ECB’s President, Christine Lagarde, insisted that inflation will remain above target for a prolonged period.

In Short

- “We need to find the interest rate that will help us reach 2% (inflation),” Lagarde said.

- If they fail to bring it down, she warned that “higher inflation will be expected in the future, and that is dangerous.“

Lagarde: Not Even a Recession Will Calm the Inflation Rate. The president of the European Central Bank spoke about the projected recession in the face of inflation. A “mild recession” is in place, but it will not be enough to “bring inflation down,” European Central Bank (ECB) President Christine Lagarde said. She commented on November 3 at an event in Latvia, where she spoke about the economy’s future.

Lagarde warned that the ECB is concentrating on “stabilizing prices” in the Eurozone. “We need to find that interest rate that will help us reach the target we defined of 2% (inflation) in the medium term,” she said. Otherwise, he pointed out that prices will continue. Even with a recession (drop in economic activity) already projected by different analysts for the coming months.

Lagarde commented during the week that “inflation remains too high across the euro area” and “will remain above target for an extended period.” He added, “the longer inflation remains at this high level, the greater the risk of it spreading throughout the economy.“

Lagarde expects inflation to continue

Lagarde estimated that if they do not manage to lower it, “consumers and companies will also expect higher inflation in the future, which is dangerous.” For this reason, she clarified that the Eurozone would have “more rate hikes in the future.” She also declared that they are “determined to do whatever it takes to bring inflation back to the 2% target“.

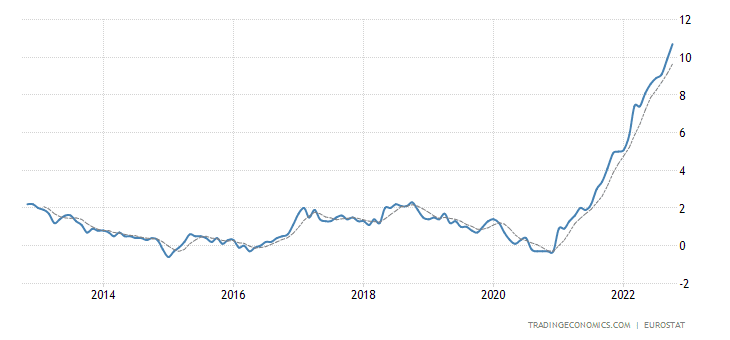

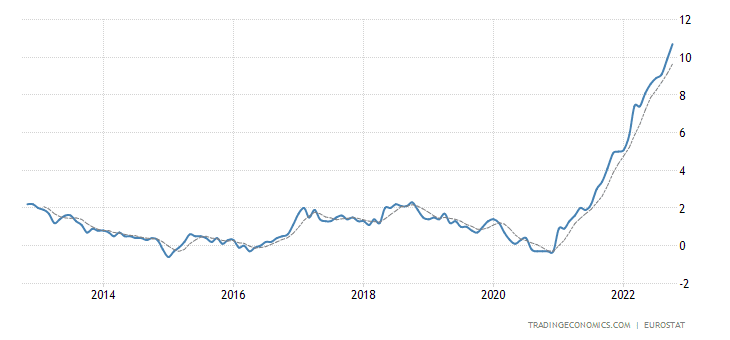

These comments come a week after the euro zone’s estimated year-on-year inflation reached an all-time high of 10.7%. And in the face of that, the ECB set the second consecutive 0.75% interest rate hike, like the U.S. Federal Reserve (Fed).

All this happens while the euro remains at 20-year lows against the dollar, trading at 1:1 parity. Likewise, other currencies have depreciated to record lows in 2022, and inflation continues globally, impacting the Eurozone, the United States, and Latin America.

This scenario comes after the heavy printing of banknotes globally during the pandemic boosted inflation, despite Lagarde’s assurances that price increases in the Eurozone would slow down by 2022.