Developers implemented Token burning after the London fork to transform Ethereum into a deflationary asset.

In Short

- The amount of ETH burned has exceeded the number of daily issued tokens.

- By the end of August, only 40% of transactions on the network were based on EIP-1559.

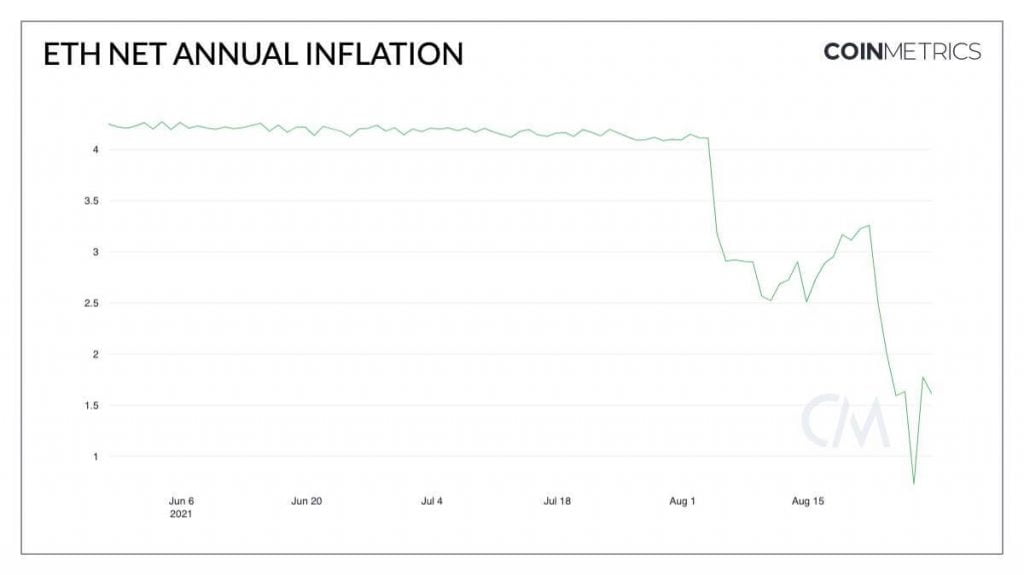

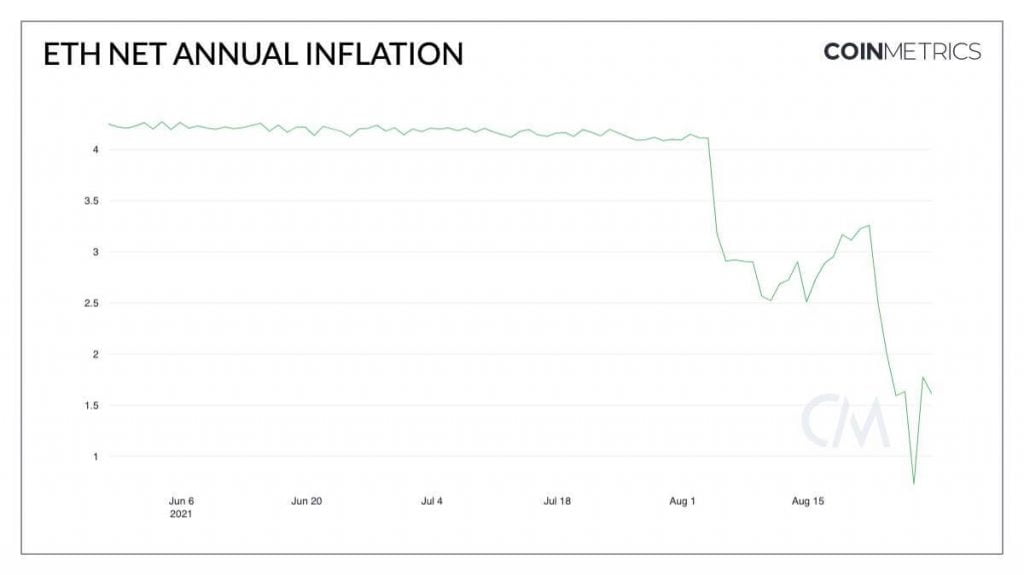

ETH burning plunges Ethereum annual inflation by 35%. Recent data from Coin Metrics reveals the annual net inflation of ethers (ETH), Ethereum’s native cryptocurrency, has slowed to levels hovering around 1% and 3%. This is due to the token burn implemented last August 5 with the London fork.

Ethereum burning numbers

Etherscan statistics indicate that 173,407 ETH, worth more than USD 650 million, have been burned since that date. With this amount, it has been possible to reduce by more than 35% the annual issuance of this network’s coins, which used to increase by 5% yearly.

Coin Metrics agrees with this analysis, noting in its Coin Metrics weekly report that in the nearly 30 days since the update, there have been times when the number of ethers (ETH) burned managed to exceed the number of coins issued. This is a fact the market sees as a deflationary signal as the number of tokens in circulation decreases.

Coin Metrics indicates that the ratio of total ETH issued to total ETH burned is less than one. The chart shows how the annual net ETH inflation started to decline from the first days of August. It reached levels below one by the end of the same month.

Token burning was one of the most significant changes introduced to Ethereum with the London fork. It is part of the new fee scheme that seeks to make the network deflationary and lower its high fees.

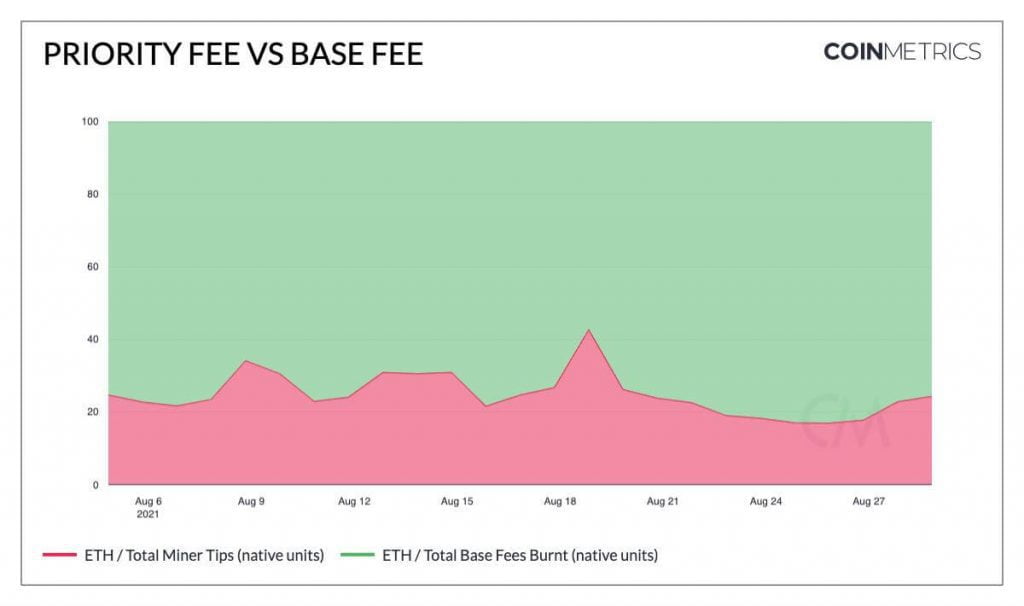

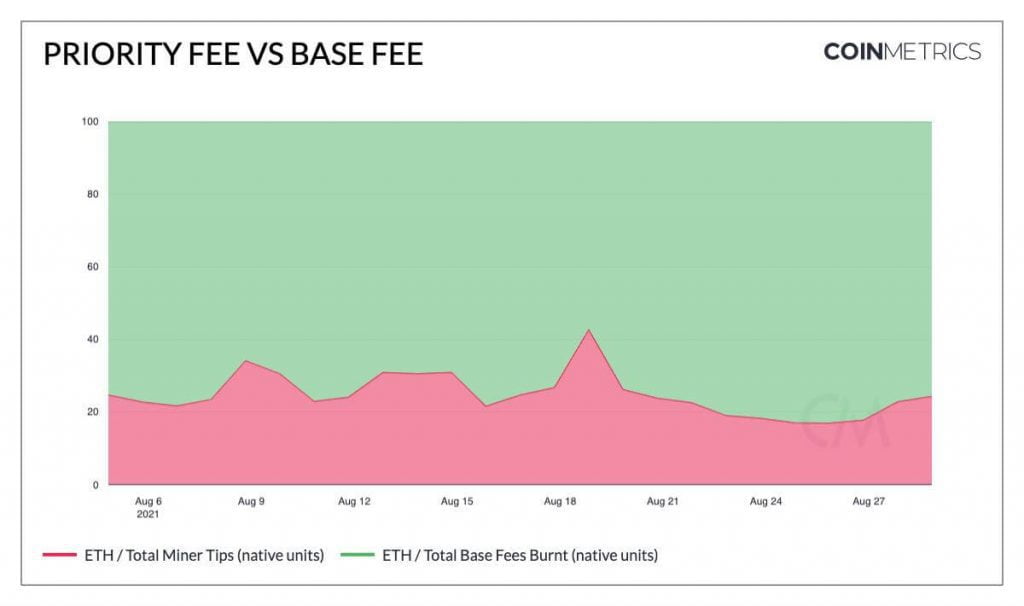

Since the activation of the EIP-1559, two types of commissions began to be managed: the base fee burned daily and the priority fee paid to miners for faster processing of transactions per block.

As a result, inflation on the Ethereum blockchain has been significantly reduced, as the data above shows. However, the same does not hold for the total amount of fees. The lowering of which could materialize in the long term with the activation of Ethereum 2.0.

Regarding movements on the network, The Block draws attention to the boom in non-fungible tokens (NFT) trading.

“Activity on the Ethereum blockchain remains high, with 1.18 million transactions per day. The network continues to move USD 9.11 billion in volume per day, and a total of more than USD 260 billion per month.”

The Block Research

All of this activity revolves primarily around the trading of digital collectibles. While these trades contribute to the base commission burn, they also cause “gas rates to rise significantly, especially when minting NFT collections.“

Not all Ethereum wallets have implemented EIP-1559

Coin Metrics also presents its calculations on priority (or tipping) fees in its weekly report. It claims that these costs have accounted for about 20% to 30% of Ethereum’s total daily fees.

The blockchain analytics firm notes that priority fees are still low because more wallets implement EIP-1559 transactions natively.

“Although developers introduced EIP-1559 through a hard fork and, as such, is mandatory for all network participants, there is still a mechanism within Ethereum nodes that converts legacy transactions to EIP-1559.”

Coin Metrics

However, the Coin Metrics team notes an acceleration in the daily percentage of transactions using EIP-1559 versus the legacy fee mechanism. EIP-1559 transactions have gone from accounting for 23% of transactions shortly after the hard fork to just over 40% by August.

The market expects to increase the percentage of transactions based on the new fee mechanism in the coming months as portfolios catch up to support the new format.