The halving of Bitcoin is a historic event that generates many feelings in the digital currencies. It has an influence on cryptocurrencies but also the rest of the altcoins market and related submarkets. It is an epicenter event that shakes all assets of the same genealogical line.

Halving is an automatic network event that occurs every 210,000 blocks or four years. It consists of cutting BTC rewards to miners by 50% for each valid block of transactions they process on the network. Considering the market and the currency’s influence, the magnitude of this event becomes evident in each edition. Historically, the halving causes an upside, given that it is the backbone of Bitcoin’s price cycle due to its deflationary nature. There have been three halvings in the history of this blockchain (2012, 2016, and 2020). Within a year of the event, the price of BTC reached higher magnitudes in each edition.

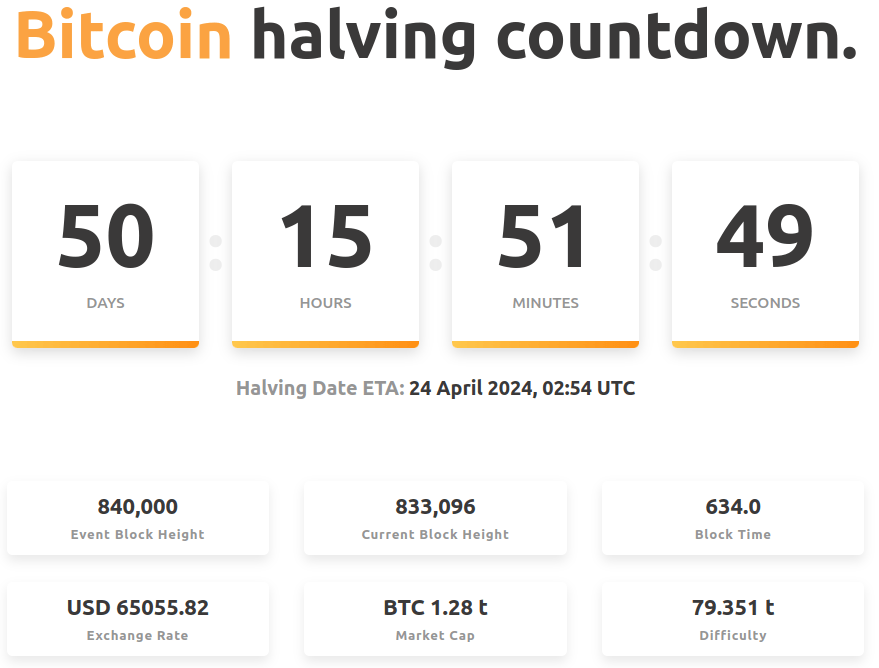

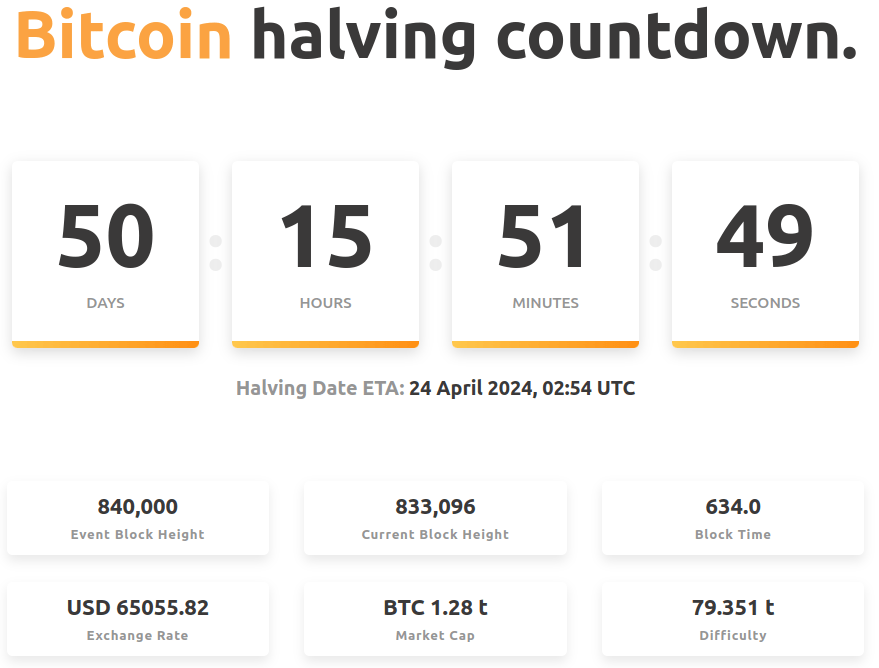

The latter generates a flurry of expectations and speculation among cryptocurrency market analysts. What will happen to Bitcoin and the entire crypto market as a halving result? That’s the big question. Bitcoin halving is a month and a half away: questions are mounting.

Halving, ETFs, and the Bitcoin price

Unlike the previous three editions of the halving, Bitcoin ETFs on the NYSE mark the fourth event. These products cause enormous buying pressure on the currency, leading to the price approaching record highs even before the halving. Simply put, the effect of the new scarcity will allow the foundation for the new all-time high to be established by this time in 2025. Thus, what is happening now is a kind of calisthenics. The latter assumes as authentic the theory of BTC price cycles.

There will be a new all-time high caused by halving. The debate centers on what the final price will be. Some analysts venture to forecast the price of Bitcoin at $500,000 or more. Others are more moderate and have estimated between $120,000 and 200,000 dollars per coin. The truth is that the currency has yet to break above the 2021 highs but will most likely do so. In that timeframe, there are still entry opportunities for investors. Whatever happens, Bitcoin’s halving will generate a 50% cut in liquidity. If demand remains as it is now, the price rally could increase compared to the current point. For investors thinking longer term, the good news is even better. There will still be 28 halvings pending on the Bitcoin network.

Bitcoin surpassed $64,000

After several days of record highs for bitcoin ETFs, the price of the crypto asset soars ahead of expectations for the week ahead. Bitcoin’s (BTC) price surpassed the $64,000 mark it had reached last February 28. Bitcoin is trading at $64,007. The number is the highest price for bitcoin since November 15, 2021. With this upward movement, BTC is closer to its all-time high price of $69,000.

Why is the price of Bitcoin rising?

This weekend’s price rise is due to the high expectations the market is showing for the week about to begin. Recall that, over the past few days, bitcoin ETFs listed on U.S. exchanges have set a record for trading volume. In the words of Eric Balchunas, senior analyst at Bloomberg Intelligence, what is happening with these financial products “is ridiculous.”

We will have to wait for the market to develop its movements during the next few days to know if these expectations occur. Just as some have optimistic expectations, some point out that a correction is possible. For example, Julio Moreno, an analyst at CryptoQuant, warns that some indicators show that the market could be “overheated.”

Anyway, beyond the fact that bearish corrections may occur in the coming hours or days, in the medium and long term, bitcoin will have a bullish 2024. The approval of ETFs and the massive influx of institutional and retail investment would be responsible for the rise. Added to all this is that Bitcoin technology continues to develop, creating new utilities for the network created by Satoshi Nakamoto.

Coinbase Report

A recent report from Coinbase, the world’s second-largest bitcoin and cryptocurrency exchange, reads as follows:

“Recent performance has been consistent with our bullish outlook (…), although we are cautious about some negative seasonal factors that could still emerge in March. Traditional assets tend to be affected by drivers such as tax payments, which could lead to some temporary downward pressures. The large and sustained positive movement in funding rates and open interest could also have ramifications if it causes cascading long liquidations. That said, we are still generally bullish on our outlook over the next few months as spot ETFs feed into wealth management firms and net inflows absorb liquid circulating supply quicker than bitcoin miners produce.”

Coinbase, bitcoin, and cryptocurrency exchange.

By saying the latter, Coinbase is referring to the fact that the pace of BTC buying by ETF issuers is outpacing the pace of BTC issuance by miners, by the simple law of supply and demand, drives up the BTC price. Gabe Parket, an analyst at Galaxy Digital, says that “Bitcoin’s approach to record highs is the culmination of growing confidence in the asset among investors, RIA [registered investment advisor] platforms, and U.S.-based institutions.” For Parket, “Bitcoin has re-emerged and is at the forefront of macro investor discussions, and is now mentioned in the same breath as gold and Treasuries as a fundamental macro hedging asset.”