Bitcoin’s smaller addresses reached an all-time high recently, suggesting considerable growth in the user base.

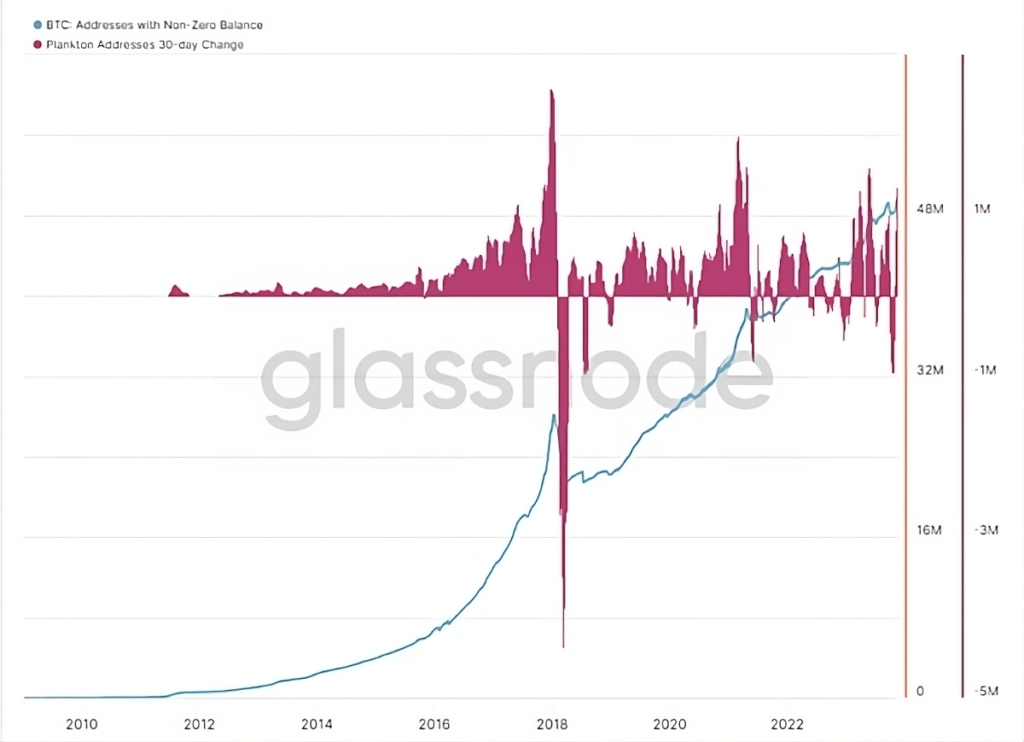

Small Bitcoin Wallets Reach Record Highs. Since Bitcoin’s good momentum resumed in 2023, small Bitcoin wallets have risen sharply. The numbers show retailers must catch up to enter the pioneering cryptocurrency ranks. Similarly, we can also interpret this boom as a continuation of the robust growth of the BTC user base. In such a way, the Bitcoin network celebrates the arrival of the goal of more than 50 million funded addresses, i.e., with a non-zero balance.

But you can see the actual movement in the so-called Plankton cohort. The latter is a category of addresses with 0.01 BTC or less, which are seeing explosive growth, especially recently. It is worth mentioning that this type of wallet represents a barometer for assessing the growth or decline of user entry to the network. In any case, enthusiasm continues rampant among enthusiasts of the most significant virtual currencies. In this sense, most analysts are confident that the accumulation phase will soon end to give way to a new uptrend. This latest bull run would close with new all-time highs, possibly in 2025.

User interest in Bitcoin rebuilds

As mentioned above, this exponential growth in small Bitcoin wallets indicates the revival of interest. The moves of large investors would sooner or later end up infecting retailers. Precisely, that is what is happening right now. As a result, recent data suggests 37.5 million Plankton cohort addresses. To get a complete sense of the good momentum, people added 1.6 million in 30 days. This month is the first time such a significant increase has occurred in an extremely short period.

Those numbers add to the total of 50 million non-zero balance addresses. Following Glassnode’s data, you can appreciate that in 2017, there was only half this amount. In 6 years, the number of BTC fraction holders doubled. Analysts expect new record inflows if the anticipated approval of a spot Bitcoin ETF on the stock exchange materializes. Thus, the figure of 1.6 million new small Bitcoin wallets in a month could stay the same.

At the time of writing, the price of the queen of digital currencies is $37.126 per unit, translating to a -0.6% return on a 7-day timeframe. In the 30-day arena, it still maintains green numbers with a growth of 8.9%. A similar fate is experienced by the rest of the main coins on the market, judging by the data offered by the CoinGecko portal.

Custodial wallets vs exchanges & ETFs

When it comes to Bitcoin and other cryptocurrencies, many individuals and organizations opt to use exchanges to manage their digital assets. However, there is a growing trend towards non-custodial wallets, which many consider safer than exchanges. In this context, a non-custodial wallet refers to a software program or app that allows users to manage their assets without depending on a third-party service provider. One of the most significant risks associated with exchanges is the possibility of hacking or theft. Since exchanges are centralized platforms that store large amounts of digital assets, they are a prime target for hackers. In contrast, non-custodial wallets are decentralized and do not store digital assets in a central location. Instead, users have complete control over their private keys to access and manage their digital assets.

Another advantage of non-custodial wallets is privacy. Exchanges require users to supply private information, such as their name, address, and national IDs, which can cause concern for those who value privacy. On the other hand, non-custodial wallets do not require users to provide personal information, allowing for greater anonymity. Non-custodial wallets also allow users to transact with anyone they choose without an intermediary. The absence of a man-in-the-middle means that users can send and receive digital assets without relying on a centralized platform, which can be especially useful in countries where access to exchanges is restricted.

Moreover, non-custodial wallets allow users to maintain control over their assets and evade the risks related to third-party custody. With a non-custodial wallet, users are the sole owners of their digital assets, and they can choose to store them offline or on a secure hardware wallet, giving users greater peace of mind, knowing that their digital assets are controlled and not subject to the risks associated with exchanges.

In conclusion, non-custodial wallets offer several advantages over exchanges. They provide greater security, privacy, and control over assets, making them an appealing option for individuals and organizations looking to administer their digital assets safely and securely.