Galaxy Digital shows potential scenarios for the digital currency following this weekend’s event.

- Galaxy Digital outlines a bearish, neutral, and bullish view of Bitcoin.

- In this bullish cycle, bitcoin has already broken several historical patterns.

Galaxy Digital, a U.S. bitcoin mining and digital asset management company, released a report on the market impact of halving. This event, which halves bitcoin (BTC) issuance every four years, will occur this Saturday for the fourth time in history. “The impact halving will have on the price of bitcoin is an ongoing debate that occurs at every halving,” he clarifies. As such, he breaks down three views that are currently out there on this impending event.

Three Post-Halving Views

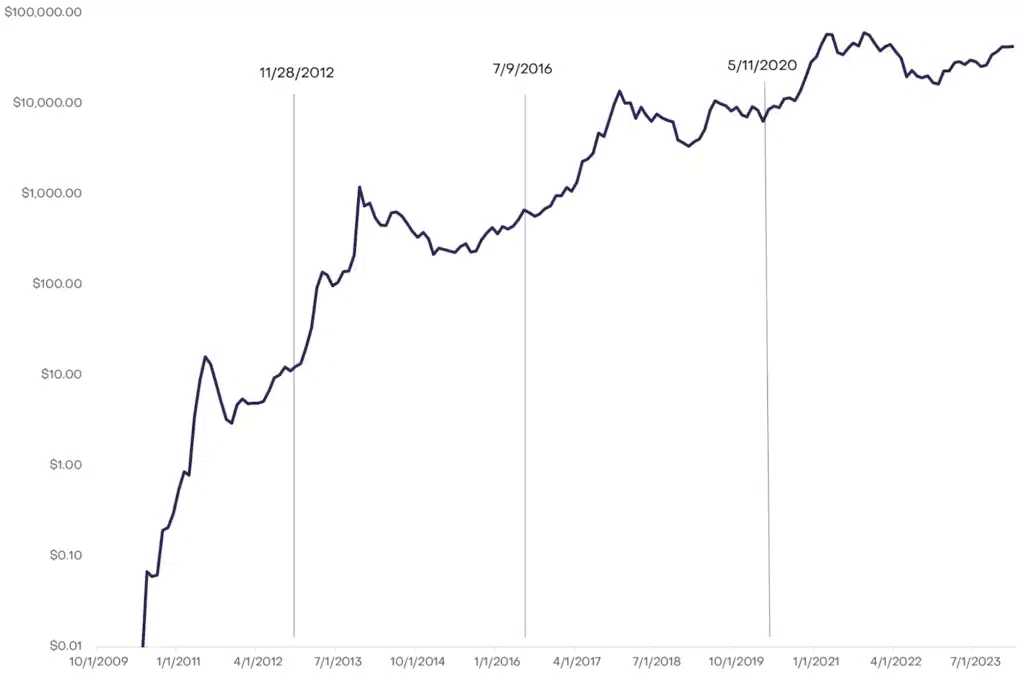

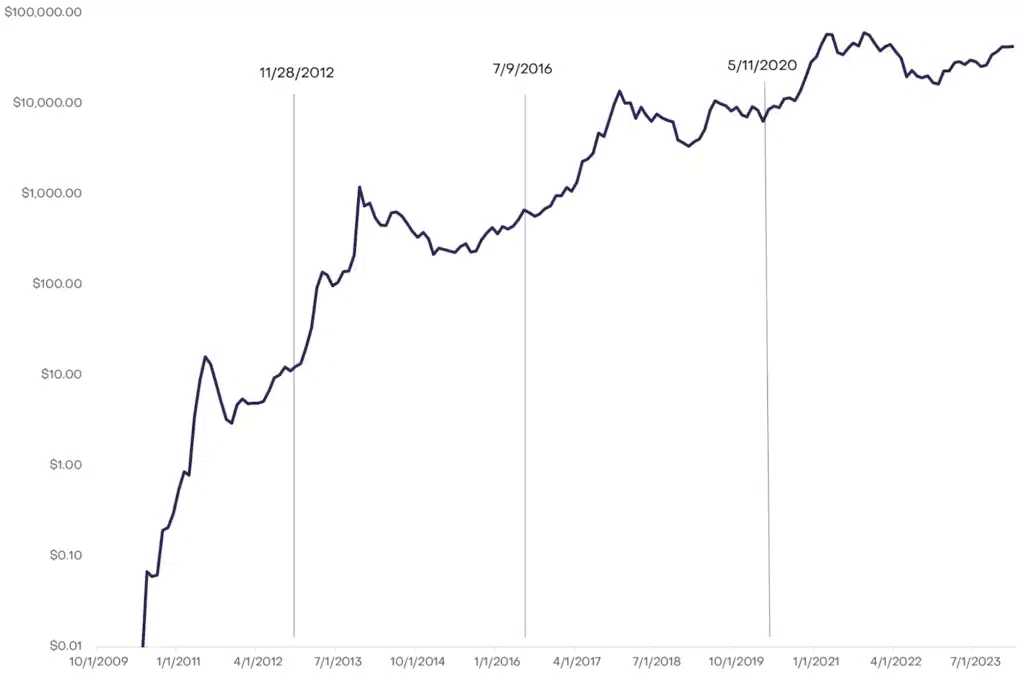

The first is a bullish view because halving “makes bitcoin more scarce overall as an asset and reduces the absolute amount of sales by miners.” He elaborates that many consider miners as forced Bitcoin sellers, as it is their source of income. Therefore, in the face of reduced supply, demand may move the price up. “Many believe that the reduction in supply growth corresponding to a reduction in selling pressure from the mining community led to an increase in bitcoin’s value after the November 2012, July 2016, and May 2020 halvings and could do the same after the fourth halving,” he says.

The second view among traders is bearish because they believe the market has adapted from the previous three halvings and has already discounted this event. This view occurs in the face of Bitcoin’s rise to reach a new all-time high (ATH) price a month ago, something that had never happened before an issuance halving.

It further indicates that this view holds that the impact of halving on BTC supply dynamics diminishes over time. To put this in perspective, it points out that the decrease from 900 BTC issued per day to 450 BTC that will occur before the next halving is much smaller in absolute terms than the first one. It was from 7200 BTC to 3,600 BTC back then. Finally, he notes that the third view out there is neutral, on the basis that the bull markets that have followed the halvings would be linked primarily to changes in demand rather than supply. For example, he explains that such bull markets “could be more correlated to global market liquidity, central bank rates, and other macroeconomic conditions.”

If history rhymes, the “BTC hype” is about to begin

Historically, Bitcoin has entered a bull market after halving for up to 600 days, known as “hype.” This concept refers to a time of increasing demand due to market excitement.

“If history repeats itself, we are currently at the end of the accumulation phase and will slowly enter the hype stage sometime in 2024,” Galaxy Digital mentions. And it details factors that contribute to this happening. The firm clarifies that while you can see Bitcoin’s price action ahead of the upcoming halving as the market hype stage that follows such an event, new developments are driving this. He singles out the launch of bitcoin exchange-traded funds (ETFs) in the United States.

“The fourth bitcoin halving will come amid a major paradigm shift for the asset following the introduction of ETFs,” he says. He stresses that these products have accumulated $12.5 billion in inflows. Against this backdrop, he details that “Bitcoin has re-emerged to the forefront of macro investor discussions, now mentioned in the same breath as gold and Treasuries as a fundamental macro hedging asset.”

“The advent of bitcoin ETFs in the U.S. represents a monumental shift destined to alter conventional notions about bitcoin price cycles, the assessment of headline behavior, and the dynamics of rotations within cryptocurrencies,” Galaxy Digital culminated with a bullish view. This report comes as Bitcoin registers a price pullback, a behavior it typically engages in near-halving days. Bitcoin is currently trading near $60,000.