For the first time since July, the correlation between the two assets enters negative territory.

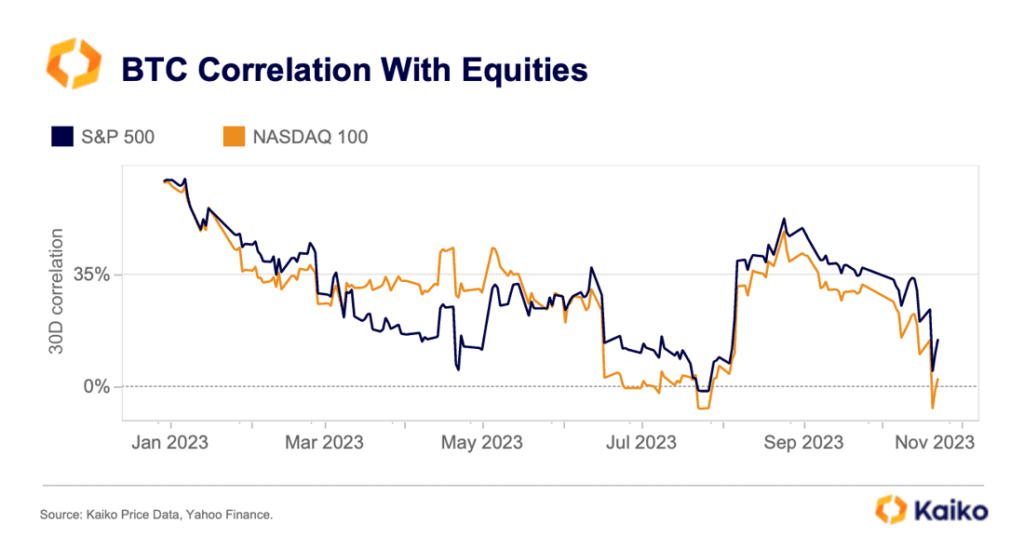

Bitcoin Decouples From Nasdaq. Bitcoin (BTC) has lost correlation with major Wall Street stocks while holding 17-month highs. The rolling correlation between Bitcoin and the Nasdaq 100 (NDX), the index that compiles shares of the top 100 publicly traded companies, has fallen into negative territory for the first time in 3 months since July. You can appreciate the correlation between the two assets by the orange line in the following chart from analyst firm Kaiko, published in its weekly report on October 30.

In simple terms, a rolling correlation is a statistical measure that shows how one asset’s price moves to another asset’s price over a particular period. You can compute the correlation between two magnitudes by comparing the returns of two assets over a specific time frame. The term “rolling” means that you update the calculation regularly to include the latest data points and exclude the oldest ones, creating a moving window of data. Investors often use rolling correlation to identify the degree of correlation between assets and to make investment decisions based on their findings.

Bitcoin and SP500

Likewise, bitcoin’s correlation with the S&P 500 (SPX), the index that gathers the shares of the leading 500 listed companies, has also fallen. It did not become negative (anti-correlation), but it is close to the zero line and at its lowest since three months ago, as reflected by the blue line on the chart.

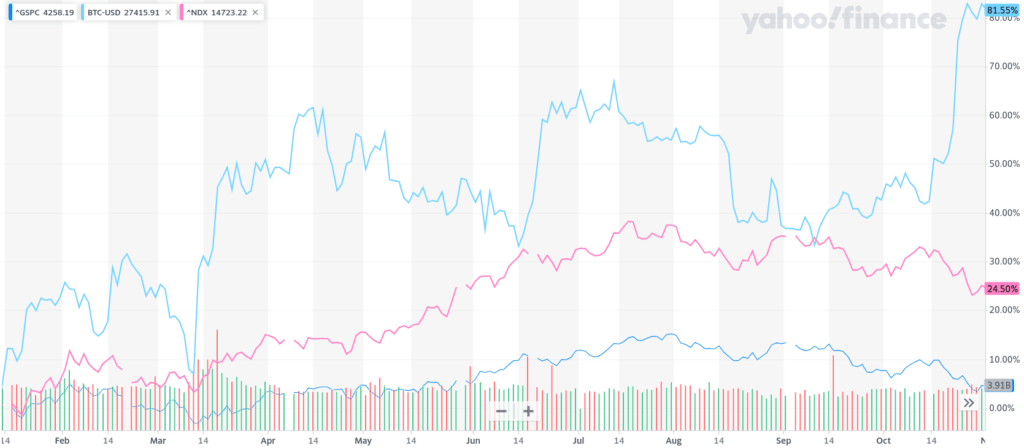

Bitcoin has been increasingly less correlated to stock markets since late August. All this is happening while the price of BTC has experienced a significant 36% rise in just over a month. In contrast, over the same period, the Nasdaq 100 and S&P 500 have gone down, as seen in the following chart from Yahoo Finance.

Market Uncertainty

Kaiko warns that, in recent weeks, stock markets have plummeted in the face of the ongoing turbulence in the Middle East.

“The sharp divergence between cryptocurrency and traditional markets limits a growing trend we have observed since the FTX collapse.”

Kaiko Research

On the other hand, Pierre Veyret, the technical analyst at investment firm ActivTrades, said that, with the current uncertainty and risk increasing, investors tend to shift from equity markets to commodities (and bitcoin qualifies as a commodity).

“Global market sentiment towards riskier assets continues to be negatively impacted by a combination of factors, including declining fixed income markets, rising oil prices, rising borrowing costs and bad economic developments, such as the problems in the Chinese real estate sector, the US Fed shutdown and disappointing macroeconomic data.”

Pierre Veyret

Meanwhile, demand in the bitcoin market has surged on expectations that the US will approve the first spot BTC exchange-traded funds (ETFs), as well as the proximity to the next halving of the currency’s issuance. Bitcoin’s recent rise has heightened the idea that it could continue to rise. In the last week, investment products in the asset have seen the most significant capital inflows in just over a year.