The rise in the price of digital currency puts it in that ranking alongside the likes of Apple, Amazon, and Microsoft.

In Short

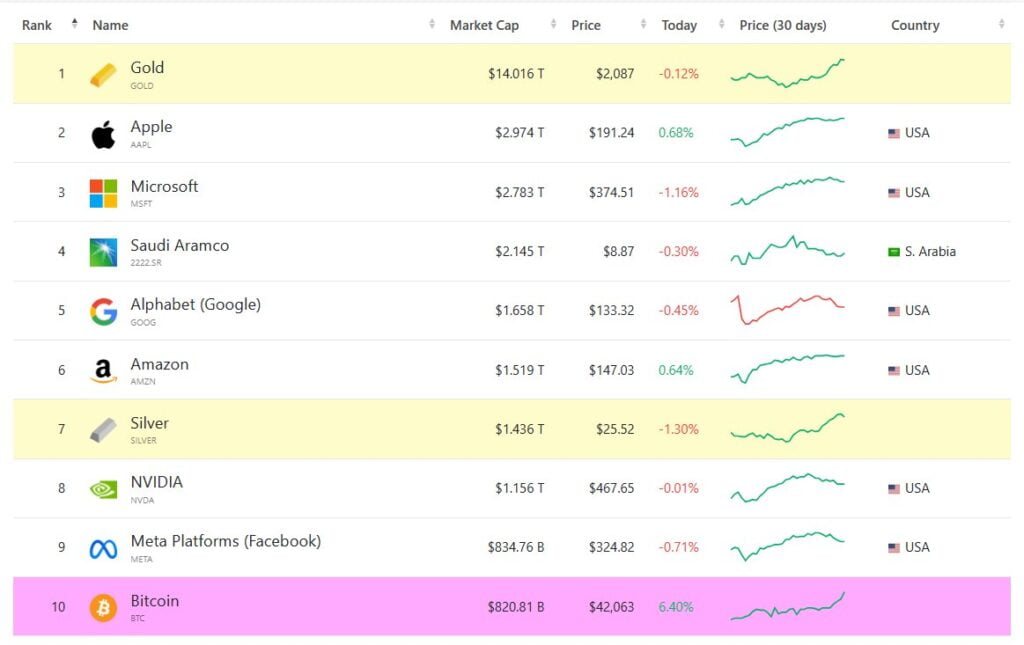

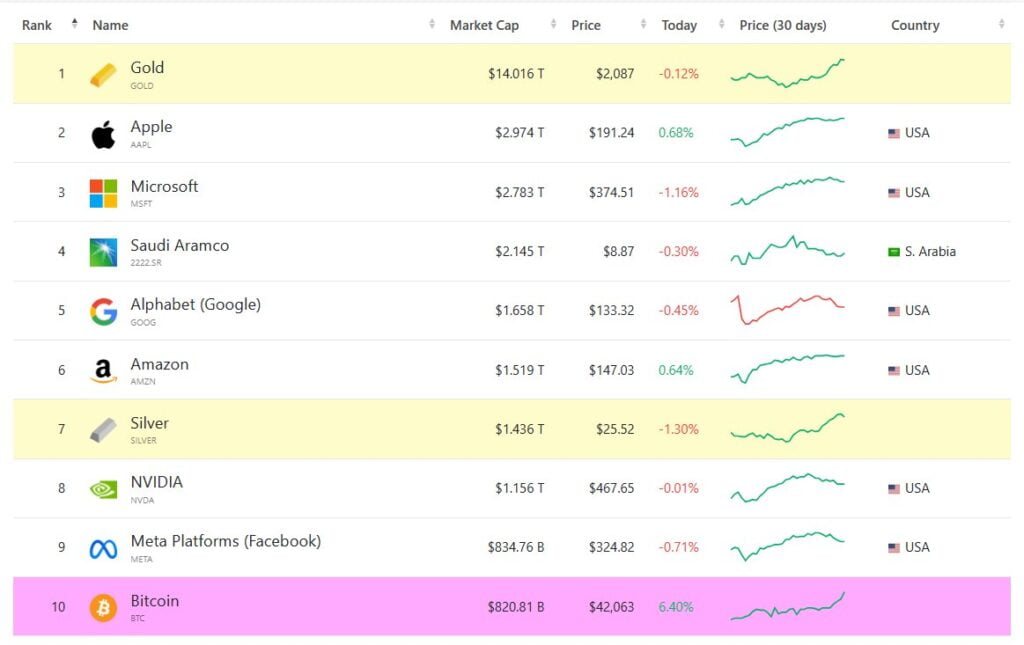

- The market capitalization of bitcoin is $820 billion.

- Bitcoin had already been in the top 10 during the 2021 bull cycle.

Bitcoin is back in the Top 10 Most Valuable Assets. Bitcoin (BTC) has regained its position in the select group of the world’s ten most valuable assets. The digital currency had a dizzying surge during the current trading day, surpassing $42,000. The number represents a 12% rise in its price in seven days. The movement in price has propelled Bitcoin’s market capitalization to $820 billion. Bitcoin jumps to the same category as corporate giants such as Apple, Amazon, and Microsoft.

This milestone marks the return of Bitcoin, which had already been in the 8th position during the bull cycle of 2021, following in the footsteps of silver market capitalization. Bitcoin reached the 8th spot a day before reaching its all-time high of $69,000. At the top of the list is gold, the most valuable asset in the world today. It has a market capitalization of 14 trillion dollars. Silver ranks seventh in the top 10 most valuable assets with $1,400 billion. At the moment, bitcoin now exceeds the market value of the U.S. company Berkshire Hathaway, owned by tycoon Warren Buffet, a confessed anti-bitcoin. His company currently has a market capitalization of 777 billion dollars. Likewise, the digital asset has outperformed other companies such as Tesla, owned by Elon Musk, and international payments giant Visa.

Bitcoin Expectations

Bitcoin has taken off its price and capitalization motivated by the high expectations generated by the proposals for bitcoin spot exchange-traded funds (ETFs), which SEC will likely approve in January 2024. To this, economist Tuur Demeester adds other macroeconomic factors such as the historical high reached by the price of gold, the initiative to eliminate the Central Bank of Argentina proposed by President-elect Javier Milei, next year’s halving, and the expansion of Bitcoin layers 2.

The next Bitcoin halving is an event that will occur in the year 2024. It is a pre-programmed event that happens every four years. The mechanism will reduce the rate of Bitcoin generation. The halving is a crucial part of the Bitcoin protocol, and it is one of the reasons why Bitcoin is considered a deflationary currency. The reward for mining a new block on the Bitcoin network during the halving cuts in half. Miners will receive half the amount of Bitcoin they used to receive for verifying transactions and adding them to the blockchain. The current reward for mining a block is 6.25 BTC, which will reduce to 3.125 BTC after the halving.

Bitcoin Halving

The halving is significant because it reduces the supply of new Bitcoins entering the market. This reduction in supply, combined with the increasing demand for Bitcoin, would drive up the price of Bitcoin. In the past, the halving connects to a significant increase in the price of Bitcoin, and many investors and traders are anticipating a similar outcome in 2024. However, it is essential to note that halving is not guaranteed to lead to a price increase. Many factors, including market sentiment, adoption, and regulatory developments, influence the price of Bitcoin. Therefore, while the halving is an essential event for Bitcoin, it is not the only factor that will determine the future price of Bitcoin.

In conclusion, the next Bitcoin halving is an event that will occur in 2024. It’ll reduce the rate of Bitcoin creation. It would also drive up the price of Bitcoin. However, it is essential to remember that many factors influence the price of Bitcoin. The halving is not guaranteed to lead to a price increase.