Chainalysis reported an 880% increase in the global adoption rate of Bitcoin and cryptocurrencies between 2020 and 2021.

The World uses 9 times more Bitcoin than in 2020. Bitcoin and crypto adoption have jumped again so far in 2021. According to research firm Chainalysis, cryptocurrency use has increased by 881% since 2020.

“Our data shows that residents of more and more countries around the world are diving into cryptocurrencies or seeing an increase in existing adoption,” Chainalysis notes in the excerpt from its geographic report on crypto. The report, in its full version, will be published next September.

The firm based its data on the study of three-point indicators in 154 countries. The analysis generates an index from 0 to 1 based on the value transferred in general and retail trade and exchange volumes on P2P exchanges.

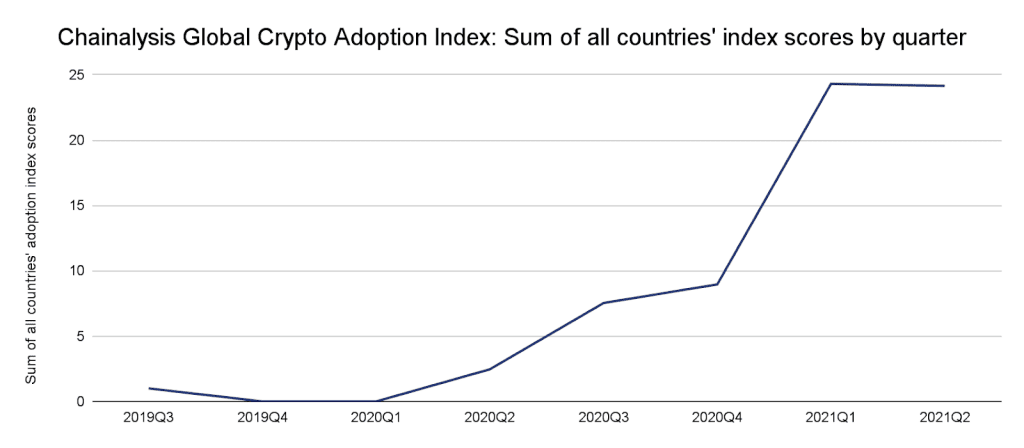

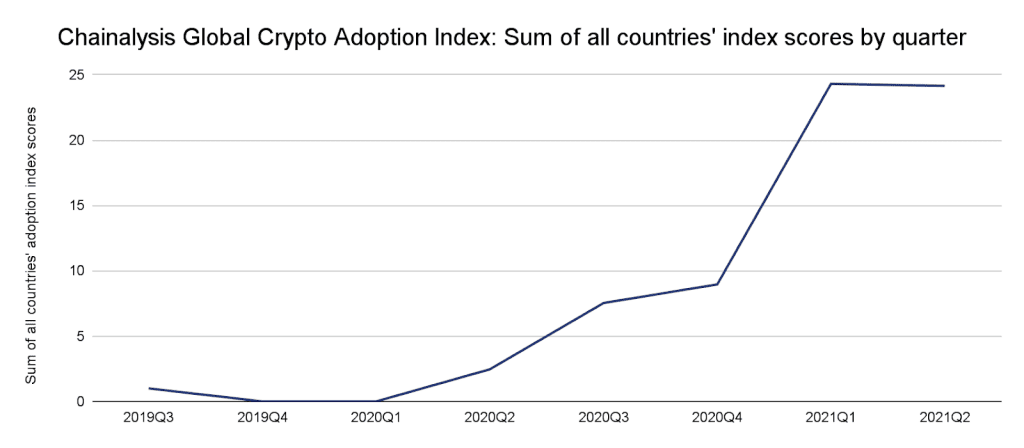

The sum of the indexes of all the countries analyzed generated a score of 24 at the close of 2021 Q2. The previous year, it hovered around 2.5 overall, while in 2019 it was just above 1. Since that time, the increase in the global adoption rate has been 2,300%, the research highlights.

Analysts point out that the reasons for this growth are most varied depending on the particular cases of each country.

In emerging markets, many turn to cryptocurrency to preserve savings against currency devaluation, send and receive remittances and conduct trade transactions. At the same time, institutional investors were the driver behind the adoption increase in North America, Western Europe, and East Asia over the past year.

Chainalysis

P2P commerce: The emerging markets driver.

While the general reasons vary, Chainalysis notes a common driver for bitcoin and cryptocurrency usage in emerging markets. The research highlights the appearance of the top nations such as Vietnam (leader of the ranking), Kenya, Nigeria, and Venezuela. The South American country moved from third to seventh between 2020 and 2021, although its citizens continue to find new use cases for cryptocurrencies.

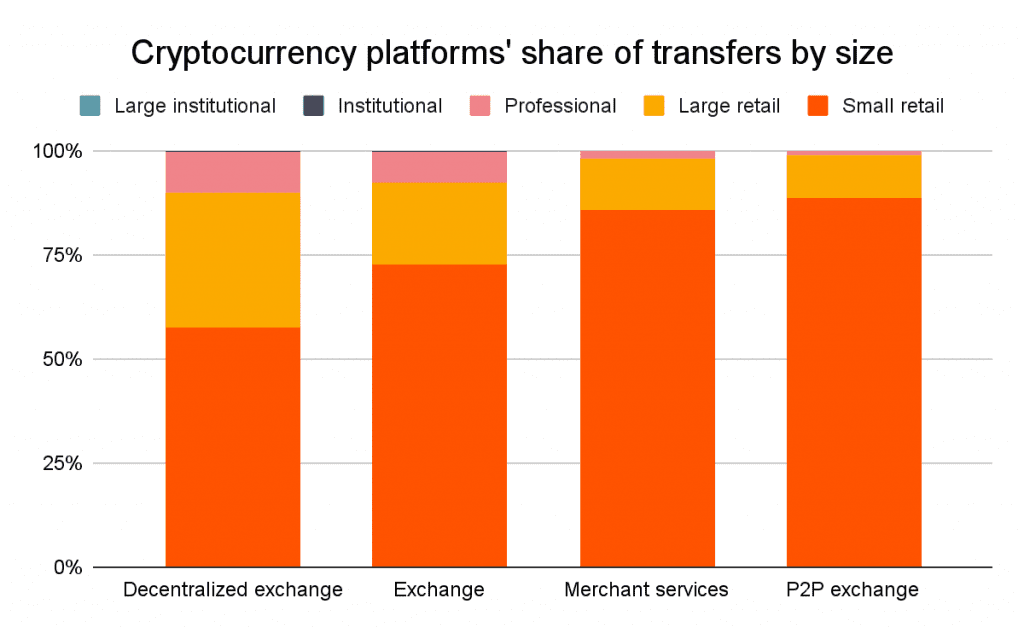

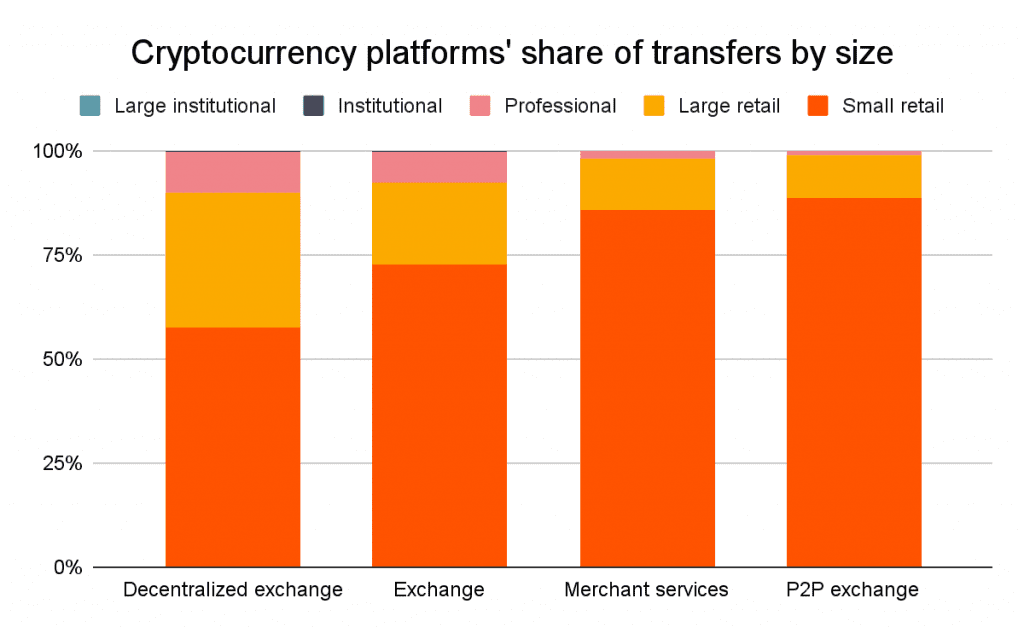

The analysis exposes that P2P trading stands out the most in these nations. Citizens use these marketplaces “as their primary avenue for accessing cryptocurrencies, often because they do not have access to centralized exchanges,” Chainalysis cites interviewees from each country.

Many emerging markets face significant currency devaluation, leading residents to buy cryptocurrencies on P2P platforms to preserve their savings.

Chainalysis

In contrast to the rise of emerging markets, the new Chainalysis ranking highlights the decline of Russia, China, and the United States compared to last year. To a large extent, this could be due to restrictive and regulatory developments in these countries against Bitcoin and other cryptocurrencies.