Bitcoin ETFs collectively hold $28 billion in assets under management (AUM).

In Short

- The SEC recognized bitcoin as a commodity in the ETF authorization.

- According to analysts, bitcoin’s AUM could surpass that of gold eventually.

Bitcoin’s Biggest AUM after Gold. The launch of bitcoin spot exchange-traded funds (ETFs) in the United States changed the game board in the market. This digital currency is the second commodity with the most assets under management (AUM) in the economic powerhouse, after gold. Precisely, bitcoin ETFs listed in the United States have collectively achieved an AUM of $28 billion. The news comes in a week since the SEC, the local securities regulator, allowed its launch, recognizing the currency as a commodity.

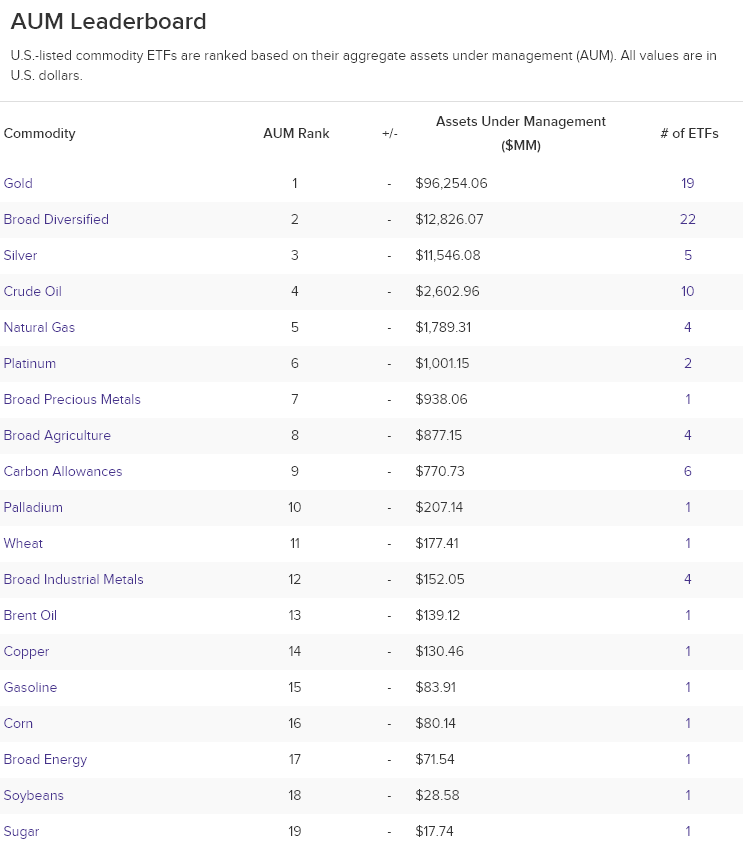

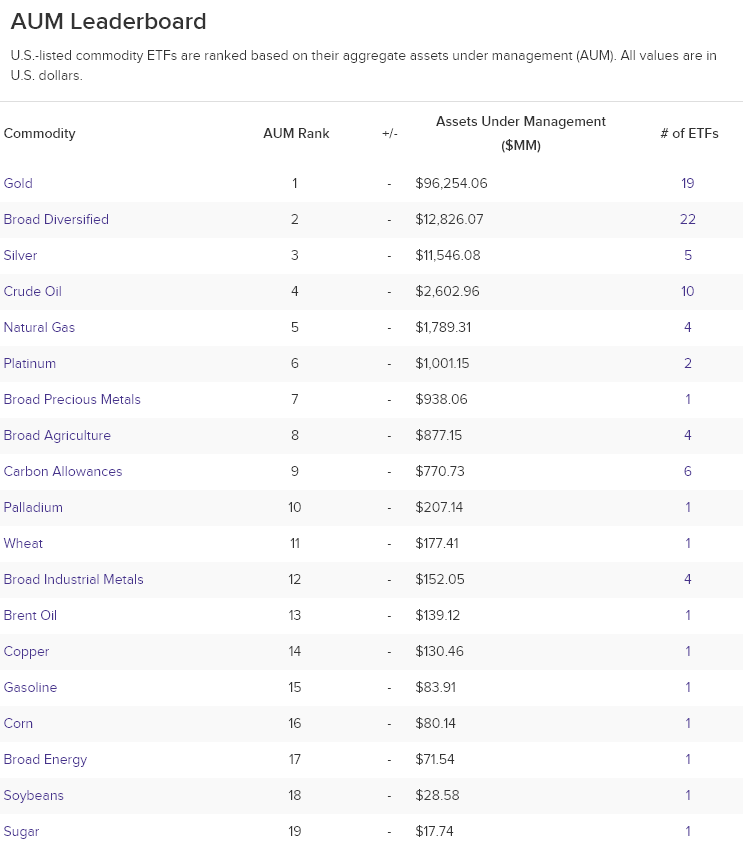

Investment in Bitcoin ETFs has surpassed that of ETFs based on financial asset pools, currently ranking third with a total of $12.8 billion in assets under management (AUM). Bitcoin ETFs now trail only silver, oil, and natural gas ETFs, which hold $11.5 billion, $2.6 billion, and $1.7 billion in AUM, respectively. Gold ETFs remain the undisputed leader regarding AUM, with a staggering $96.2 billion. Gold leadership is evident in the following list compiled by Bitcoin market analyst James Van Straten, which does not yet include Bitcoin ETFs:

List of ETF types with the most assets under management in the United States. Source: James Van Straten.

Van Straten exclaims, “Let’s see when Bitcoin AUM overtakes gold!” This milestone is within reach, as Bitcoin ETFs currently hold 30% of the AUM held by gold ETFs. Remarkably, this substantial percentage occurred in seven days without a significant influx of new capital.

Capital move from GBTC to the other bitcoin ETFs

Van Straten stressed that since the approval of BTC spot ETFs in the United States, capital outflows from one of them, Grayscale Bitcoin Trust (GBTC), are keeping pace with inflows into the others, meaning that no significant new demand is entering these financial instruments. One explanation for the muted performance of GBTC, which transitioned from futures to spot following regulatory approval, is its high commission fees. Additionally, the weakening demand and increasing supply for Bitcoin may hinder further capital inflows into these instruments.

Amidst anticipation of ETF approval, demand surged, propelling Bitcoin higher. However, following the event, investors engaged in the largest profit-taking spree since the currency’s all-time high two years ago. The event resulted in the coin’s price plummeting from $49,000 to around $42,000. Analyst firm Glassnode identifies this unusual large-scale profit-taking as a hallmark of bullish market trends. They believe that the upward trend could resume once ETFs attract substantial capital inflows and the planned BTC halving in April-May diminishes the supply in the market.

AUM Definition

Assets under management (AUM) is a crucial metric used to gauge the size and scale of a financial institution or investment manager. It represents the total market value of all the assets a firm is responsible for managing on behalf of its clients. AUM encompasses a wide range of financial instruments, including stocks, bonds, mutual funds, real estate, and alternative investments.

AUM serves as a key indicator of a firm’s financial strength and influence in the investment landscape. A larger AUM typically indicates a wider client base, greater expertise, and a more established reputation. Investors often consider AUM when evaluating investment managers, as it suggests a firm’s ability to attract and retain clients, as well as its potential investment returns.

AUM also plays a significant role in determining a firm’s profitability. Investment managers typically charge fees based on a percentage of AUM, meaning that a larger AUM translates into higher fee revenue. This financial incentive drives investment managers to strive for strong performance and attract more clients to grow their AUM.

In summary, AUM is a multifaceted metric that reflects the size, influence, and profitability of a financial institution or investment manager. It serves as a valuable benchmark for investors when evaluating potential investment opportunities.