Bitfinex exchange created USDT stablecoin. Since its inception, many people have questioned the quality of Tether’s collateral reserves.

In Short

- The CTO defends itself and says that Tether has improved transparency in its reserves.

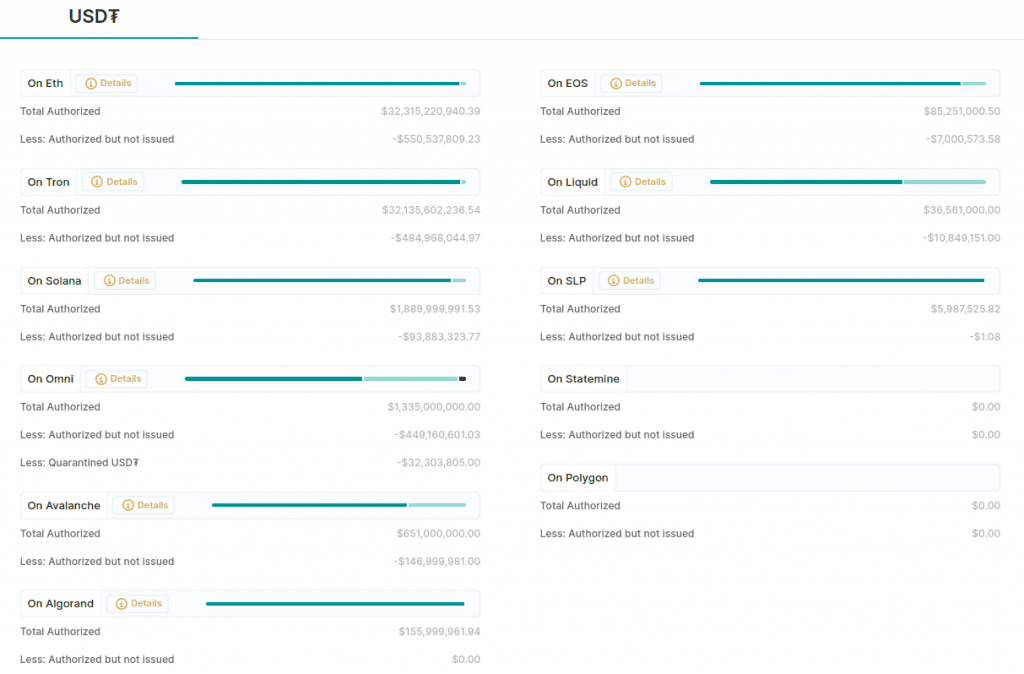

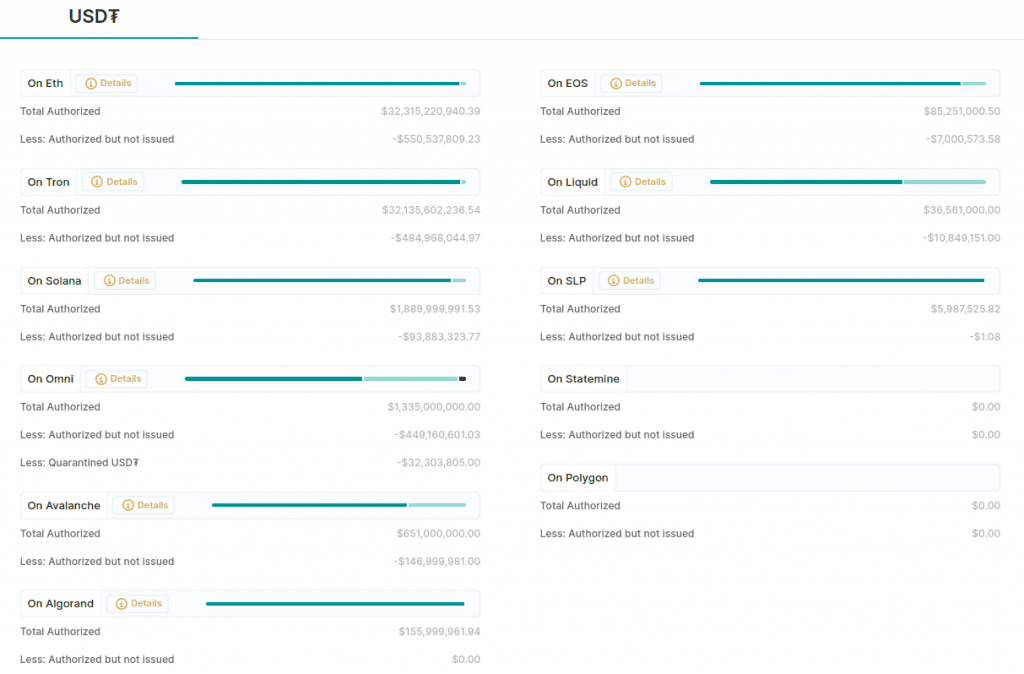

- Tether (USDT) currently is the stablecoin with the largest market capitalization.

Is Tether Under Attack? Paolo Ardoino, chief technology officer (CTO) of Tether, which issues the USDT stablecoin, claims that the token is under attack by hedge funds. These companies, he says, intend for USDT to lose its parity with the U.S. dollar, and their strategy would be to spread false information about the USDT stablecoin’s reserves.

1/

— Paolo Ardoino ? (@paoloardoino) June 27, 2022

I have been open about the attempts from some hedge funds that were trying to cause further panic on the market after TERRA/LUNA collapse.

It really seemed from the beginning a coordinated attack, with a new wave of FUD, troll armies, clowns etc. https://t.co/hhcsgHV1Ow

In a Twitter thread, Ardoino claimed that after Terra USD’s fall and LUNA’s fall, hedge funds created a “coordinated attack” against his stablecoin. Reserves do not back that “100% of USDT” would be the argument put forward by the alleged attackers. For the businessman, this is false. He argues that “USDT is 100% backed and has never failed in accountability“.

In addition, the CTO comments that detractors spread the rumor that Tether owned stock reserves in Evergrande, China’s second-largest real estate company. For almost a year now, many people have accused different organizations that he could cause an economic crisis similar to 2008 due to the debt defaults he owns.

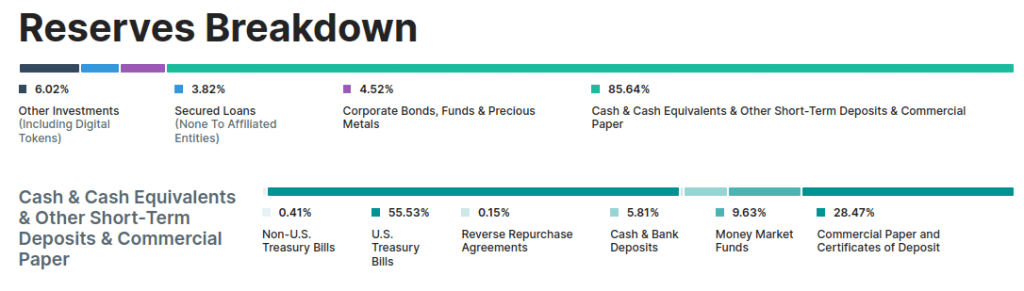

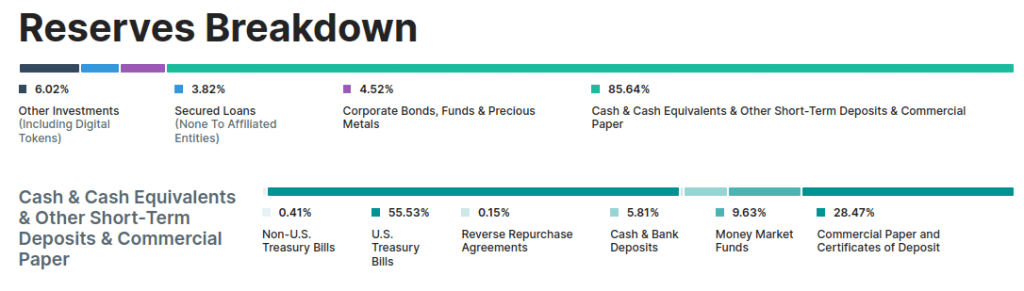

The CTO defended himself by commenting that Tether has never had any exposure to this Chinese real estate company, nor does it have any exposure to Chinese securities (commercial paper). He even comments that the current goal is to reduce reserves in securities to zero and transfer them to U.S. Treasury bonds.

Tether’s detractors want to take advantage of its downfall

As Ardoino exposes, the objective of seeking the fall of Tether by hedge funds is that these would have made short bets (short) against the price of the stablecoin.

A short position refers to a bet on the decline in the price of an asset. In this case, the trader borrows against the asset to bet on, for example, USDT, and sells it in USD. If the price falls, he buys back the USDT at a lower price, returning the amount borrowed and making a profit on the fall in price.

The CTO comments that this has been the behavior of hedge funds. They take advantage of the current fear that the cryptocurrency market is experiencing, unfounded by the fall of Terra USD last May. Within this hurricane of distrust, UDST was affected, losing its parity slightly and recovering again later.

However, while the CTO reassures Tether’s reserves, this is not the first time people have questioned them. In early 2021, Tether published a report on its stablecoin reserves. In it which they claimed to have more than $35 billion in reserves. However, some specialists doubted the reliability and convertibility since cash, or cash equivalents, back all of them.