A niche Coinbase says will lead the “DeFi renaissance.” Re-staking enables higher returns for investors.

In Short

- Ethereum is the second-largest cryptocurrency by market capitalization.

- Vitalik Buterin has warned about potential systemic risks in re-staking.

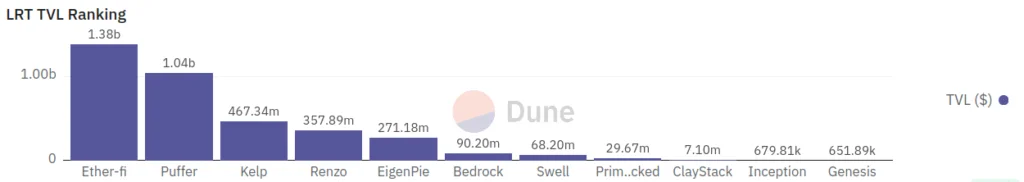

A new trend on the Ethereum network is transforming the decentralized financial landscape (DeFi). It is re-staking, which has already amassed a total locked-in value (TVL) of over $3.5 billion. People using protocols such as Etherfi, which exceeds $1.3 billion TVL, drives the renewed interest in re-staking. Similar protocols as Kelp and Renzo closely follow Etherfi. Both exceed $300 million each, as reflected in the following graph from Dune Analitycs.

What stands out in this new wave is the massive use of EigenLayer, a protocol that uses the funds deposited inside it. (secondary tokens received for staking a cryptocurrency network) to validate other networks, generating additional rewards to those already received by users in the initial staking. The platform allows users to maintain access to their funds. Thus, users have greater control over their assets and can stake in obtaining higher profits. Ultimately, it functions as an infrastructure that allows other protocols, such as Etherfi, to integrate their services efficiently. In fact, by using Etherfi services on EigenLayer, you can earn points and rewards.

How does re-staking work?

Re-staking allows investors to reuse tokens received for investing in liquid staking platforms (Lido, for example) to get additional rewards. The dynamic starts with blockchain digital assets on staking platforms, thus obtaining derivative tokens later deposited into a re-staking protocol. The latter uses these funds to validate other networks, generating higher profit than the initial staking.

It’s worth clarifying that not everyone is enthusiastic about this trend. Vitalik Buterin, the co-creator of Ethereum, has warned about potential systemic risks associated with re-staking. Buterin notes that using the network for purposes other than transaction validation “can be dangerous,” so the practice should be discouraged. However, according to Bitcoin (BTC) and cryptocurrency exchange Coinbase, re-staking creates the “renaissance of DeFi.” “We believe that a successful re-staking ecosystem with attractive additional yield could be an underappreciated anchor for ether liquidity,” the exchange added in a report.

Buterin warnings

Vitalik Buterin, co-creator of Ethereum, published a blog post explaining the risks of “overloading the Ethereum consensus.” In his view, using the network for purposes other than transaction validation “can be dangerous.”

The first use, Ethereum as an oracle, is for users to vote on which facts are trustworthy by sending ETH, using a SchellingCoin mechanism (the most voted option is “the truth,” according to this consensus mechanism proposed by Vitalik Buterin). In this type of oracle, those who send ETH to vote for the majority answer would get a proportional share of all the ETH sent to vote for the minority answer, he explains.

On the other hand, he warns about re-staking or “re-staking.” It is a set of techniques in which Ethereum validators can simultaneously use their stake as a deposit in another protocol. If they breach the rules of the other protocol, their deposit shrinks. In other cases, there are no incentives in the protocol. They use their share to vote. People use the EigenLayer protocol for these types of operations.

Third, Vitalik Buterin mentions the second layer (L2) projects recovery driven by the core network (L1). He explains that many people proposed that if an L2 has an error, the L1 could fork to recover it. A recent example is a design that uses soft forks of L1 to recover failures on L2, he details.

“If you are designing a protocol where, even if everything breaks completely, the losses are limited to the validators and users who opted to participate and use your protocol, this is low risk. If, on the other hand, you intend to get the social consensus of the Ethereum ecosystem to fork or reorganize to solve your problems, this is a high risk, and I submit that we should strongly resist all attempts to create such expectations.”

-Vitalik Buterin, co-creator of Ethereum.