This year, $1.61 billion worth of ETH tokens has left exchanges ahead of Ethereum’s final protocol meltdown.

Ethereum on exchanges is the lowest since 2018. The number of Ethereum’s ETH tokens managed by crypto exchanges fell to its lowest level since last September, reflecting investors’ intention to hold their tokens in the hope of an ETH price rebound throughout 2022.

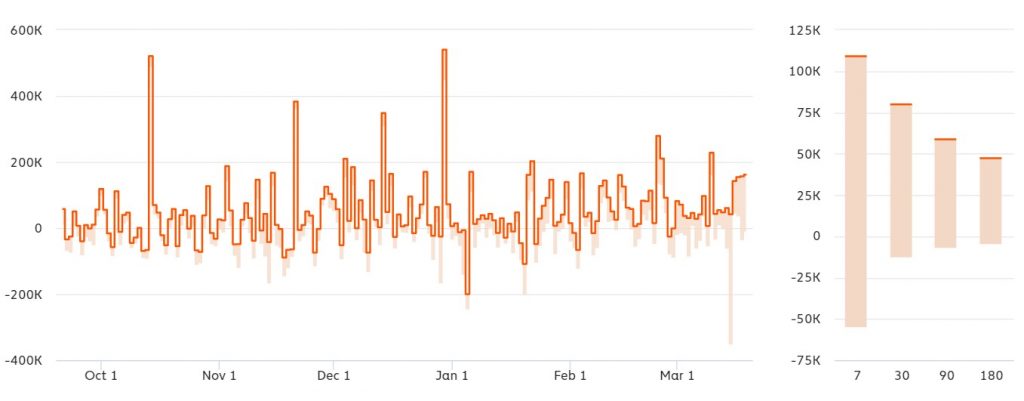

Recently, nearly 550,000 ETH worth approximately $1.61 billion has exited centralized exchanges this year, according to data provided by Glassnode. The massive outflow of ETH decreased the exchanges’ net balance to 21.72 million Ethereum units—below its record high of 31.68 million ETH in June 2020.

Biggest Ether tokens drop since October 2021

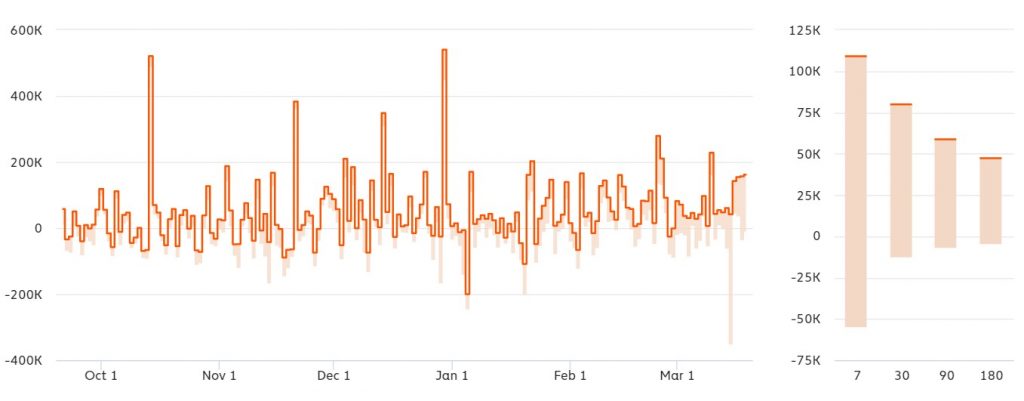

As IntoTheBlock data shows, more than 30% of all ETH withdrawals from exchanges witnessed in 2022 occurred earlier this week. In detail, more than 180,000 ETH left cryptocurrency exchanges on March 15. The figure made the ETH outflows to just over $500 million in a week by March 18.

Largest Outflows in 2022 – over 180k $ETH was withdrawn from centralized exchanges within a single day

— IntoTheBlock (@intotheblock) March 18, 2022

-Last time such a magnitude of ETH left exchanges was in Oct 2021, preceding a 15% price increase within ten days

-190k ETH was also deposited into Lido’s stETH liquid staking pic.twitter.com/wayu2nvRlR

Likewise, Chainalysis data showed similar readings. The average amount of Ether tokens leaving the exchanges this week was 120,000 ETH per day, indicating a clear bullish signal.

“Assets held on exchanges increase if market participants are more interested in selling than buying assets,” Chainalysis

IntoTheBlock provided a similar bullish forecast to Chainalysis. By citing market behavior in October 2021, Ethereum’s price rose 15% ten days after the Ethereum network detected massive withdrawals of ETH from centralized cryptocurrency exchanges.

Ethereum supply crisis likely

The increase in daily Ethereum withdrawals from exchanges averaged 150,000 ETH this week. Many moved to the “stETH liquid staking” pools on the Lido platform.

Lido is a non-custodial staking service that allows users to overcome the difficulties associated with staking on the Ethereum 2.0 Beacon Chain. Ethereum staking requires at least 32 ETH. Lido tries to solve the capital efficiency problem by issuing a tokenized version of the staked ETH known as “stETH.”

According to Etherscan data, more than 1 million ETH were added to the Ethereum 2.0 contract in the last 30 days as the protocol prepares to completely switch to the new “Proof of Stake (PoS)” algorithm later this year.

ETH price rally continues

Optimism surrounding Ethereum’s switch to Proof of Stake (PoS) has led Ether to rebound this week. The price of ETH rose more than 17% during the week to position itself at nearly $3,000.

IntoTheBlock noted that users deposited around 190,000 ETH last week for staking on the Ethereum 2.0 network (the next Ethereum network upgrade) using the Lido platform. The Ethereum 2.0 staking contract, or staking contract, currently has over 10,000,000 ETH staked on it. That accumulates over $29 billion in wagered value on the ETH 2.0 network.

You cannot ignore Ethereum’s gains in the current crypto market situation. Each of the top 10 cryptocurrencies in the market, plus Terra, has seen their share price rise by at least 5% this week. Particularly after the Federal Reserve announced a 25-point interest rate hike on Wednesday. Bitcoin, in particular, has risen by 8%. However, BTC also suffered an outflow from exchanges of 39,000 BTC on Friday, amounting to around $1.6 billion.

Related posts

- ETH burning plunges Ethereum annual inflation by 35%

- Ethereum Fees are Low Now

- Ethereum 2.0 has more than 300,000 validators