Stake pools have become an inexpensive option for investing in Ethereum 2.0 staking.

- Staking pools may suffer the same fate as Tornado Cash.

- Ethers (ETH) in staking will not be able to be withdrawn until mid-2023.

- If Coinbase were to close trades, it would lose more than 1.8 million ETH.

Ethereum 2.0 staking vs. Tornado Cash. ETH 2.0 is not yet born, but already at this point, it could find itself at the mercy of the United States Authorities. If staking pools were to receive sanctions like those suffered by Tornado Cash, the entire network would be compromised.

Tornado Cash protected itself against the government behind the wall of “decentralization.” Its goal was to increase the privacy of the cryptocurrencies that users received, preventing them from being traceable. However, under the argument that criminals used it, the U.S. Treasury decided to consider Tornado Cash a threat.

Although it seemed that the sanction would not fall on any entity since it was a decentralized platform not controlled by anyone, some decentralized finance platforms (DeFi) aligned with the U.S. Government. They began to censor any transaction from any address related to Tornado Cash. That was the case with Circle, developer of USD Coin (USDC), who decided to freeze funds from addresses that had used Tornado Cash.

Ethereum 2.0 staking is in trouble

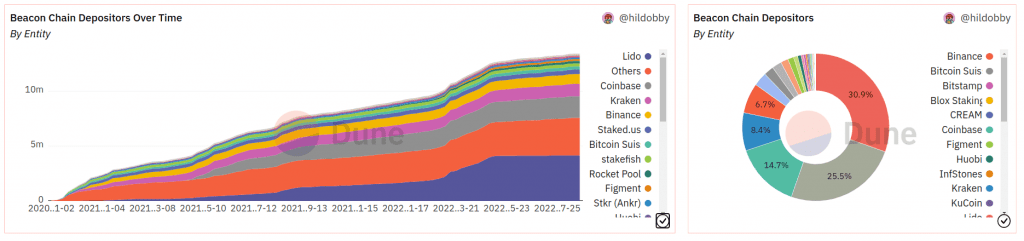

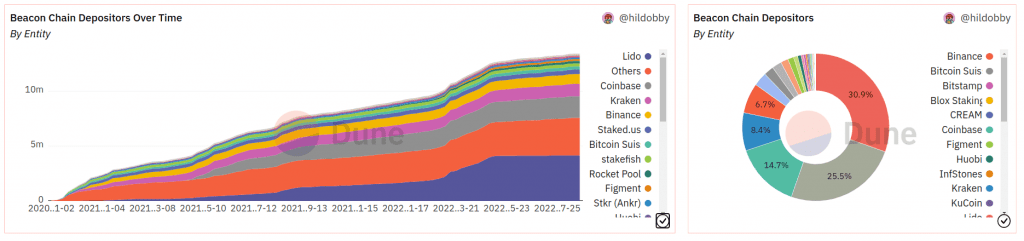

In this context, the development of what will become Ethereum 2.0 is complicating its situation. A validator node requires 32 ethers (ETH), equivalent to $60,000 as of today, making it practically inaccessible to anyone. Those who wish to invest in staking opt for cheaper solutions, such as pools that offer minimum investments of up to 0.0001 ETH (less than $1), leading to these platforms controlling 70% of all ETH deposited in staking: more than 7 million ETH.

It is worth noting that while the staking pools hold this amount, it is not ETH from them. The ETH in staking comes from their clients who invest in the platform. While some have argued that decentralized staking platforms, such as Lido, were not under state control, Tornado Cash was the perfect example of how this supposed decentralization does not protect them from governments.

Another danger within Ethereum 2.0 is that you can not withdraw (yet) your staked ETH. The Ethereum 2.0 protocol states that while validators could start trading since the blockchain went live in December 2020, they cannot withdraw their ETH until the sharding stage completes and runs in mid-2023.

If they all decide to abandon staking, owners will shut down approximately 68% of validator nodes. Platforms would liquidate about 7 million ETH, leaving losses to the customers of these platforms of around $16 billion (at the current ETH price above $2,000).

What if the U.S. sanctions all staking pools?

Given that U.S. sanctions are against any “threat against national security.” Let’s imagine that Ethereum staking becomes an economic “threat” to the U.S., so it decides to sanction these platforms. In this case, two scenarios could arise for the staking pools: force the validators to shut down or have them censor transactions associated with problematic addresses.

While this is a hypothetical case, Coinbase’s CEO Brian Armstrong, whose company currently controls 14.1% of all ETH in staking, said that, in such a scenario, he would instead abandon staking than censor transactions. Since more than 60% of staking is in pools’ hands, forcing the State to censor transactions would completely break the network by saying who can and cannot use Ethereum.

Any government did not bring about this current crossroads in Ethereum. The developers, migrating from Proof of Work (PoW) to Proof of Stake (PoS), have left the network vulnerable. If something like this happened, the network could lose much of the ETH in staking, or transactions would begin to get censored. In both cases, they would break the network, putting Ethereum in need of mercy from governments.

“We’d stop Ethereum staking if regulators threaten”: Coinbase CEO

Coinbase has 14.1% of all ether (ETH) in staking. If the U.S. were to sanction Ethereum 2.0 staking platforms, Coinbase CEO Brian Armstrong would rather shut down trades than censor user transactions. He responded to Lefteris Karapetsas, founder of an app dedicated to cryptocurrency privacy protection, Rotkiapp. He asked the four leading staking platforms (Lido, Coinbase, Kraken, and Binance), who control more than 60% of the ETH in staking, what they would do in such a scenario.

By this publication, the CEO of Coinbase was the only one to respond. In his case, he comments that it is a hypothetical situation that he hopes not to face but that, if it were to happen, he would choose to abandon staking. Armstrong adds that, in this situation, he expects a possible third option rather than just two.

Staking ETHs will not be withdrawable until mid-2023 when developers implement the stage known as sharding. If Coinbase decides to withdraw before this stage, it will lose about 1.8 million ETH. Recall that Ethereum 2.0 protocol penalizes validators who disconnect. However, since this is a staking pool, the losses would not be directly from Coinbase but from its customers, who are the ones who have given their ETH to Coinbase for it to manage.

Brian Armstrong denies that his company will censor transactions from U.S.-sanctioned addresses. His statement takes on special force with the recent case of the Tornado Cash mixer. Circle, the creator of USD Coin (USDC), froze all USDC from addresses that had used this mixer. Others, such as node provider Infura, denied access to any wallet connected to one of their nodes to use Tornado Cash.