Contents

Financial derivatives are exchangeable securities that depend on the price of an underlying asset.

Introduction to cryptocurrency derivatives. In certain situations, derivatives are typically advanced financial instruments and are generally high-risk, useful to manage risk through hedging.

In traditional finance, underlying assets can be stocks, commodities, indexes, currencies, interest rates, and exchange rates. In the crypto world, cryptocurrencies are usually the underlying asset. A financial derivative is a contract that involves two or more parties that agree on the price level of the base asset at a different moment in time. Futures, options, warrants, and swaps are popular derivatives.

All derivative contracts are standardized. Every market participant knows in advance the type and characteristics of the Contract. It also implies that traders can buy or sell derivative contracts in exchanges. The process of standardizing an agreement (Contract) or, in general, any financial instrument is called commoditization. Every market participant knows what is buying or selling, so the traders don’t need to know each other.

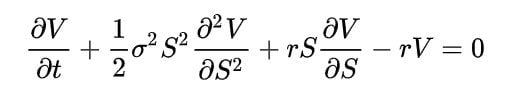

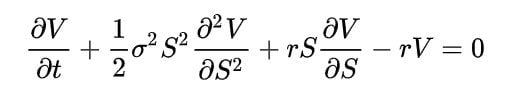

The pricing of a derivative can be a tricky thing. The price of derivatives floats according to the offer and demand laws in exchanges, but there are ways to know the approximate value of a Derivative in a mathematical form. This introduction to cryptocurrency derivatives will only show the starting point for option pricing. Assigning a price to a Derivative is called quantitative pricing and involves quite sophisticated math (see the Black-Scholes equation to price options)

Types of derivatives

Derivative contracts can be similar in appearance, but the risk assumed and the way to trade differ greatly between them. For example, standard options have a fixed risk (amount of money you can lose) before accepting the Contract, but that’s not the case with futures.

Futures

A futures contract is an agreement to buy or sell something (the underlying asset) at a predetermined price at a fixed time. There are futures for almost every commodity in the world: gold, silver, palladium (metals in general), corn, coffee, etc. People invented future contracts to help farmers cope with bad crops: The farmer signs the Contract to sell his grain in the future at a determined price regardless of the wheater and the yield of the crop.

Options

With an Option Contract, you have the right (but not the obligation) to buy (Call Option) or sell (Put Option) the underlying asset at a fixed price (Strike Price) on a future date (expiry date). After the expiry date, the Option is worthless. Traders make several option combinations (option legs) to cover or hedge their positions in other assets or to trade the asset volatility.

Swaps

A swap is a derivative in which two parties exchange the liabilities or cash flows from two financial instruments. Most Swaps involve cash flows based on a loan or bond. Usually, traders don’t interchange the principal. Interest rates, commodities, and currencies are the most common swaps. Swaps usually entail swapping a net capital source with a floating cash stream. In other terms, a trader may turn from an interest-rate variable loan to an interest-rate loan or vice versa.

Growth of the crypto derivatives market

The derivatives market for crypto is still new. Almost every existing derivatives exchanges for crypto coins are unregulated and operate in jurisdictions where the law for crypto exchanges is not well established. The availability of Derivatives, particularly for regulated trading, is still limited. CME is one of the few trading sites that deliver crypto derivatives – but only Bitcoin’s future is open.

Why trade crypto derivatives?

Minimize price volatility risk

You can use derivatives to eliminate (or limit) the risk exposure of your crypto holdings and prevent portfolio losses from fluctuations in the underlying asset’s value due to unforeseen market conditions. Like an annual magazine subscription, the monthly amount you pay is always the same. By entering into this arrangement, you reduce the chance of paying a higher monthly cost over the year.

Hedging

You can also use Financial derivatives to hedge your crypto portfolio. For example, you can buy bitcoin and at the same time buy some bitcoin puts; if bitcoins fall in price, the put option will cover some of the losses. Derivatives are a critical financial tool for institutional and investor risk management.

Trading

Traders also use derivatives to bet on crypto-monetary values to benefit from fluctuations in the corresponding asset prices. For instance, a trader may attempt to “short” (using a put option) the coin to benefit from an expected downturn in general cryptocurrency values. A trader can also use the bitcoin price volatility to make some profit. Crypto derivatives allow traders to extend their strategies. You can see the big difference if you think of the traditional mechanism to make money in the stock markets: purchase an asset at a low price and then sell it later at a higher rate.

Where are crypto derivatives traded?

Bitmex is the largest crypto-derivatives exchange by trading volume. Trading derivatives involves lots of extra information not necessary when buying or selling crypto. You need to know strike prices, expiry dates, and some info about how the Option is evolving (the infamous greeks). So don’t expect a user-friendly interface. Bybit is another well-known derivatives exchange. They provide some tutorials to learn about derivatives and how to trade them on their platform. All the mentioned exchanges give users mobile apps and decent customer support. Deribit and BaseFEX are also famous crypto derivatives exchanges.

Bottom Line

Investors trying to just HODL, speculate, and expand their buying leverage should use long, short, and neutral derivative strategies. You can enlarge your trading opportunities using crypto derivatives. But you must only use crypto derivatives if you understand their uses and risks. If used adequately, options, swaps, or futures are excellent tools to grow your portfolio.

Learn more

- What are Central Bank Digital Currencies (CBDCs)?

- Cryptocurrencies: What is a Stablecoin?