Ethereum Stakers are leaving Binance and Coinbase. Network validators show a trend of exiting centralized exchanges toward liquid staking DeFi protocols.

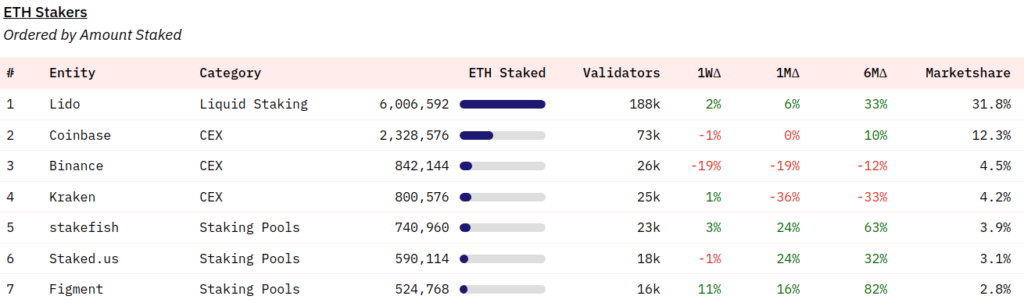

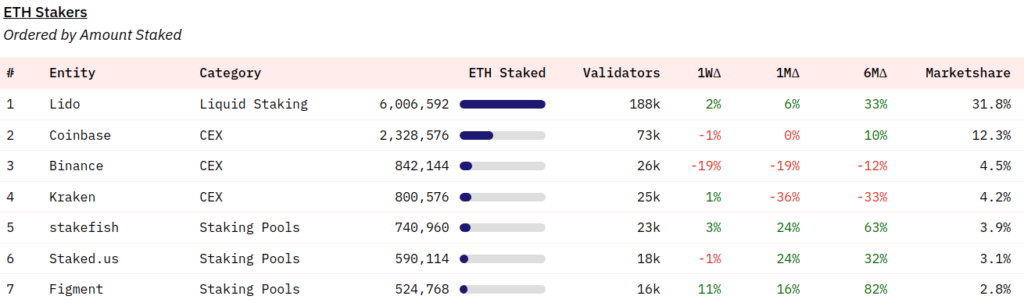

- The three largest centralized staking pools lost a share of their validators.

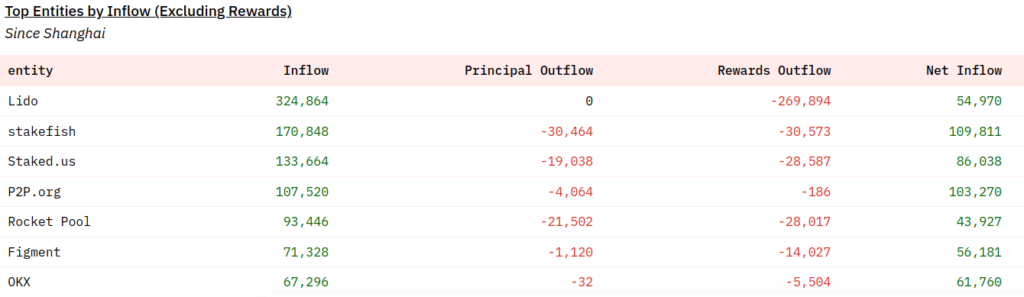

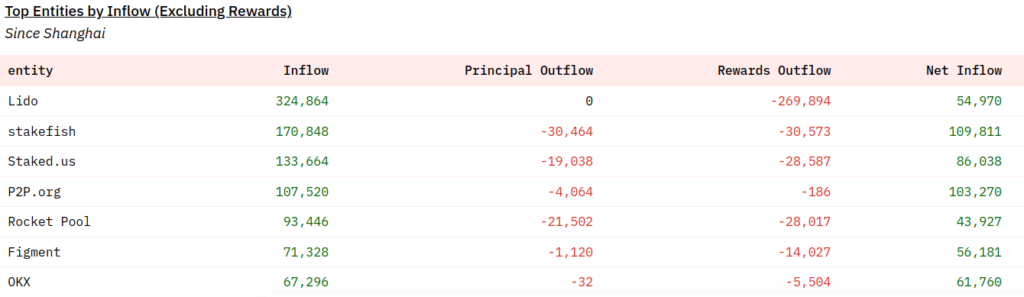

- In contrast, the liquid staking pools received millions in deposits.

Contents

The Effect of Shapella

With the activation of withdrawals with the Shapella update, the landscape in Ethereum staking has changed. Beginning a few weeks ago, a significant movement of funds from centralized staking pools, such as Binance, Coinbase, and Kraken, to liquid staking protocols is impressive. According to data shared at Dune Analytics, Coinbase, the second largest staking pool with 12% of network staking, they lost 182,229 ETH since the Shanghai activation.

Meanwhile, Binance, the third largest Ethereum staking pool with 4.5% of validators, lost 153,452 ETH in a week. That’s equivalent to 18% of the ETH it had on deposit, worth USD 286 million. From month to month, the loss of funds also fueled 18% for this exchange. Finally, Kraken also showed staking losses from April 12 to date. In one month, staking ETH on this platform fell by 35%. The figure is close to 281,747 ETH.

Where is Ethereum staking migrating to?

The fastest-growing category among decentralized finance protocols was liquid staking pools like Lido or Rocket Pool. These, unlike traditional centralized pools, grant tokens to users in compensation for the funds they deposit. This way, users maintain their liquidity by blocking staking funds. Another peculiarity is that liquid staking protocols allow users to withdraw their money anytime.

According to the Dune Analytics source cited above, these liquid staking pools received a total deposit of 570,546 ETH since Shapella’s activation. Equivalent to $1.063 billion. Add to that the 10% increase in the price of ETH in the days following the upgrade, bringing the $2 billion in TVL that the liquid staking pools earned in the last three weeks.

The Shapella activation

Developers activated the Shapella update upon reaching epoch 194048, marking an important milestone in Ethereum’s transition from mining (PoW) to Proof of Stake (PoS). That’s because some validators had long had their ethers (ETH) locked into the network’s smart contract, created in December 2020. According to data from the site beaconcha.in, the ETH in staking accounts for more than 18 million, 15% of the cryptocurrency’s total supply. That’s why the Shapella update has caught the attention of developers, validators, and traders alike in recent weeks.

There is a queue of validators waiting to be able to withdraw. This means they will not all be made simultaneously, but there will be a priority order based on the number of indexes each validator has received.

How Ethereum staking withdrawals get processed

In a FAQ post on Ethereum withdrawals, the Ethereum Foundation explained:

“Full withdrawals are possible through an output that places the validator in the output queue. The output queue depends on the size of the set of validators in the network. This boundary exists to regulate the rate of output and input to the set of validators in the Beacon Chain.”

Ethereum Foundation, on ETH withdrawals from validators.

On the other hand, partial withdrawals, which involve a balance over 32 ETH and do not involve the validator exiting the protocol, will be performed automatically in batches of 16 partial withdrawals every 12 seconds but can take nearly five days to process all of them. Full withdrawals, meanwhile, may take several days to process, as predicted by staking pools such as Lido and Coinbase.

Staking competition

Regarding blockchain platforms, Ethereum and Cardano are two significant players in the game. While they share some resemblances, there are also some critical differences between them. One of the most significant distinctions between Ethereum and Cardano is their age and size. Ethereum has been around longer and has a larger community than Cardano. A more user base means that Ethereum has more developers and more projects built on it. It is advantageous, as a larger community can lead to more innovation and growth.

However, Cardano is a more technologically advanced blockchain platform focusing on scalability and sustainability. Developers designed Cardano’s architecture to be more modular and flexible than Ethereum’s, meaning that Cardano can be adapted more efficiently to meet the specific needs of different projects.

Ultimately, which platform is better for a project depends on the specific needs and goals. Ethereum may be a better choice for projects that require a large and established community, while Cardano may be a better fit for projects that require more flexibility and scalability. It’s essential to grasp the strengths and faults of each platform before making a decision.

Ethereum Staking

Ethereum staking is a process that allows users to earn rewards by holding and validating transactions on the Ethereum network. Staking involves locking up some of your Ether holdings as collateral to participate in the network’s consensus mechanism. In return for staking your Ether, you will receive rewards in the form of more Ether. The rewards you receive depend on the amount of Ether you stake and the time you hold your stake.

Ethereum staking is a crucial aspect of the network’s move towards a Proof-of-Stake (PoS) consensus mechanism, a more energy-efficient and secure alternative to the current Proof-of-Work (PoW) mechanism. PoS allows users to validate transactions and create new blocks on the network by staking their cryptocurrency holdings rather than by competing with other miners in a race to solve complex mathematical problems. The shift to PoS significantly reduced the energy consumption and associated environmental impact of the Ethereum network.

To participate in Ethereum staking, users can run a node themselves or use a service provider. Running a node requires technical expertise and a significant amount of computing power and storage space, so many users opt to use a staking service that takes care of the technical aspects for them. These services typically charge a fee for their services, but they allow users to participate in staking without the technical expertise required to run a node.