Contents

Using Bitcoin, El Salvador seeks to improve its economy from bitcoin adoption. Bonds and tax-free cities, what’ll be next?

In Short

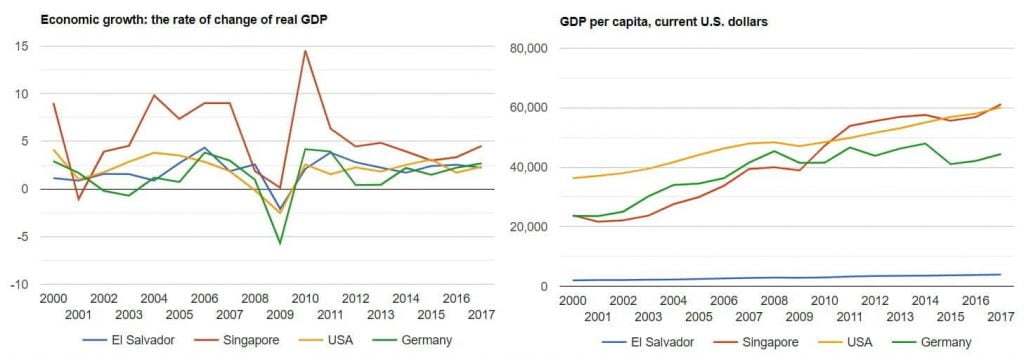

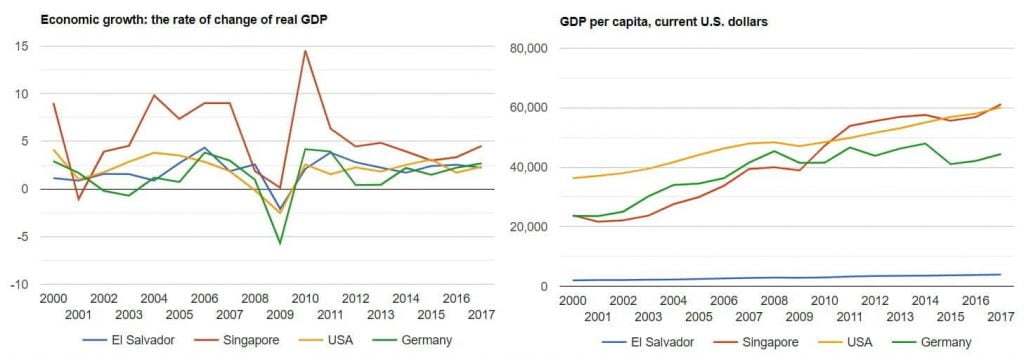

- Singapore went from being an underdeveloped country to one of the richest in the world in half a century.

- Bitcoin City would use renewable geothermal energy.

- El Salvador plans to issue Bitcoin Bonds.

At the closing of the Bitcoin Week held in El Salvador in mid-November, President Nayib Bukele announced the creation of the Bitcoin City. The government repeated the president’s words on social networks and compared the Central American nation to Singapore, the wealthiest country in Asia.

What connection does the Salvadoran state sees (and publicly encourage) between these two countries? In what way can two realities that, at present, are so distant be connected? The first thing is to find some commonalities that, although superficial, contextualize the comparison. Singapore’s population rounds today is 5,450,000 inhabitants, according to official data. On the other hand, El Salvador has “barely” one million more: 6,325,000, to be more precise.

In terms of territory, both are relatively small countries. However, the Asian nation, being a city-state, has a much smaller surface area: just 730 square kilometers against more than 21,000 square kilometers for El Salvador.

Singapore, an economic beacon for the world

Regarding the differences between the two nations in question, the economic aspect is the first thing that stands out, both at the national level and for its inhabitants. Singapore is the fourth wealthiest country globally, even though it is one of the “youngest“; it gained United Kingdom independence in 1963 and Malaysia in 1965.

The main characteristics of the Singaporean economy show an industrialized, modern country with a capitalist approach but with state control. Its 56 years of life have evolved from a country that manufactured goods with local labor to a financial center that benefits foreign investors and free trade agreements with the leading world powers.

According to Singaporean public data, this growth has come about through economic freedoms and a highly educated population, with 33% holding a university degree. Between 2010 and 2020, that percentage grew by 10%. The low tax burden in Singapore favors the arrival of large international firms that decide to establish their offices there. Singapore is the second country with few economic regulations behind Hong Kong.

The results? From 1976 to 2014, the country grew more than 6% each year. Meanwhile, per capita income went from $500 to more than $56,000 annually. Statistics place it below Spain in this ranking, with an almost double monthly income in euros.

El Salvador looks to bitcoin as an engine for development

Nayib Bukele wants El Salvador to become a worldwide leader in new technology enterprises by adopting Bitcoin as a legal tender in September 2021. As Singapore did from the nineties onwards, the country headed by Bukele is trying to move from an export model (mainly textiles and products such as coffee, sugar, and cotton) to an attractive one for foreign investors.

The country is trying to settle some pending debts compared to Singapore, such as social inequality and dependence on foreign economies. In this Central American country, the last decades have seen a decrease in the income gap between the poorest and wealthiest people, according to a World Bank report. Due to its decentralized nature and potential as an asset with an upward trend, Bitcoin can help the population in rural areas access a market that allows them to take care of their money.

Concerning foreign dependence, El Salvador is linked mainly to the United States, having the U.S. dollar as its official currency (in addition to bitcoin). Neither issued nor regulated by a Central Bank, cryptocurrency could be a solution.

Bitcoin is a gateway to people’s freedom.

While this point isn’t mentioned nor acknowledged by any state publication on both sides of the Pacific, both in Singapore and El Salvador, many accuse the authorities of undermining the people’s freedoms.

The Southeast Asian state had only one president in its first 31 years, Lee Kuan Yew. Although he is considered the main responsible for the country’s exponential growth, many reports state that this was due to strict regulations on freedom of expression and even human rights violations in justice.

Many also blame Nayib Bukele for being authoritarian. This year alone, the Salvadoran president had to respond to criticism from the opposition and the media for replacing Supreme Court judges “at will.” The Bitcoin Law also produced rejection, especially at the beginning, before the authorities clarified that the use of cryptocurrency was optional.

El Salvador clings to Bitcoin to get “to the moon.”

El Salvador and Singapore have connections that excite the Central American country for the future. The links are in the challenges and the tools to achieve the promised progress. Singapore has already achieved a marked improvement in the quality of life of its population. El Salvador is clinging to Bitcoin to get “to the moon.”

The roadmap to achieve this has several milestones reached and a new goal. They have already adopted cryptocurrency mining with geothermal energy. Profits were even earned and reinvested. The next step is to build Bitcoin City, the “bitcoiner paradise” that Bukele promised at the end of a historic week for his country.

What is Bitcoin City?

Nayib Bukele announced the construction of Bitcoin City, the first “bitcoiner city” powered by geothermal energy and almost tax-free. According to the announcement, Bitcoin City will be exempt from taxation at the income, capital gains, property, contracting, and municipal levels. The president clarifies that the only tax levied by the city will be value-added tax or VAT.

In this way, the Salvadoran government deepens its strategy to attract private investments by bitcoiners worldwide, as they now have more significant economic incentives to establish their businesses in El Salvador.

Bukele added that the Bitcoin City would be free of CO2 emissions to be built next year because they plan to make it near a volcano used for its energy supply. Consequently, geothermal energy will also allow the installation of mining farms throughout the city, with zero greenhouse gas emissions.

What will Bitcoin City include? It will have everything: residential and commercial areas, services, museums, entertainment, bars, restaurants, airport, port, train. You name it! – Nayim Bukele

Bukele even clarified that Bitcoin City would have its own mayor’s office. That is, it will have the legal status of a city.

Where will the “Bitcoin City” be located?

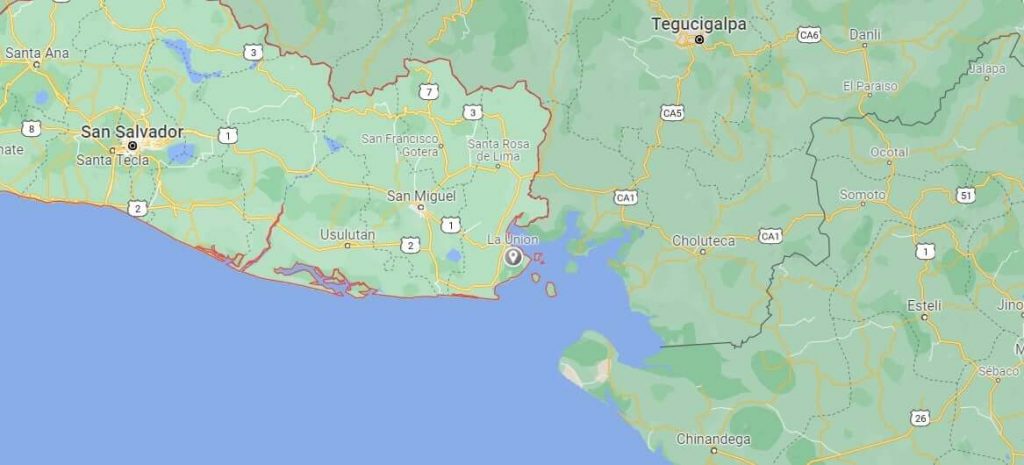

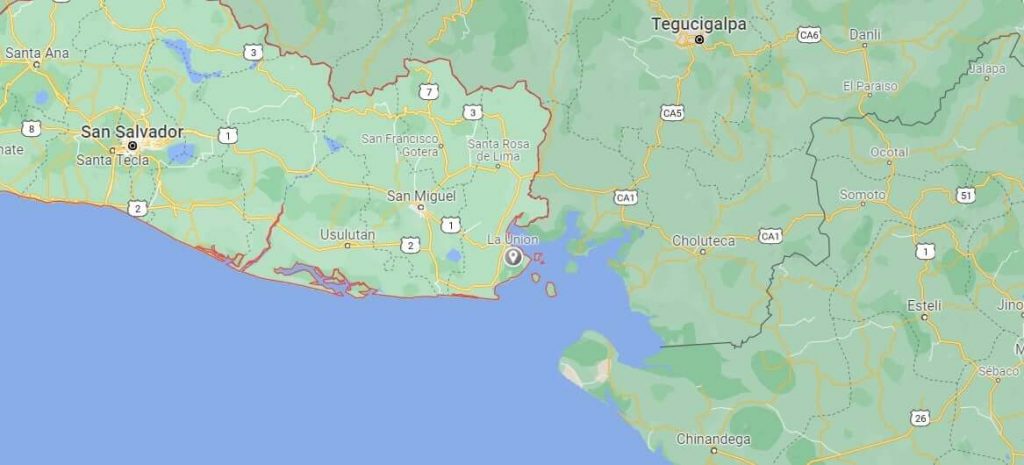

The government plans to build Bitcoin City near Colchagua, in the Salvadoran region near the Gulf of Fonseca. El Salvador, Honduras, and Nicaragua have coasts on this Gulf.

The volcano of the same name is near the municipality of Colchagua. It has no record of eruptive activity, but engineers plan to use it for geothermal energy generation. Bukele says the “old volcano” will initially power Bitcoin City. He refers to the Tecapa volcano, a geothermal power plant built 22 years ago in 1999. It will then rely on the Colchagua volcano closer to the city. “This will provide energy to the city and the bitcoin mine,” said the president.

Bitcoin government bonds

Bukele also gave other announcements during his presentation at the closing of LaBitConf. With Blockstream’s chief strategy officer, Samson Mow, Bukele announced the first government bitcoin bond. It will be named volcano and issued on Liquid, a Bitcoin sidechain.

Volcano aims to raise liquidity of $1 billion, as announced by Blockstream. The government will split this money in half: $500 million will be added to the country’s bitcoin reserves, currently at 1,120 bitcoins. The other $500 million will be for infrastructure for energy and mining.

For Blockstream’s CSO, the launch of these bonds initiates the “nation-state level FOMO,” as countries will compete to launch their version of this new type of financial instrument, which would have substantial implications on the adoption and price of Bitcoin. Anyone can buy the bond for up to a minimum of one hundred dollars.

Don’t miss

- El Salvador receives four times more remittances with Bitcoin.

- Crypto legal in Texas. McDonald’s accepts Bitcoin in El Salvador.

- How to Track Bitcoin Whales.