The investment firm thinks these products will launch on exchanges in January 2024.

In Short

- According to VanEck, savvy investors are positioning themselves before ETFs are approved.

- The firm filed for SEC approval to launch a Bitcoin ETF.

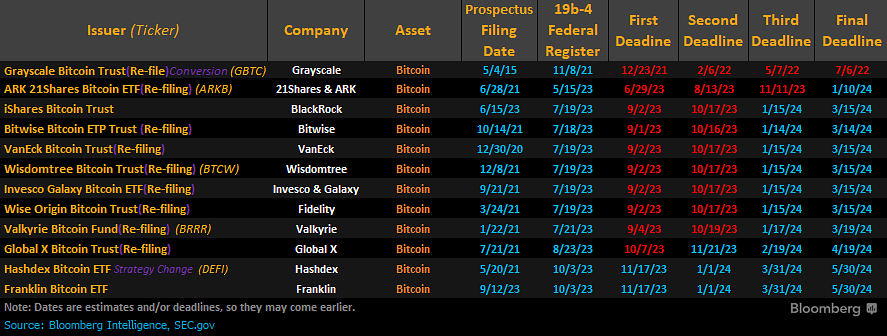

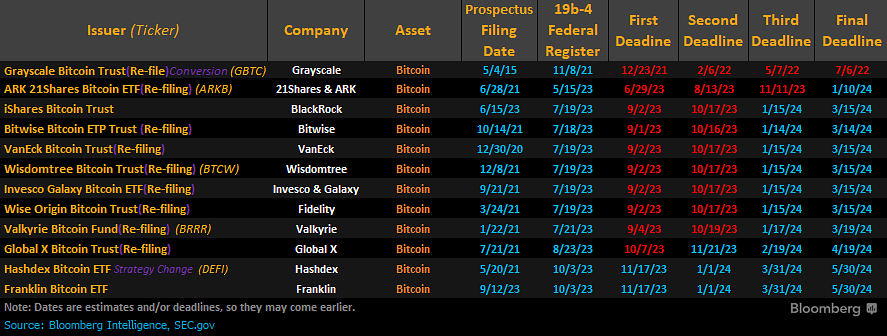

VanEck: Approval of 12 Bitcoin ETFs is imminent. A U.S. spot Bitcoin ETF would be bullish for the digital currency’s price. Investment management firm VanEck, one of 12 companies applying for a spot bitcoin (BTC) exchange-traded fund (ETF), believes that approval of all such applications will be “imminent.” In a recent analysis, the firm thinks that Bitcoin ETFs in the United States will launch in January next year. Given that possibility, VanEck assures that the most astute institutional investors are taking positions to take advantage of what is coming.

According to the current asset price, the accumulation of BTC by institutional funds reached a new all-time high, with 863,434 BTC, equivalent to $31 billion. The number beats the previous record of 841,316 BTC ($30 billion) set in April 2022. Funds have added around 22,100 bitcoins, representing an increase of 2.6%.

The Chicago Mercantile Exchange (CME) also reflected Institutional inflows. BTC futures trading volume on CME also reached record highs days ago, with an increase of 73.4%, the highest since last April. The number represents some USD 44.1 billion. All the attention generated by the ETFs has boosted the price of bitcoin as the date approaches for applicant companies to receive approval or rejection by the U.S. Securities and Exchange Commission (SEC).

Investors buying Bitcoin

In addition to funds, VanEck believes bitcoin is also attracting the attention of potential investors acquiring the digital asset directly due to its strong performance. BTC posted a 37% increase in price over the past 30 days, as seen in the following chart from TradingView:

The “sharp sell-off in U.S. government debt” also has investors looking for better ways to earn returns. For example, iShares 20 Plus Year Treasury Bond ETF (TLT), an exchange-traded fund composed of U.S. Treasury bonds with maturities of 20 years or more, has fallen 15% in six months. “Foreign central banks have been selling U.S. Treasuries and buying gold. Customers are increasingly asking if bitcoin will be the next gold,” says VanEck.