Contents

The Merge will be a historical process in Ethereum and demands some precautions to get a smooth transit.

In Short

- The Ethereum Foundation published explicit instructions for users and holders.

- Exchanges are also taking some preventive measures.

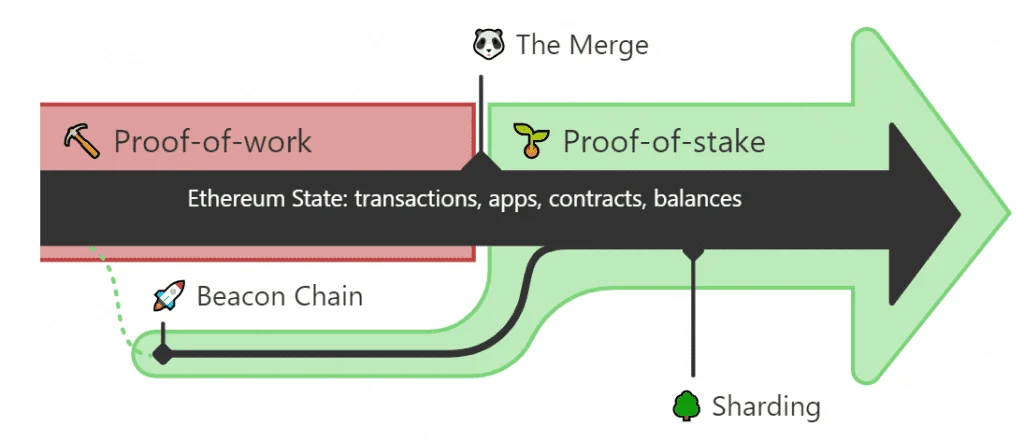

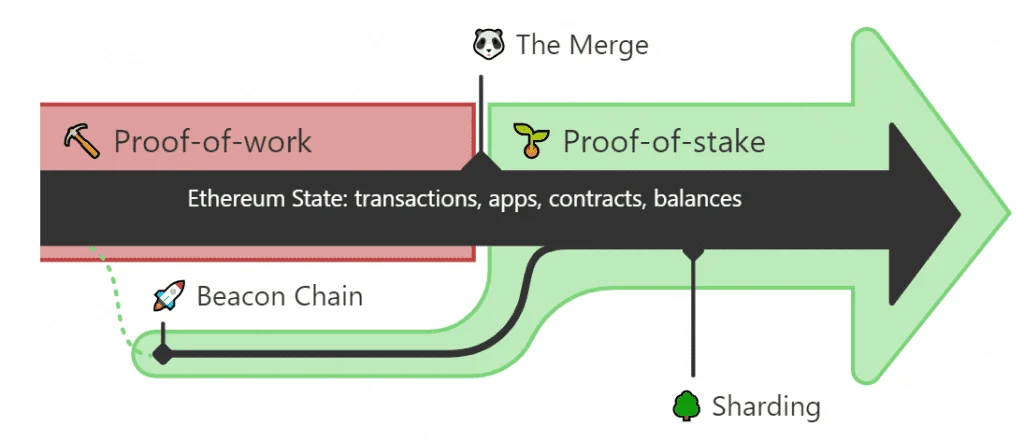

Just over a week before the Merge, preparations are beginning at Ethereum for a process that will change how the network works. However, users and holders of Ethereum’s native cryptocurrency, ether, developers, and those who operate Ethereum nodes must take certain security precautions (ETH). The Merge, also called “merging,” is the process that will culminate the transition from the Ethereum we know to a new version. This post explains the Merge should not affect Ethereum-hosted assets. If there is a fork (“fork“), these get duplicated, but they would still exist in Ethereum 2.0.

Leaving your ETH in a wallet is the safest thing to do

First, it is appropriate to note that the Ethereum Foundation clarified that Ethereum holders and users do not need to do anything to prepare for the Merge or even after it finalizes. Beyond the consensus algorithm change, the network’s accounting system (ledger) will remain intact from its genesis. By holding funds in a self-custodial wallet, there is no risk. Examples of such wallets include Metamask, Trust Wallet, Defiant, and Nifty, although there are many more.

“As the mainnet merges with Beacon Chain, it will also merge Ethereum’s transactional history. You don’t need to do anything. Your funds are safe.” Ethereum Foundation.

On the other hand, the same criteria apply to those who have funds in second-layer scalability solutions like Arbitrum, Optimism, or ZKSync. If you keep your funds in secure (preferably cold) wallets, nothing should happen to them. That said, they will not receive tokens from a possible fork if they have their ETH in the second layer, as will those with funds in the main chain. Finally, the issue is different for those running nodes (validators or non-validators) of Ethereum. In those cases, there are specific necessary updates and other details to keep in mind described on the Ethereum Foundation site.

Do not move funds during the Merge

In addition to keeping the money in a self-custody wallet, it is essential to avoid moving it during the Merge in case of unforeseen events. This process should complete in approximately 10 minutes. Bearing that an Ethereum transaction can take quite a long time if the network is congested, it is advisable not to make movements several hours before the Merge.

Several cryptocurrency exchanges (such as Binance, FTX, and Bitso, among others) announced that they will suspend ETH movements from a few hours before the Merge until after the process. The idea is to prevent unsuspecting users from losing their funds by moving them when the network is in complete transition. The same recommendation applies to second-layer scalability solutions, suspending fund movements before, during, and after the Merge. ZKsync reported this, and other rollups are likely to do so. In any case, it is not advisable to leave ETH in exchanges while the Merge takes place because these are centralized entities that can hold funds or freeze movements for a time.

Major stablecoins will continue in Ethereum 2.0

If you own savings in stablecoins, you should rest easy. With those tokens, you should take the same precautions as ETH and not send them during the Merge. Afterward, you can continue to use them usually. Regardless of whether or not there is an Ethereum fork, the leading stablecoin issuers, Tether and Circle, have confirmed that they will support the network with Proof of Stake (PoS). Likewise, the decentralized protocol Maker (issuer of the DAI stablecoin) will do the same.

Thus, you should know that these stablecoins will have “official” backing and that you do not need to do anything with them before the Merge other than storing them in a secure wallet. Something similar happens with non-fungible tokens (NFT). While these tokens duplicate in a fork event, those backed by their issuers (platforms such as Opensea, for example) will be the “real” ones. Most likely, the ones with that backing will be those minted on the network with PoS, i.e., Ethereum 2.0. This is the case of the already-named Opensea, the leading Ethereum NFT marketplace.

Beware of scams!

When there is uncertainty about an issue and the course of action to follow, opportunists want to take advantage. So be especially vigilant with offers of help and recommendations received before the Ethereum Merge. Many myths and misconceptions are circulating these days. You should know, for example, that there is no cryptocurrency called ETH2.0 or anything like that. The Ethereum 2.0 cryptocurrency will remain ether as it is now. Therefore, we must be careful if someone advises “migrating” funds to the new network.

In any case, if there were to be an Ethereum fork with PoW, its token could be called ETHPoW. Several exchanges already allow trading with that token (a purely speculative type of trading for now), but it has nothing to do with Ethereum’s native cryptocurrency.

“Do not send your ETH anywhere in an attempt to ‘upgrade to ETH2’. There is no ETH2 token, and there is nothing else you need to do to keep your funds safe.” Ethereum Foundation.

Finally, a potential fork could result in the sale of duplicate NFTs on the forked network. As explained, these would not have the endorsement of the issuers of the original NFT (on the PoS network), so it would not be a genuine NFT.