Accumulation, higher prices, and long-term savings are some of Ethereum’s highlights. Devs deployed more than 4 million Smart Contracts on Ethereum in 2022.

In Short

- There has been a historic spike in ETH addresses.

- Ether trades above $1,500 but fails to climb back above $1,600.

- The number of Smart contracts grew by 300% in 2022

Like Bitcoin (BTC) and the other major cryptocurrencies on the market, the start of the year for Ethereum’s cryptocurrency, ether (ETH), has been remarkable. It is up more than 30% this year, 2023, and has managed to consolidate above $1,500 per unit. Here you have five metrics to explain the Ethereum market outlook

Ethereum realized price

This movement reflects a new profit peak for ETH investors and savers, according to data published by Glassnode. ETH has reached a 1-month high for the realized price (the capitalization divided by the circulating ETH). That realized price is $1,364 and is based on the total capitalization of the currencies the last time they moved.

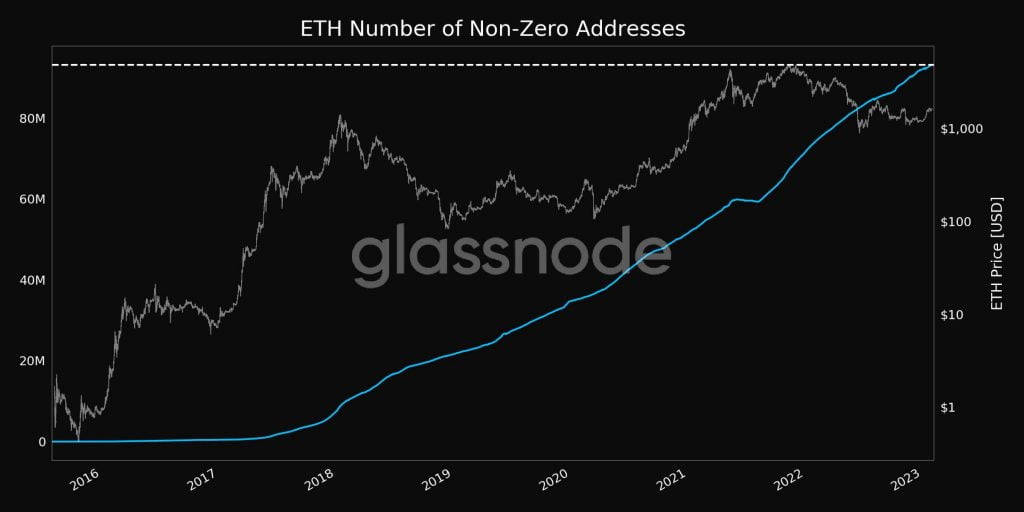

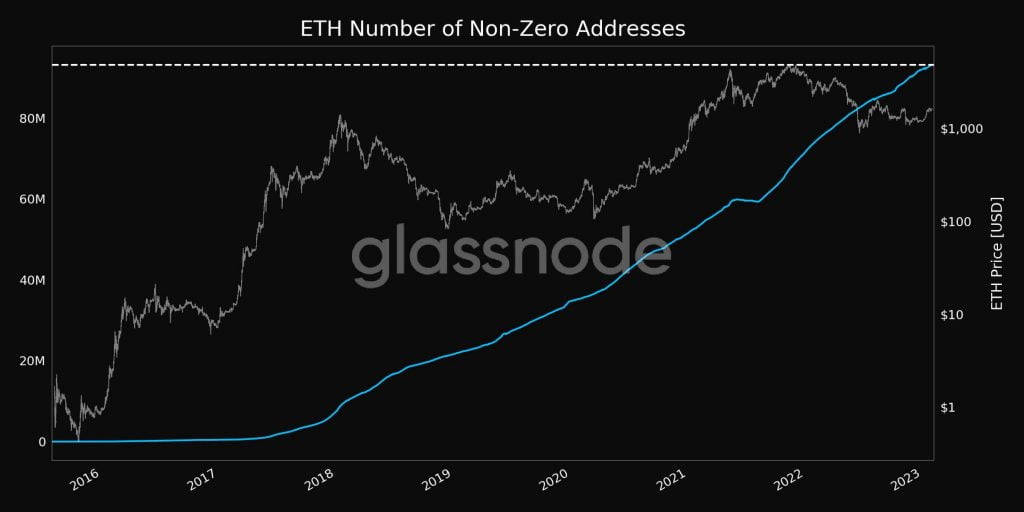

Ethereum addresses

Meanwhile, investors continue accumulating ETH, commonly seen for bitcoin. Data from the same firm reports a new all-time high of Ethereum addresses with some amount of ETH deposited: more than 93.12 million. At the same time, we found that coins held (or not moved) for at least 2 to 3 years have also peaked, although, in this case, for 13 months, suggesting that investors have been taking advantage of the 2022 bear market to accumulate and wait for a new market rally.

Some people with large amounts of ETH have not waited too long and have started taking profits with the January price rise. At least that is indicated by the other metric we highlight in this note: addresses with at least 100 ETH have fallen to a 1-month low, coinciding with the latest downward moves in the cryptocurrency market.

ETH is trading at $1,581 per unit at the time of writing. So far this year, it is up 31%, less than the nearly 40% rise of BTC, the leading cryptocurrency on the market. The market had a slight setback last week. In the case of ETH, it failed to stay above $1,600 for long and leveraged traders betting on a rise lost the biggest daily amount in three months.

Smart Contract Growth

Smart Contracts on the Ethereum network grew by 293% in 2022. Up to 4.6 million Smart Contracts, critical to creating decentralized applications (dApps), have already been implemented. According to a report by software and blockchain development firm Alchemy, the peak of smart contract proliferation on Ethereum was last year’s fourth quarter. In those last three months of the year, there were 453% more smart contract deployments than in the previous quarter, between July and September.

The timing of that “explosion” coincides with the months after the Merge, which probably shows that developers were waiting for the results of that process to continue their work on Ethereum. Interestingly, it also coincides with a significant event for the industry, such as the collapse of the FTX exchange. There was also an increase in smart contracts in the Goerli test network. There was a 721% increase between 2021 and 2022, totaling 2.7 million.

The bear market for cryptocurrencies in 2022 did not impede the technological development of the major networks. While Ethereum went through milestones such as the Merge and the increase in Smart Contract creation, Bitcoin continued to grow in terms of its hash rate, making the network more secure than it was at the beginning of last year.

Implications of the number of Ethereum Smart Contracts

Ethereum is a network whose central premise is the creation of decentralized applications (dApps) on it. To that end, smart contracts play an essential role. A Smart Contract is a self-executing deal with the terms of the arrangement between both parties directly written into lines of code. To this end, the participants sign it in advance and thus accept the stipulated terms.

The fact that there are more Smart Contracts on Ethereum means that developers are building more dApps on the network or that existing ones continue to expand. Corporations can harness this technological resource in various industries, such as Decentralized Finance (DeFi), gambling, predictive markets, and voting in decentralized autonomous organizations (DAOs).