A report published by Bitcoin maximalist Jesse Myers claims that Bitcoin could absorb 25% of the world’s wealth by 2030.

In a recent publication, Bitcoin expert Jesse Myers claims that Bitcoin could absorb 25% of the world’s wealth. This scenario, he explains, positions BTC as one of the most attractive investments. Consequently, Myers explains, Bitcoin would have to reach a price of $10 million per coin or more to do so.

Myers’s position may look exaggerated because of his drastic optimistic scenario for the long term. Still, BTC increased more than 70,000% in the last ten years after touching its all-time high of $69,000, according to information from Investing.

Why could Bitcoin absorb 25% of the wealth?

Myers explains that analyzing Bitcoin’s value proposition is crucial for his clarifications. It is necessary to consider many scenarios to ensure that Bitcoin can absorb 25% of the world’s wealth in a few years.

Its ability to catch value over time and become increasingly solid and bulletproof makes Bitcoin a volatile but very safe investment in cyber terms if you leave aside the loss of keys and theft from centralized platforms (at this point, that is a different matter).

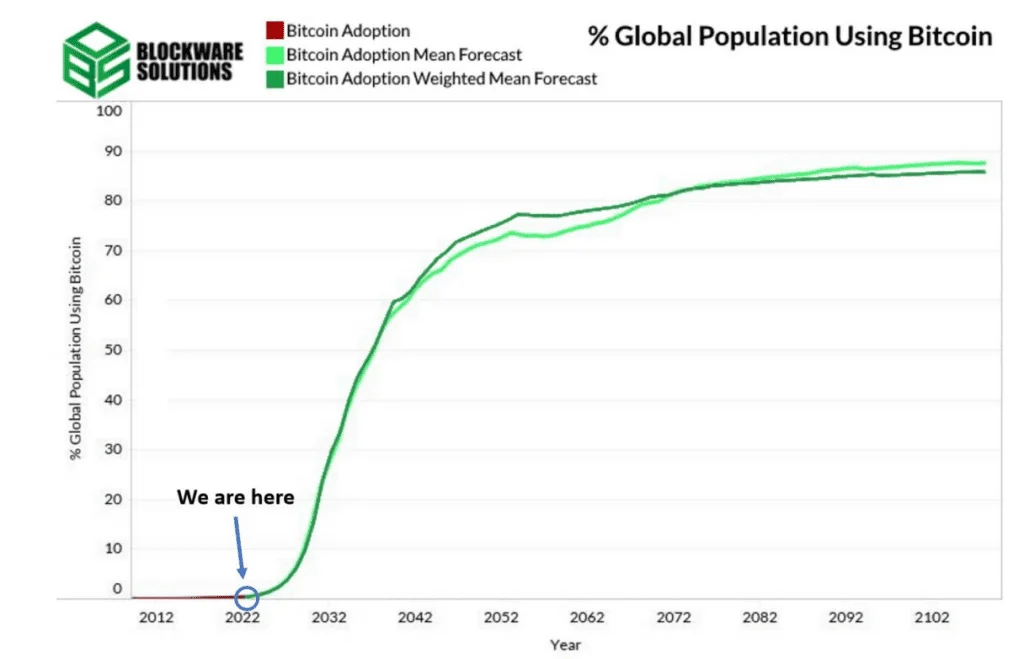

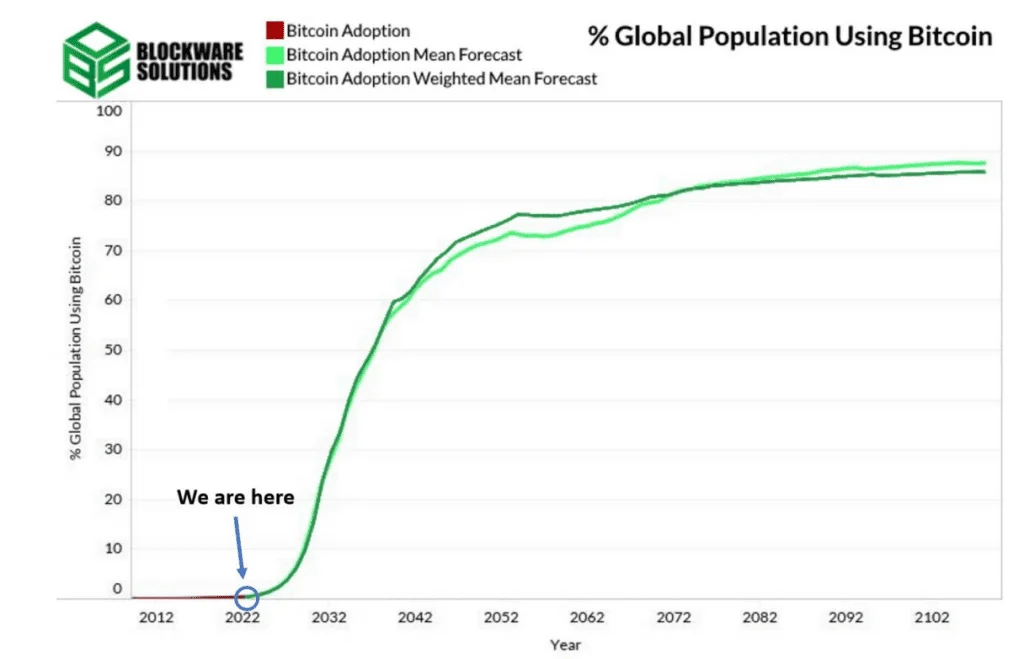

Bitcoin’s unique and attractive properties make it one of the best stores of value. In his paper, Myers comments: “The value stored in Bitcoin becomes more valuable over time due to Bitcoin’s design of increasing scarcity: it just has to survive the (admittedly brutal) volatility along the way.” Over time, more and more people will relate to Bitcoin. That has been happening, and Blockware Solutions expects it to continue similarly.

Although Bitcoin maximalists claim there is no cap, there is. Myers makes this very clear, although he also explains that we are still far from reaching it. As a store of value, Bitcoin faces many challenges, and other assets of the same type are far less volatile.

The chances of the world’s millionaires deciding to sell their mansions or Rembrandt or Fabergé eggs to buy Bitcoin are close to zero. If, as it has been doing, Bitcoin increases in value rapidly every four years. Therefore, the wealth directed toward the cryptocurrency, as a store of value, will also increase. Bitcoin accounts for 0.05% of global investment, but this figure will continue to rise rapidly and steadily if the Bitcoin price maintains its four-year cycle.

Bitcoin could appreciate 500-fold in value over the next few years

Myers’ conservative estimates put Bitcoin at an extravagant $10 million per coin. But it is not unreasonable to think that this could happen.

“Overall, my assessment of where Bitcoin’s ceiling is simple… It’s very high. Almost to the point where I’m embarrassed to show my analysis. My conservative estimates suggest an outrageous total potential for Bitcoin’s price: $10 million/Bitcoin, in today’s dollars.”

Jesse Myers

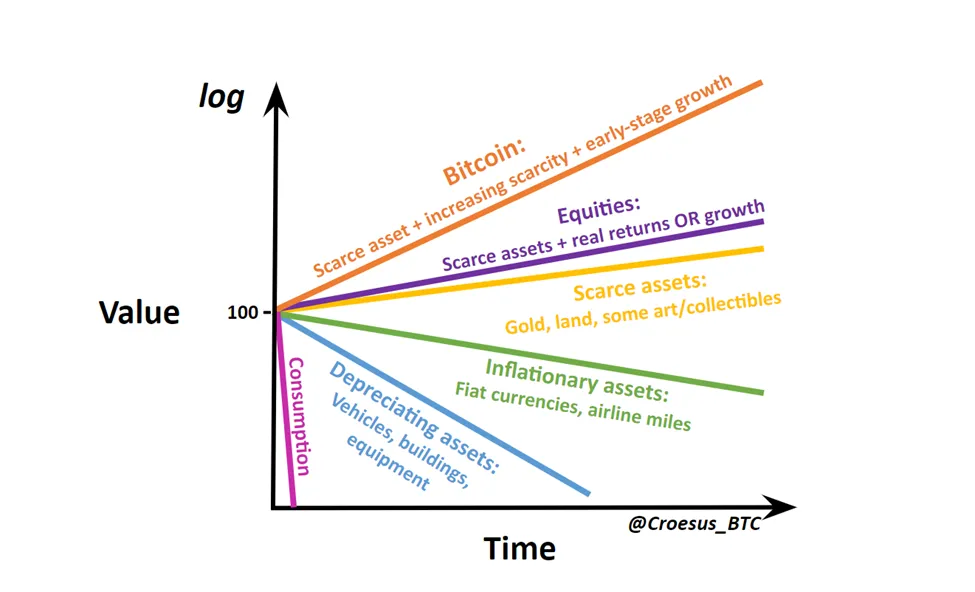

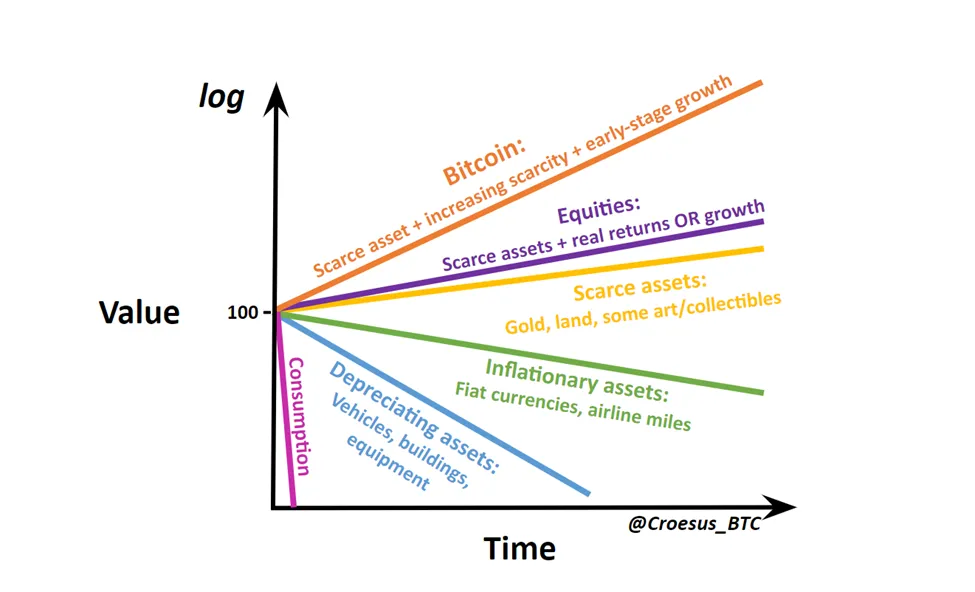

The above chart, published by Myers on his blog, compares macro assets over time. Bitcoin’s upward price trend is a natural ecosystem design, and Myers is not alone in expecting this to happen. In its worst-case scenario, ARK Invest puts Bitcoin at least $258,000 by 2030. The investment firm is convinced and has repeatedly reported that Bitcoin will only get stronger as the years go by.

As we see then, the cases of scale in the price of Bitcoin are diverse, but they all point to a single possibility, the exponential increase, which would mean even a revaluation of up to 500 times. Consequently, to think that Bitcoin could absorb 25% of the world’s wealth is not a far-fetched prediction, but it is quite true that there are still many moons and bearish cycles ahead for this to happen.