The relationship of BRC-20 tokens with NFT Ordinals gives reason to believe that they could also affect Bitcoin’s stability.

- BRC-20 token issuance takes up less block space than NFT Ordinals.

- There are already at least 1,400 tokens created using the BRC-20 standard.

Could BRC-20 tokens threaten Bitcoin? While chatting with friends about NFT Ordinals and BRC-20 tokens, one of them told me, “You can upload anything in hex (hexadecimal system) to Bitcoin. Anything you can think of. The Ordinals paved the way.” In that case, will Bitcoin be doomed to relive crises that other networks went through when implementing similar protocols? Like the congestions in Ethereum related to ERC-20 tokens, for example.

The Ordinals Craze

The phrase my friend commented to me, although consisting of an idea many of us may have thought of before, doesn’t fail to hit hard when you don’t see it coming. Indeed, free will is part of Bitcoin’s DNA, and that may be its emancipation and its doom at the same time.

The BRC-20 standard is the brainchild of a developer known as Domo on social networks. While not hiding his enthusiasm about his invention, the computer scientist insists it is experimental-level technology. He adds that it should not be considered the definitive standard for creating fungible tokens in Bitcoin.

Domo used the NFT Ordinals protocol, developed by Casey Rodarmor, to implement his idea. If you want to deploy, issue, and transfer BRC-20 tokens, you must make an inscription, the name of the data uploaded to the Bitcoin network via Ordinals.

The relationship between the two inventions has raised concerns in the Bitcoin community about how much the use of the BRC-20 protocol could affect the functioning of Bitcoin.

NFT Ordinals have already saturated Bitcoin more than once

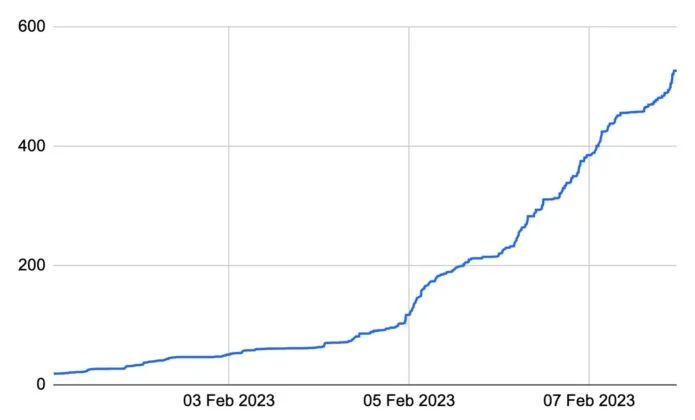

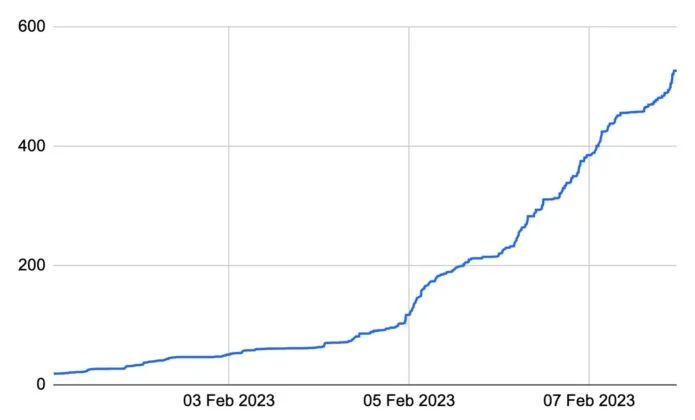

At the beginning of 2023, the NFT Ordinals sparked a fever in the Bitcoin community that negatively affected this network’s performance. In mid-February, the number of Ordinals people uploaded to Bitcoin was such that it caused temporary congestion. On February 12, over 20,000 unconfirmed transactions in the Bitcoin mempool. At that time, 66 blocks were waiting to get uploaded to the network, and the average fee to confirm high-priority transactions was 14sat/vB. In addition, the mempool was at maximum capacity.

The main suspects for causing such a bottleneck were the booming NFT Ordinals. The problem was more than just the number of transactions they generated. There’s also the issue of the space they occupy in each block and how heavy they make Bitcoin’s blockchain. Well-known developers and bitcoiners, such as Adam Back and Luke Dashjr, harshly criticized this protocol and supported censorship of transactions that included this data type.

In March, the story of the saturation of the Bitcoin network repeated itself. At the beginning of the month, more than 100 blocks were waiting for confirmation. Despite a slowdown in the tide of registrations with Ordinals after the January rush, between February 28 and March 7, an average of about 15,000 NFT Ordinals were registered daily.

Could NFT Ordinals history repeat itself with BRC-20 tokens?

While it makes sense to fear that BRC-20 tokens will provoke a reaction similar to that of NFT Ordinals in Bitcoin, there are reasons to think this is much less likely. First, registrations of NFT Ordinals take up much more space than registrations related to BRC-20 tokens. The transaction that gave rise to the BRC-20 token, named “PEPE,” is 162 B in size. Meanwhile, image or NFT inscriptions can pass 150,000 B, almost a thousand times more than BRC-20 token inscriptions.

The difference in the sizes of the two transactions may bring some relief to those concerned about potential congestion related to BRC-20 tokens in Bitcoin. While they could increase traffic on the network, they would only hog less space. This allows the bundling of more transactions in each block. However, there are other problems that such tokens could cause.

Shitcoins 2.0 Festival

The name BRC-20 comes from the ERC-20 standard, which Vitalik Buterin and Fabian Vogelsteller created for Ethereum in 2015. BRC-20 states ERC-20 tokens originate through a smart contract. Unlike tokens created through enrollments, making them much more versatile than their bitcoiner counterpart. ERC-20 tokens were a vital part of the 2017 ICO rush. Many projects get funding through these token offerings at launch price. Their buyers hoped these tokens would rise in value, sell them and make “easy money.”

The problem is that this methodology also made it easy for many fraudsters. Many exploited people’s hunger to invest in these tokens and lost significant money. Creating ERC-20 tokens is easy, just like generating BRC-20 tokens, even though they work differently on different networks. While the ICO fever ended long ago and left essential lessons in the cryptocurrency ecosystem, the emergence of a tool like the BRC-20 standard may bring something similar.

Despite Domo’s insistence that these tokens should have no value nor should they spend sums of money to issue them, in less than a month, people launched at least 1,400 tokens with this standard, according to the UniSat wallet search tool. The same creator of BRC-20 tokens thinks Taro (See DeFi on Bitcoin is a better-developed tool for issuing tokens.

Sometimes we need more than warnings for people who see an opportunity to make money. No matter how absurd or risky the method is. The best we can do is educate ourselves and stay informed. And hope this new technology will bring more benefits than difficulties.