More nations will adopt Bitcoin, as El Salvador did, according to KPMG. Despite the market downturn, the firm sees strength and increased Bitcoin adoption.

In Short

- El Salvador inspires other countries to adopt Bitcoin in the future.

- KPMG forecasts the extinction of several cryptocurrencies due to a lack of clear proposals.

KPMG, an audit and tax firm, presented a report (PDF) in which it assures that the bitcoin (BTC) and cryptocurrencies ecosystem has achieved sustained maturity and considers that more countries will follow the example of El Salvador and the Central African Republic in the adoption of the digital asset.

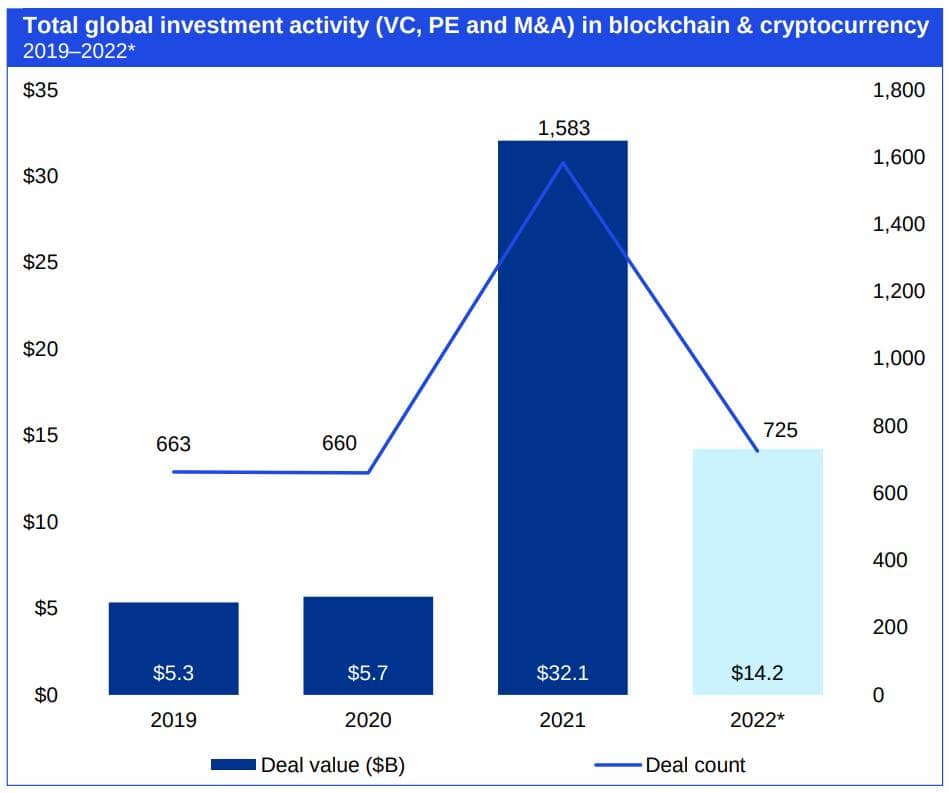

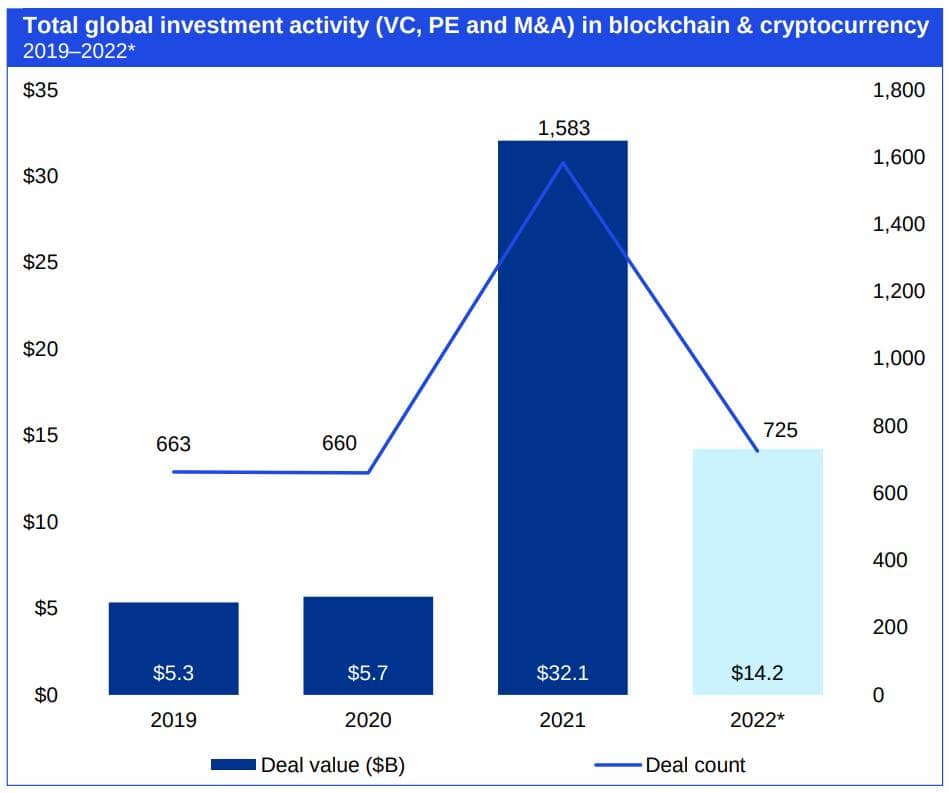

The Pulse of Fintech indicates that mid-year investment “remained well above all years before 2021” despite several factors that have affected the market, such as the conflict between Russia and Ukraine, rising inflation in countries such as the United States, and the collapse of Terra,

Global investment in cryptocurrencies and blockchain fell to $14 billion during the first half of 2022, highlighting and signaling the maturity reached by Bitcoin and the rest of the industry. The firm points out the report for the first half of this year.

Bitcoin and monetary sovereignty

Another aspect included in KPMG’s analysis is the “increasing focus” on monetary sovereignty provided by Bitcoin adoption in cases such as El Salvador and the Central African Republic.

One year ago, on September 7, 2021, El Salvador turned the first country to use Bitcoin as a legal tender. The measure intended to create more options to move its economy, more possibilities to attract foreign investment and greater financial freedom.

For the auditing firm, El Salvador’s move sparked “a growing interest in the use of crypto to exercise sovereignty and move away from the use of legal tender currencies such as the U.S. dollar.” It implies that other countries might do the same in the remaining years of 2022 and the following few.

Bitcoin scarcity is programmed in its inner working and has a maximum issuance of 21 million units. In sharp contrast, the money issued by sovereign states does not have a cap since they own the monopoly to print money. Some countries are considering moving away from the U.S. dollar for international payments.

Many crypto projects will die

For his part, Alexandre Stachtchenko, director of blockchain and crypto assets at KPMG France, indicated that “some cryptocurrencies will become extinct” because they do not have “clear and solid” value propositions. While people may perceive it as a negative, it is quite the opposite for the executive.

“It could be quite healthy from an ecosystem point of view because it will remove some of the clutter that was created in the euphoria of a bull market.” Alexandre Stachtchenko

Likewise, he added that this would allow the best companies to survive in times of turbulence like the current ones.