Visa wants to open the doors to exchange stablecoins and CBDC with their created protocol.

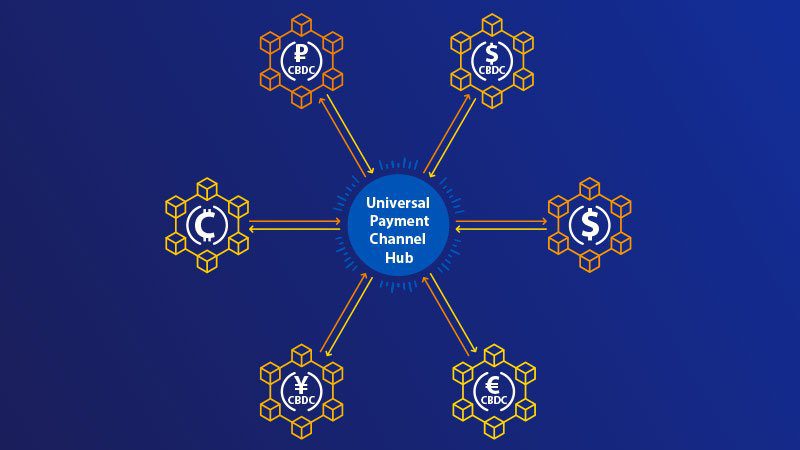

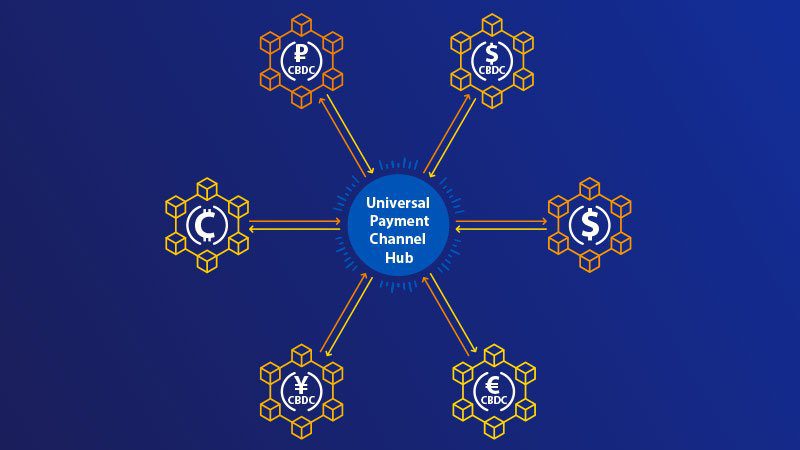

Visa develops a platform to trade stablecoins and CBDCs. The international financial services corporation Visa has developed a new concept called “Universal Payment Channel” (or UPC). In the future, this new tool will open the doors to interconnect multiple blockchains, which will allow the transfer of stablecoins and central bank digital currencies (CBDC), among other assets.

In a statement from Visa, they explain that UPC should be seen as a:

“Universal adapter between blockchains, which will allow central banks, businesses, and consumers to exchange value, regardless of the currency form factor seamlessly.“

Also, all this would happen instantaneously across multiple networks and be compatible with several digital wallets. As envisioned by Visa, central bank digital currencies are likely to “play an important role in the future,” as “over the past two years, central banks around the world have shown increasing interest in exploring CBDCs.”

Approximately 80% of the world’s central banks are exploring CDBC use. In addition, 40% are already conducting proofs-of-concept.

UPC would work outside blockchains

Visa undoubtedly wants to leverage CBDCs with the Universal Payment Channel. In that sense, they believe that the success of CBDCs implies the ability to make and receive crypto payments, regardless of currency, channel, or form factor, and that is where the UPC concept announced by the company would fit in.

Later, Visa explains that “specialized UPC payment channels would be established outside of blockchain and would leverage smart contracts to communicate with the various networks securely and reliably and improving speeds, overall.“

Visa aims for greater integration of stablecoins

Visa’s interest in working with stablecoins already has a history. Last May, the company settled its first transaction with the USD Coin (USDC) stablecoin. The transaction was a pilot scheme in which the Crypto.com exchange and digital asset bank Anchorage also participated. Visa has previously shown interest in crypto integration, as reported in this post. They planned to leverage their current payment network to implement crypto payments from blockchains.

More resources

- Visa Research Paper on UPC (PDF)

- Payments for CBDC via Universal Payment Channels: Policy Guidance (PDF)