Halving reduces miner rewards every four years, which could increase value, but volatility may influence it.

Bitcoin Halving History Lessons. The crypto world is on the threshold of a crucial event: the expected Bitcoin halving in April 2024. This phenomenon has profound implications for supply, demand, and, of course, the price of the pioneering cryptocurrency. Incidentally, halving, a phenomenon that occurs every four years, halves the reward miners receive for each block of Bitcoin they generate. This mechanism seeks to limit the total amount of Bitcoin, set at 21 million. But how does halving affect the price?

Halving has several impacts on Bitcoin. First, it decreases the supply of Bitcoin on the market, making the cryptocurrency potentially more valuable. Available supply can lead to significant BTC price increases. A price surge occurred in previous halvings. However, it is crucial to consider the crypto market volatility. Results can vary.

Background of Bitcoin halving

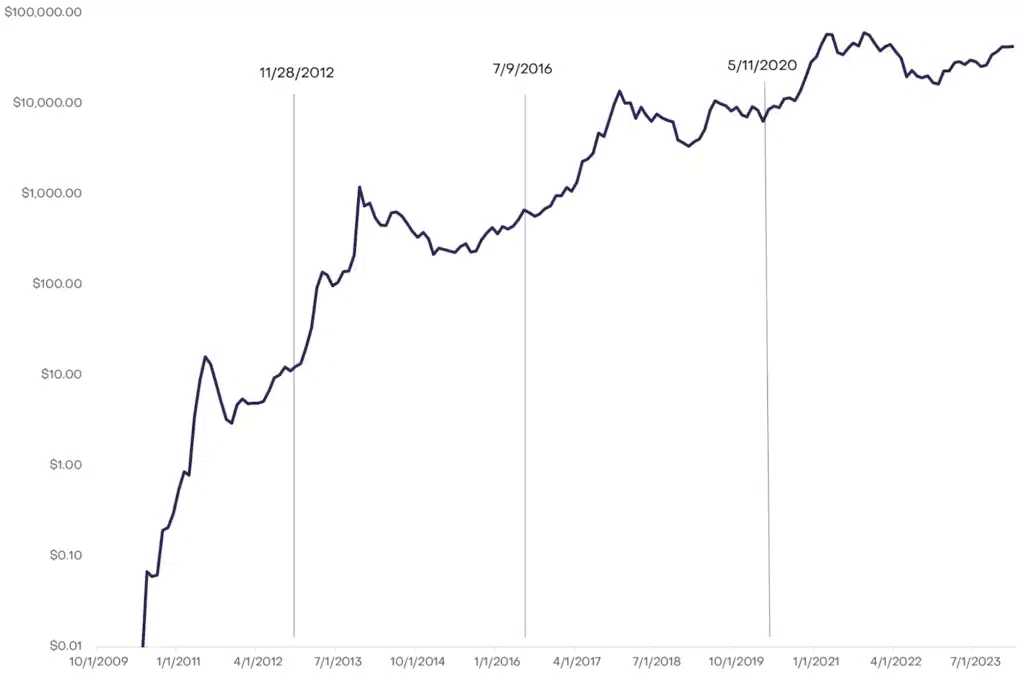

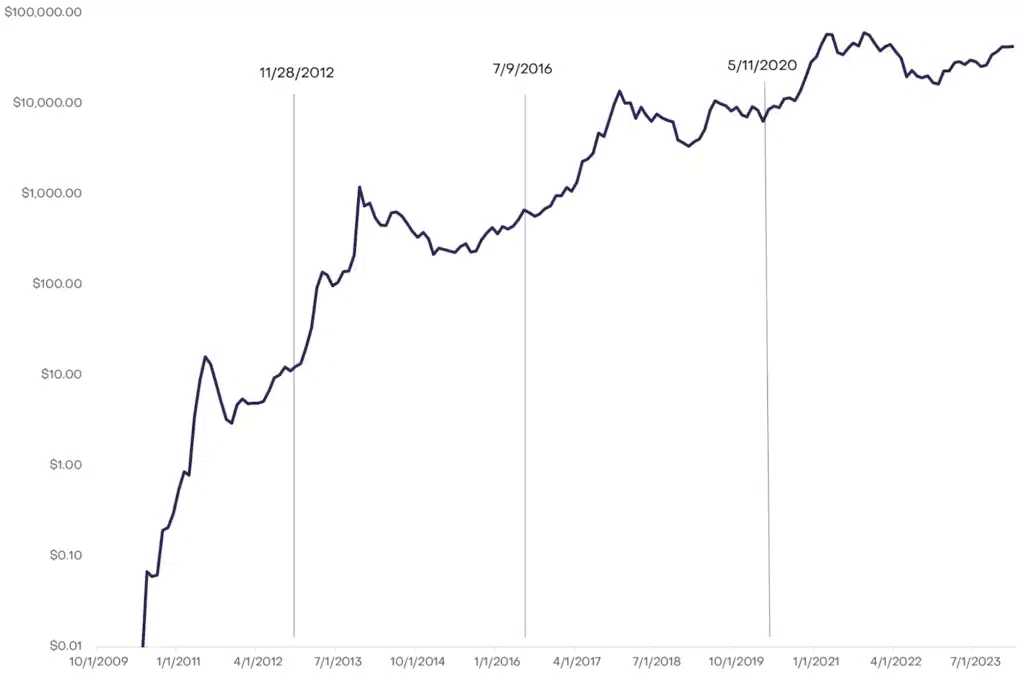

When we analyze the above, we observe some patterns. For example, each has been followed by a significant increase in the Bitcoin price, although the timing and magnitude of this increase have varied. To cite one situation after the first halving, the price experienced exponential growth the following year. In the subsequent ones, the consequence was the same: an exponential increase in price, although with a slightly different behavior, as the rise came with a delay. This is because market conditions were different, something we must consider when the long-awaited halving of 2024 arrives.

For a clearer view, the first time it happened was in November 2012, when the miners’ reward decreased from 50 to 25 Bitcoin per block. Before the halving, one Bitcoin was worth about $12.31. After the event, the price remained stable for a few months and climbed to over $1,000 in November 2013. For this first halving, its community was relatively small, public awareness of cryptocurrencies was limited, network computing power was low, and mining costs were lower.

Expectations and results on price

Next, the second halving took place in July 2016, reducing the reward to 12.5 Bitcoin per block. Before the event, one Bitcoin was worth around $650.63. After halving, the price experienced a slower rise but reached over $19,000 in December 2017. Bitcoin has achieved greater general recognition. This event attracted increased attention, which led industry insiders to anticipate a positive impact on the price to offset the reduction in rewards to miners.

The third halving occurred in May 2020, at the height of the pandemic, reducing the reward to 6.25 Bitcoin per block. Before the event, one Bitcoin was worth about $8,800. Subsequently, the price declined slightly but raised to $69,000 in November 2021. It effectively captured worldwide attention, which intensified the focus on its future. Numerous investors and analysts tried to predict the direction of Bitcoin’s price after that halving.

We expect the next Bitcoin halving event to take place in April 2024, and investors will have to wait and see how this event will affect its price. Finally, it is worth mentioning that the first three Bitcoin halves coincided with periods of global economic and financial prosperity. By the way, staying informed and being prepared to take advantage of these fluctuations is essential for those interested in entering the Bitcoin market.

I leave with this quote from Saifedean Ammous: “The Bitcoin halving is like a clock that marks the passage of time in the digital economy every four years, signaling that the system works as designed and that the system controls predictably the Bitcoin supply.”

Myths and truths

This event has generated several myths and realities. Below, I will provide you with some of them:

Myth 1: Halving leads to Bitcoin scarcity

Fact: Although halving reduces the rate of creation of Bitcoin, it does not automatically lead to a shortage. The total supply of Bitcoin is limited to 21 million, and halving adjusts the creation rate of new Bitcoins. Scarcity has been an intrinsic feature of Bitcoin since its original design.

Myth 2: Halving affects the price of Bitcoin.

Fact: Historically, Bitcoin halving is associated with significant increases in the Bitcoin price. Price movements are because the reduction in miner rewards can reduce Bitcoin supply in the market. With steady or increasing demand, this decrease in supply can lead to an increase in the price of Bitcoin.

Myth 3: Bitcoin halving makes mining less profitable.

Fact: Bitcoin halving, on the one hand, reduces miners’ rewards, potentially affecting mining profitability. However, it is crucial to note that many miners continue their operations even after halving. They maintain the conviction that the price of Bitcoin will increase sufficiently to compensate for the reduced reward. In addition, technological advances in mining may boost efficiency and, consequently, miners profitability.