI.

You can exchange these tokens with other Ethereum network users, but Aave allows you to use them as collateral to request a loan. You can also use a cryptocurrency or token as collateral within the UniSwap market in Aave, which will provide liquidity to the UniSwap pool and allow you to request a loan through Aave.

Key facts

- Aave offers collateralized loans using the Ethereum blockchain.

- You can become a lender and earn interest by depositing crypto in Aave’s liquidity pools.

- Aave is a lending protocol implemented as Smart Contracts.