Cryptocurrencies that promised to kill Bitcoin are dying. Networks that claim to improve Bitcoin functions end up failing or causing problems. Where does the promise of being the new Bitcoin leave off?

In Short

- DASH went more than 14 hours without mining a single block.

- Bitcoin has never presented the problem of being unable to mine blocks or having its network stop.

Years ago, it was customary to hear things like “the new Bitcoin.” Protocols and cryptocurrencies offered advantages that Bitcoin supposedly could not achieve: instant transactions and privacy. We cannot deny that some did, but at what cost?

These networks offered “something better than Bitcoin,” so to speak. While they didn’t necessarily sell themselves as something better than Bitcoin, they advertised themselves as an option to use instead of Bitcoin. Dash was one of them. Dash quickly became popular in Venezuela as a payment option, with low fees and fast confirmations; everything was great. But recently, something happened that revealed a shortcoming: the Dash network stopped for more than 14 hours, without mining a single block, due to an update error.

Dash was not sold as a “Bitcoin Killer” as if it happened with Solana against Ethereum. However, their selling point was that the Bitcoin network has a limited capacity to process one block every 10 minutes, with a maximum capacity of 7 transactions per second (TPS).

Decentralization, security, and scalability: the trilemma of blockchains

Bitcoin has its shortcomings; it is a reality. Processing 7 TPS against VISA’s average of 1,700 TPS may seem alarming. However, Bitcoin has some strengths that make its weaknesses look very small when compared. In addition, Bitcoin has second-layer solutions to cover these shortcomings—for example, the Lightning network.

Vitalik Buterin, co-creator of Ethereum, coined the term “the blockchain trilemma.” This problem defines that a cryptocurrency network has 3 points of growth: decentralization, scalability, and security. However, the trilemma explains that networks can only achieve two out of three.

Bitcoin is the most secure cryptocurrency network on the planet. Every transaction confirmed in Bitcoin is captured in a network protected by approximately 350,000,0000 TH/s, as this is the mining capacity all miners currently contribute. No network comes close, not even 5% of the total hash rate.

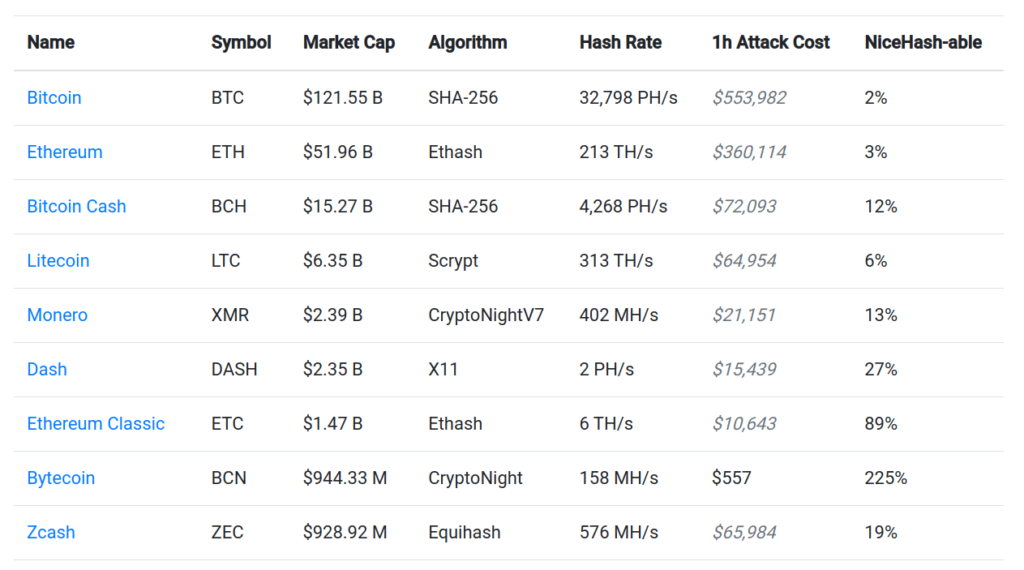

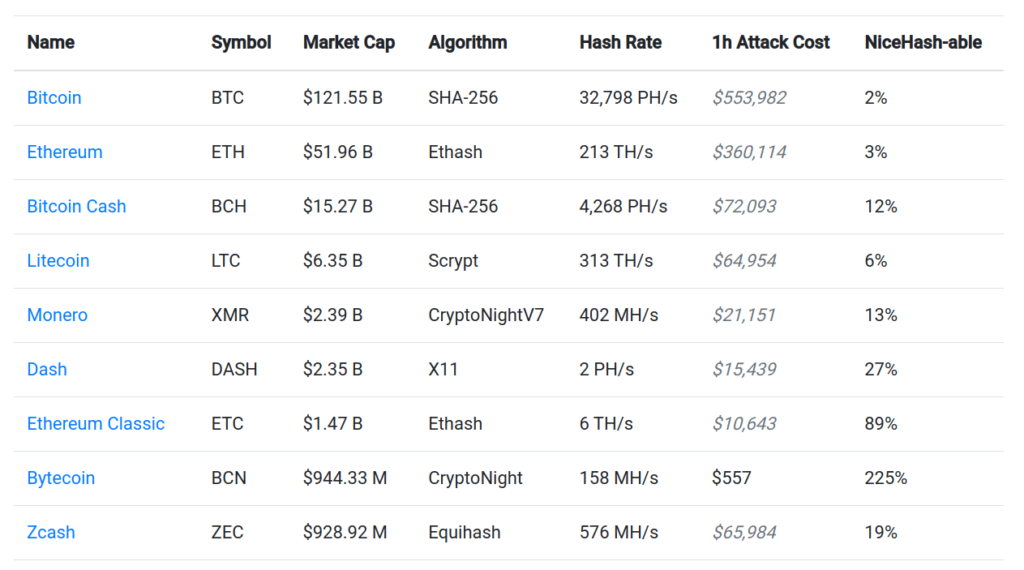

According to EXAKING’s table, attacking Bitcoin by renting a hash rate through the NiceHash portal costs half a million dollars an hour. Dash, for example, costs $15,000, a significant difference. In addition, this cost is an estimate; if the demand for Bitcoin hash rate increases excessively, its price will skyrocket, so this price is only an estimate.

Bitcoin has a high level of decentralization due to the numerous nodes located worldwide. Some data show that Bitcoin has about 17 thousand nodes. No network has more. However, this number reflects the number of public nodes; others calculate that Bitcoin has more than 400,000 nodes.

Since Bitcoin offers these two great strengths (decentralization and security), based on the trilemma, it needs to improve on the issue of scalability. However, Layer2 solutions, such as the Lightning network, offer improvements in exchanging BTC with instant payments and meager fees. Therefore, for a network to offer improvements “that Bitcoin doesn’t have,” you must consider what you are sacrificing.

What happened to Dash would never happen to Bitcoin

Dash’s bug was due to a bad update to its Dash Core nodes in its 19.0 release. Due to an issue with the update, nodes indexed incorrectly newly validated blocks. The problem prevented the network from adding new blocks. The solution was to release a new Dash Core update.

These types of errors are sometimes the result of lousy software audits. Dash was not the first; in August 2022, a stablecoin named aUSD lost all its parity against the dollar due to an update error that caused infinite issuance of coins, costing less than 1 cent due to the oversupply by the issuance of new coins.

This type of scheme is not possible in Bitcoin. However, Bitcoin is not exempt from errors in its software. Even so, changing the source code requires a very high auditing process. Developers meticulously audit the Bitcoin code for even the slightest error, as any mistakes found will result in the update rejection. This process can take up entire days.

In addition, Bitcoin has a feature called “backward compatibility.” Currently, Bitcoin Core nodes run version 24.0. However, if the upgrade to version 25.0 causes some network error, users can continue to run version 24, or even much older versions, without any problems. The only restriction is that it will not be possible to use the updates included in version 25, but the network will continue to function normally. Bitcoin should be able to continue operating without needing a new update.

The situation with Dash demonstrated Bitcoin is good, albeit a bit unfortunate. Only sometimes, the quickest solution is the best. Dash was not a “Bitcoin killer,” but others promoted themselves as such, announcing improvements that Bitcoin did not bring and that ended up falling by the wayside while Bitcoin continued its course.