ETH2 poses specific economic changes from the current version of the network. What will happen to ether (ETH) after The Merge?

In Short

- The economics of ETH will be based on coin minting and fees.

- Cryptocurrency issuance depends inversely on the amount of ETH staked.

Ethereum 2.0 Economic Model after The Merge. Aside from the changes that Ethereum 2.0 will bring to the current network, it also raises questions about what will happen to ether (ETH), Ethereum’s coin, after The Merge, the network’s transition to the new version, which will take place in the second half of this year. Twitter user DeFi Surfer (@808 Investor) wrote a thread on Twitter detailing the future of ether in the following months to explain what will happen.

According to these discloser details, which relied on publications by well-known Ethereum developers such as Justin Drake, Ryan Berckmans, North Rock Digital, and 0xHamZ, the network’s economy will move from two factors. These are the issuance of ETH to reward validators and the commissions paid on the network.

ETH Issuance

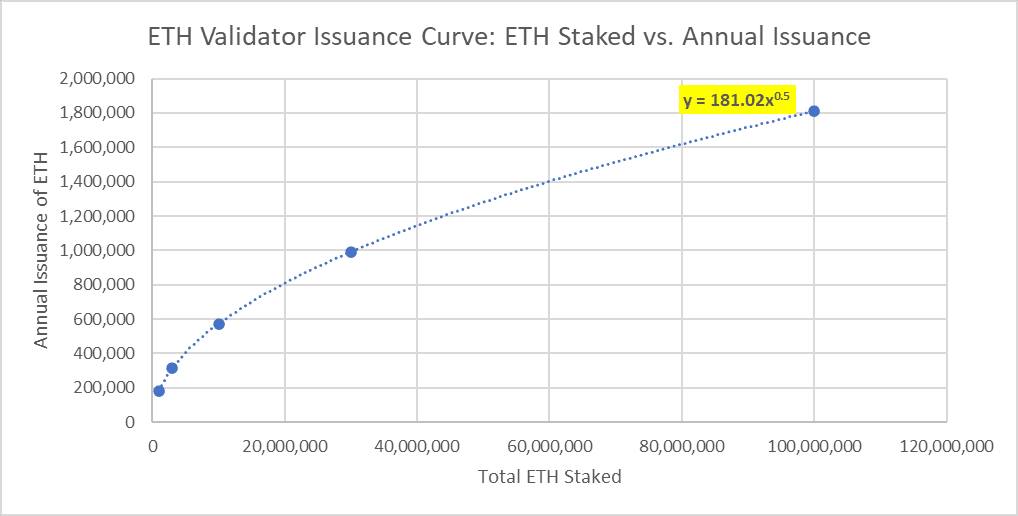

The issuance of new cryptocurrency units will now remain in the hands of validators, not miners. The mechanism has its roots in a compensation structure dependent on the number of validators, as explained in the Ethereum 2.0 roadmap.

The chart shows that ETH issuance dilutes as users stack more ETH (i.e., deposited as collateral) on the network. Using this math, with a total of 15 million ETH staked (currently, there are 12.7 million, according to beaconcha.in), you can compute that those validators will earn around 700,000 ETH a year for their contribution to the network.

On the other hand, speaking about commissions, since the implementation of EIP-1559, about 70% of those commissions get burnt, an improvement proposal that modified Ethereum’s reward and fee mechanism. The other 30%, meanwhile, goes to reward validators.

In this regard, the more activity on Ethereum, the higher the fees paid. If fees go up, more cryptocurrency units will get out of circulation. Thus, in the future, the use of Ethereum will contribute to reducing the circulation of its cryptocurrency.

So far, in 2022, Ethereum’s gas consumption (i.e., fees) ranged from 248,400 ETH in March to 301,000 ETH in January, according to Glassnode data. Projections show that the Ethereum blockchain will consume 3.2 million ETH annually by the end of 2022, of which only 978,000 ETH will remain in circulation.

Ethereum will become deflationary in the long run

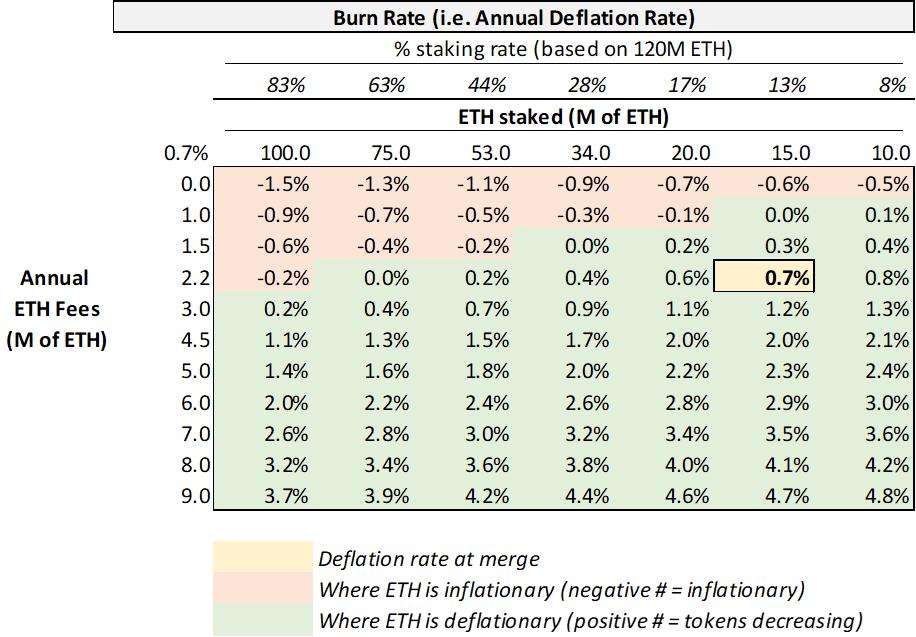

In version 2.0 of the network, users expect Ethereum to become deflationary. The issuance of its ether cryptocurrency will be less than the amount burned. For practical purposes, DeFi Surfer calculates the economic outlook for Ethereum 2.0, considering the staking of 15 million ETH and total commissions of 2.2 million ETH per year.

The consequence is that Ethereum would get a deflationary rate of 0.7% annually. Of the 2.2 million in commissions, 70% (1.5 million) will get burned. The remaining 700,000 ETH would go to validators.

ETH staking will likely increase when the merger finalizes because there will already be more certainty about how the network will work. The lock-in period for funds to be a validator will be shorter than now (where coins are locked indefinitely, at least until the merger occurs). It could also raise the return for validators to be on par with other networks that operate on a proof-of-stake (PoS) basis.

Theoretical calculations

With this, the discloser’s theoretical calculations indicate that it could go from 11% of the circulating 120 billion ETH staked to 28% after the merger, translating, as stated, into lower ETH issuance. But ether deflation can be achieved, according to DeFi Surfer, even with low on-chain activity. In the event of lower-than-average fees, issuance will reduce compared to the current allocation, so not as much ETH will need to be burned to regain a correct balance.

Added to this, if the activity on the network is higher, the burns will be even higher. Therefore, the negative balance would increase even more, and Ethereum would become deflationary even faster.

The merger of Ethereum 2.0, a key milestone for the network

Ethereum’s current network will move to its new model, Ethereum 2.0 or consensus layer, thus changing its consensus algorithm. The blockchain will no longer create new blocks through proof of work (Proof of Work or PoW) but with proof of stake or staking (Proof of Stake or PoS).

Developers are betting on achieving the expected transition in the year’s second half. However, the difficulty pump, which will end mining as we know it, has been postponed several times. In the meantime, the whole process is still being tested and refined in test networks.