Contents

Tether (USDT) is a stablecoin (stable currency) with 1:1 parity with the dollar, whose collateral is supposed to be in fiat. Nobody knows where’s the money.

Where is the $68 billion in Tether, the most popular stablecoin? In other words, in theory, Tether has enough assets to back its current capitalization of over $68 billion. If this were true, we would be talking about one of the largest banks in the world. However, numerous investigations have shown that the coin barely has any cash backing its value. A new report from Bloomberg has attempted to follow the Tether money trail and find out where it is. From Taiwan to the Bahamas to Puerto Rico to the French Riviera to China. Where Tether keeps his money is unknown. What is clear is that the company’s origins seem hazy, as much or more so than its present and future.

Conspiracy theories have surrounded the Tether company since its birth. Some say the Chinese mafia or the CIA controls it. Others link it to the death of John Mcafee in July of this year. The Bloomberg report notes that LinkedIn has only 20 employees for a company that manages over $68 billion.

History of Tether

Tether was started in 2013 by Brock Pierce, one of the first investors in Bitcoin; Craig Sellars, a programmer, and Phil Potter, an executive of Bitfinex (a cryptocurrency exchange based in Hong Kong). The main problem since its birth is that being 1:1 pegged to the dollar makes the company too similar to a traditional bank. These similarities have put it in the spotlight of regulators for some time now. Tether and other stable currencies, such as USDC, were founded by Ripple and Coinbase.

In May 2013, after the launch of Tether, the creators of a kind of stablecoin known as Liberty Reserve were arrested in Spain, Costa Rica, and the United States. The company operated an online exchange system outside government control, and some accused them of laundering more than $6.8 billion. It wasn’t exactly a stablecoin, but it looked like one. Arthur Budovsky, one of the founders of Liberty Reserve, who is serving 20 years in prison, has told Bloomberg that the U.S. will go after Tether in due course and that he felt sorry for them.

Reconfiguration

Faced with threats of justice, Brock Pierce gives his shares for free to Phil Porter and Devasini, Bitnifex’s CFO. Thanks to the union with the Bitnifex exchange, Tether became popular and began to trade on other exchanges. In March 2017, more than $50 million of Tether was already in circulation. However, in April 2017, the Taiwanese banks where Tether and Bitnifex kept their money closed their accounts, and Tether executives charter private jets to move the cash from Taiwan to Puerto Rico.

In Puerto Rico, they partner with a startup known as Noble Bank International. John Betts, director of Noble Bank, claims in the report that they had more than 98% of their reserves in cash when he worked with Tether. However, rumors about it not being backed by anything began circulating on social media, and the U.S. Trade Commission and the FBI opened an investigation.

Growth

2017 the cryptocurrency boom occurred, and Tether reached more than $1 billion. At this point, Betts urges Devasini to conduct an audit to respond to criticism, but the latter refuses. According to Betts, Devasini had started using the $1 billion reserves to make investments, totally against Tether’s principles. If the investments went wrong, Tether holders could lose their money, causing a conflict of interest between Betts, Devasini, and Porter. Finally, Devasini buys Porter’s share for $300 million and takes the money out of Noble Bank, causing the bank to fail.

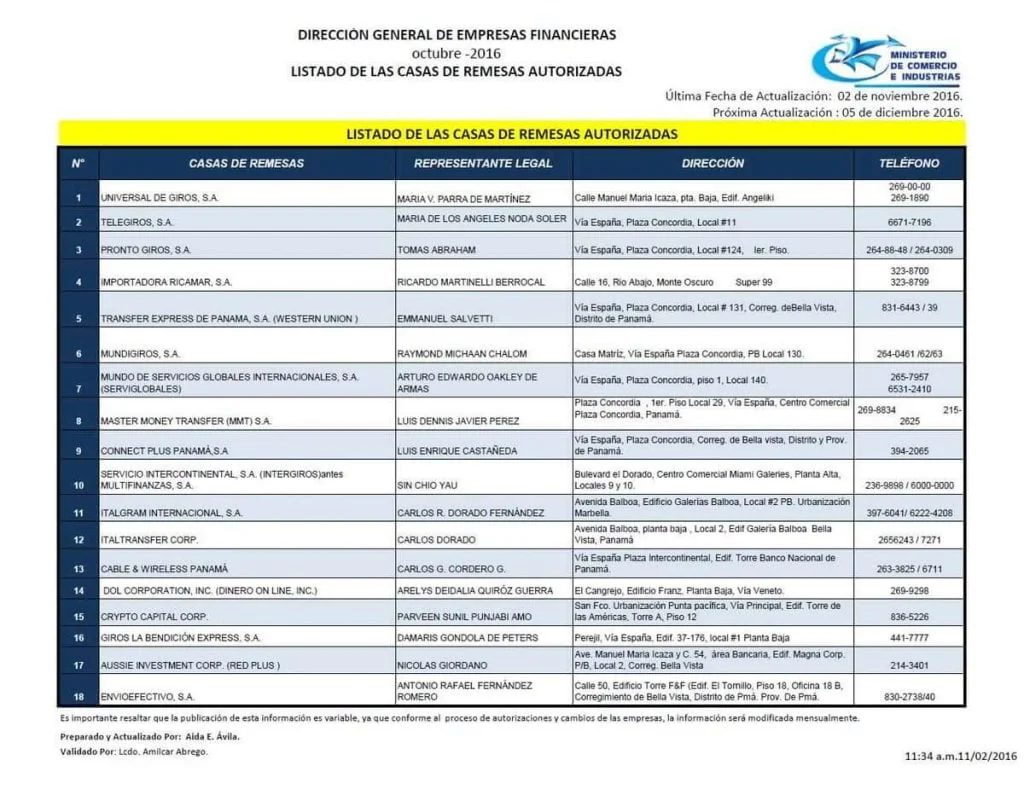

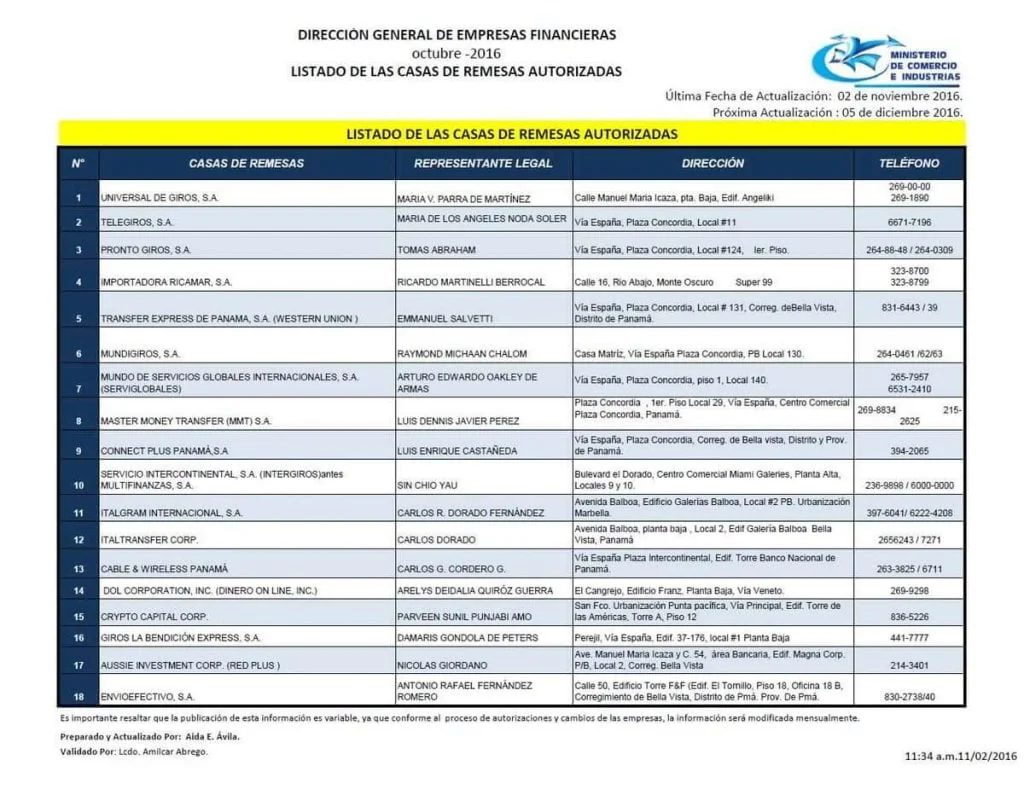

A few months later, Devasini deposited $850 million in a Panamanian investment fund known as Crypto Capital Corp, according to information from the New York Attorney General. But, for no apparent reason, Crypto Capital Corp refused to return the money to Devasini, leaving him unable to pay clients who wanted to withdraw their money. After some time trying to appease clients with excuses, Polish prosecutors seized Crypto Capital’s accounts. Later, Crypto Capital was found laundering money and involved in an international drug cartel.

No backing

In 2019, instead of admitting that Bitnifex was insolvent, Devasini filled this hole with loans from Tether reserves, leaving the stablecoin without backing. In fact, in February of that year, Tether changed the slogan on its website. No longer, “Tether is backed 1:1 with the dollar.” It becomes, “Every Tether is always 100% backed by our reserves, which include traditional currencies and cash equivalents and, sometimes, may include other assets and loan credits extended by Tether to third parties, including affiliated entities.” The change showed the direction the company was heading.

However, in May 2019, Bitnifex raised a $1 billion investment from several cryptocurrency traders. Devasini uses this money to fill Tether’s reserves. With the arrival of the pandemic, Tether’s growth is exponential, eventually selling more than 17 billion Tethers. It is, according to market capitalization, one of the largest cryptocurrencies.

Where is the money now?

The fate of more than $60 billion remains unknown. The Bloomberg report indicates that $15 billion is in a bank in the Bahamas, but the rest appears to be in financial limbo. The remaining $45+ billion could be between short-term loans to large Chinese companies and crypto companies with Bitcoin as collateral. One of these companies could be Evergrande, the Chinese real estate giant that collapsed in September this year. On the crypto side, the name falls on Celsius Network, a cryptocurrency investment fund that pays an interest rate of over 5% on billion Tether loans. Celsius provides retail users with interest-bearing accounts. Like its competitor BlockFi, Celsius has become the target of a growing list of state securities regulators about its interest-bearing accounts. Regulators say they are dealing in unregistered securities.

Tether’s response

Following the Bloomberg publication, Tether made a public statement in which it expressed:

“The Bloomberg BusinessWeek article published today is a one-act play that the industry has seen many times before, taking snippets of old news from various places and dubious sources and making it fit into a pre-packaged, pre-determined narrative.”

He adds, “Crypto and Tether, in particular, are fostering a revolution in financial inclusion, transforming a model that doesn’t work in a modern world. This article does nothing more than attempt to perpetuate a false and outdated story about Tether based on innuendo and misinformation, shared by disgruntled individuals with no direct involvement or knowledge of the company’s operations.”

It states, “The reporter … relies on John Betts, the former Noble Bank director whom Tether fired as its banker. In an ongoing lawsuit, Noble accuses Betts of engaging in egregious and wasteful personal dealings and seeking to enrich himself at Noble’s expense. It shows a complete lack of diligent research, and his actions consist of outlandish anecdotes not geared toward ethical reporting but character assassination.“

Out of Twitter

Cryptobriefing reports that someone deleted the Twitter account belonging to Tether CEO Jan Ludovicus van der Velde. The deletion came after Bloomberg published the abovementioned investigation into the company’s USDT holdings. The CEO’s latest statement read, “stay tuned.”

Van der Velde’s account was previously under the username @urwhatuknow. His latest tweet, posted on October 4, is still available as an archived page and anticipated the content of the Bloomberg article by several days. That message reads:

“Another financially enslaved dying magazine was trying to create a Tether FUD to bring in some cash and delay its extinction for a few more days. Stay tuned…. # dinosaurs.”

Van der Velde remained elusive even before the account was deleted, claims the Cryptobriefing media outlet, and says that some have questioned whether the CEO exists or if the name is simply a pseudonym. This media outlet also claims that while Tether’s harshest critics believe the company is on the verge of collapse, Bloomberg’s complaint is unlikely to produce such an extreme outcome, especially given that Tether has survived several controversies, including an investigation for bank fraud.