ETFs launched in October in the U.S. boosted open interest in BTC and ETH. At the same time, Bitcoin dominance is at yearly lows.

The volume of Bitcoin and Ether Futures hit an all-time high. After reaching record highs last November 10, bitcoin and other major cryptocurrencies have registered a significant correction. Recognizing this pullback in the cryptocurrency market, Coin Metric’s latest State of the Net report highlights some potential market factors. In recent months, the report notes that interest in bitcoin (BTC) and ether (ETH) futures have been on the rise and reached historic highs as well.

Open interest tracks the total number of active futures contracts, and a rise implies that more contracts are being opened, signaling new capital flows entering the market.

Bitcoin Open Interest

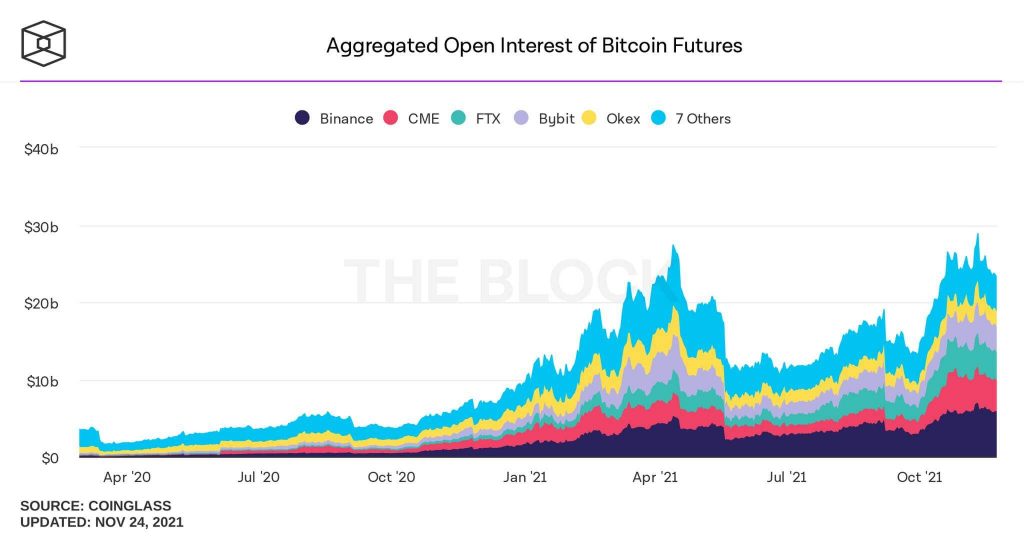

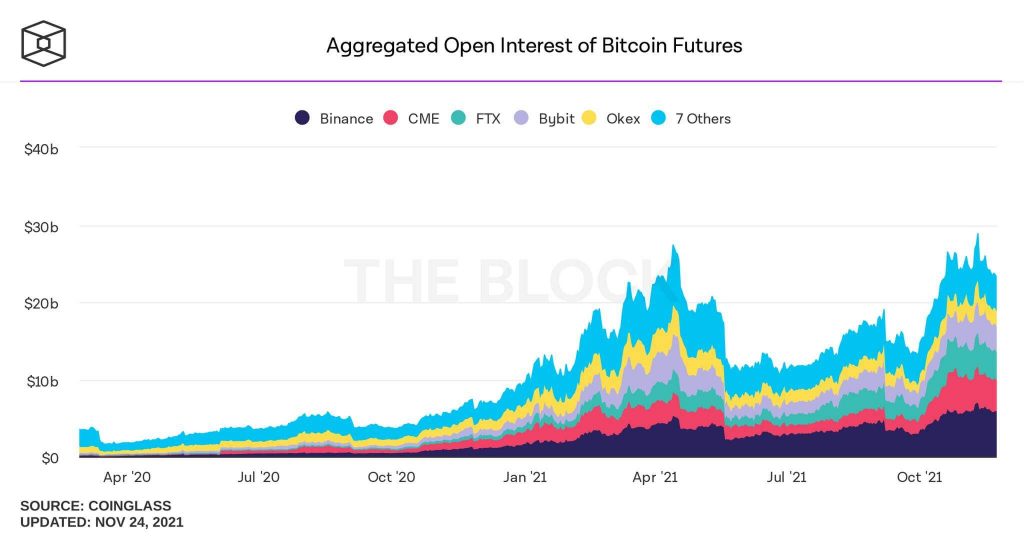

Although the data from Coinmetrics shows that BTC’s open interest exceeds $20 billion, the maximum reached is not specified. The Block portal provides a more detailed view of open interest, with open interest totals from the major exchanges, as seen in the chart below.

The chart shows that the maximum BTC open interest is $28.8 billion, recorded last November 10. Binance was the leader in terms of open BTC contracts. According to figures from The Block, on the day of the peak, it reached $6.9 billion. Next among the leading exchanges were CME Group with $4.4 billion and FTX with $4.3 billion. There has been an 18.5% decline in bitcoin open interest since the November 10 peak at $23.5 billion, although it remains among the highest levels this year.

Ethereum Open Interest

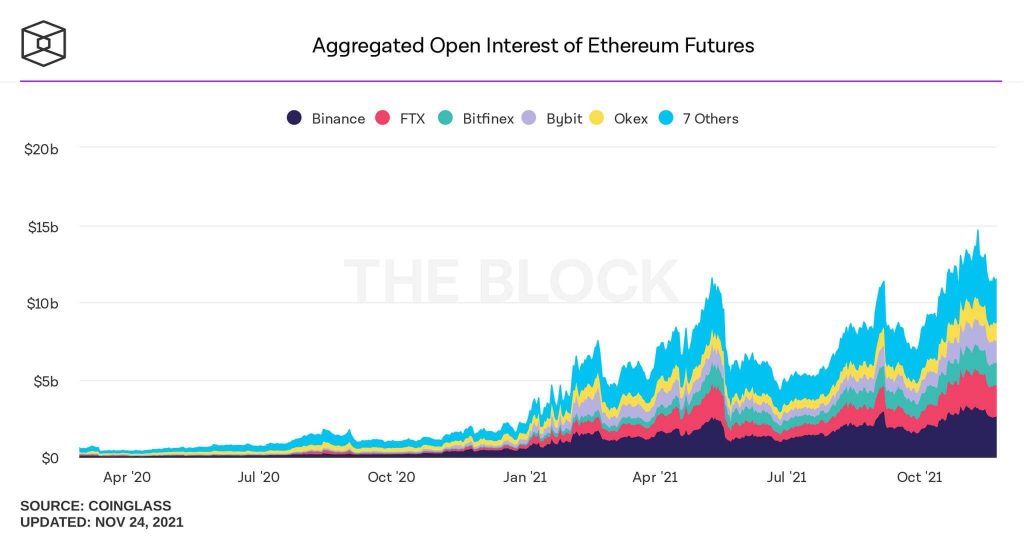

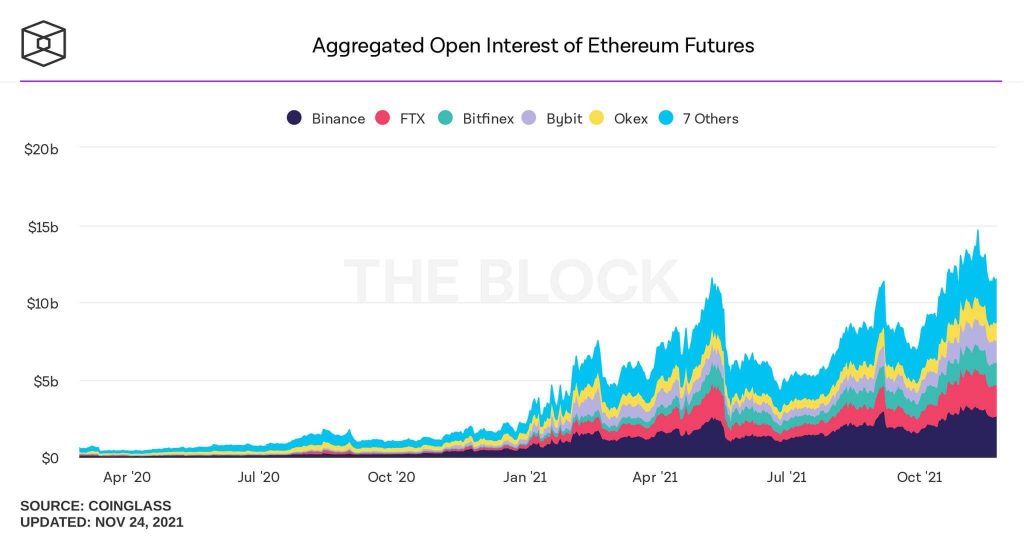

Regarding ETH open contracts, an all-time high (ATH) was also recorded on November 10, at $14.7 billion, as shown in the chart from The Block.

The chart shows the three leading exchanges in ETH futures Binance, FTX, and Bitfinex, followed by Bybit and Okex.

The Bitcoin ETF push

A month ago, this recent bitcoin futures push was associated with the launching of the first bitcoin futures ETF in the United States. Three bitcoin futures exchange-traded funds launched last October 19, although the community has advocated for ETFs backed directly by bitcoin.

ETFs launched in Canada as of March of this year were directly bitcoin-backed. With an eight-month head start, these bitcoin exchange-traded funds in Canada outperform ETFs launched in the United States in assets under management (AUM). Although the ETFs launched in the U.S., especially the former, had record performance during the first few days of their listing, the ETFs available in Canada have more assets under management than their U.S. counterparts.

The Bitcoin dominance rate (BTCD) nears the all-time lows

The Bitcoin dominance rate has been falling since October 20, when it reached a high of 47.7%. Initially, the fall stopped by an ascending support line in place in early September. BTCD bounced off this line on November 7.

However, the bounce was short-lived, and the ascending support line broke on November 19. The next day, it validated the line as resistance. RSI and MACD readings support the breakout.

The RSI, which indicates momentum, has fallen below 50. The RSI evolution is a bearish signal; it followed a significant bearish move the last time it occurred. Similarly, the MACD is declining and is negative. The short-term trend is slower than the long-term trend. The nearest support area for the BTCD is 39.8%, created by the yearly lows.

GALA and BAT, the surprises of the day

However, leaving Bitcoin aside, the pleasant surprises for November 25 are undoubtedly GALA and BAT, tokens that recorded the most pronounced increases of the day.

GALA, a coin associated with the protocol of the same name, is trading at nearly $0.67 per unit. GALA surged 66.8% in the last 24 hours. It recently reached record highs after being quoted at about $0.75, and the digital currency recorded a trading volume of over $5.7 million during this last day.

On the other hand, we have BAT, the digital currency associated with the Brave browser, which increased more than 24% compared to yesterday, trading at about $1.34 per unit. The team in charge has been forging important alliances during these weeks to promote the adoption of the protocol and its interconnection with other networks, consolidating the existing one with Ethereum and opening new paths with Solana.