Cryptocurrencies as a resource for dealing with debt capitalism

The birth of cryptocurrencies, with Bitcoin as a protagonist, occurred in a specific economic and social context. A context in which many countries were playing with the value of our money and, to a certain extent, our lives. They did so by starting up the banknote-generating machine using a traditional, graphic, and concrete image. With Bitcoin, there were more rational ways of conceiving money. It was more reasonable than resorting to that banknote machine or debt every time the coffers were empty.

Cryptocurrencies and capitalism

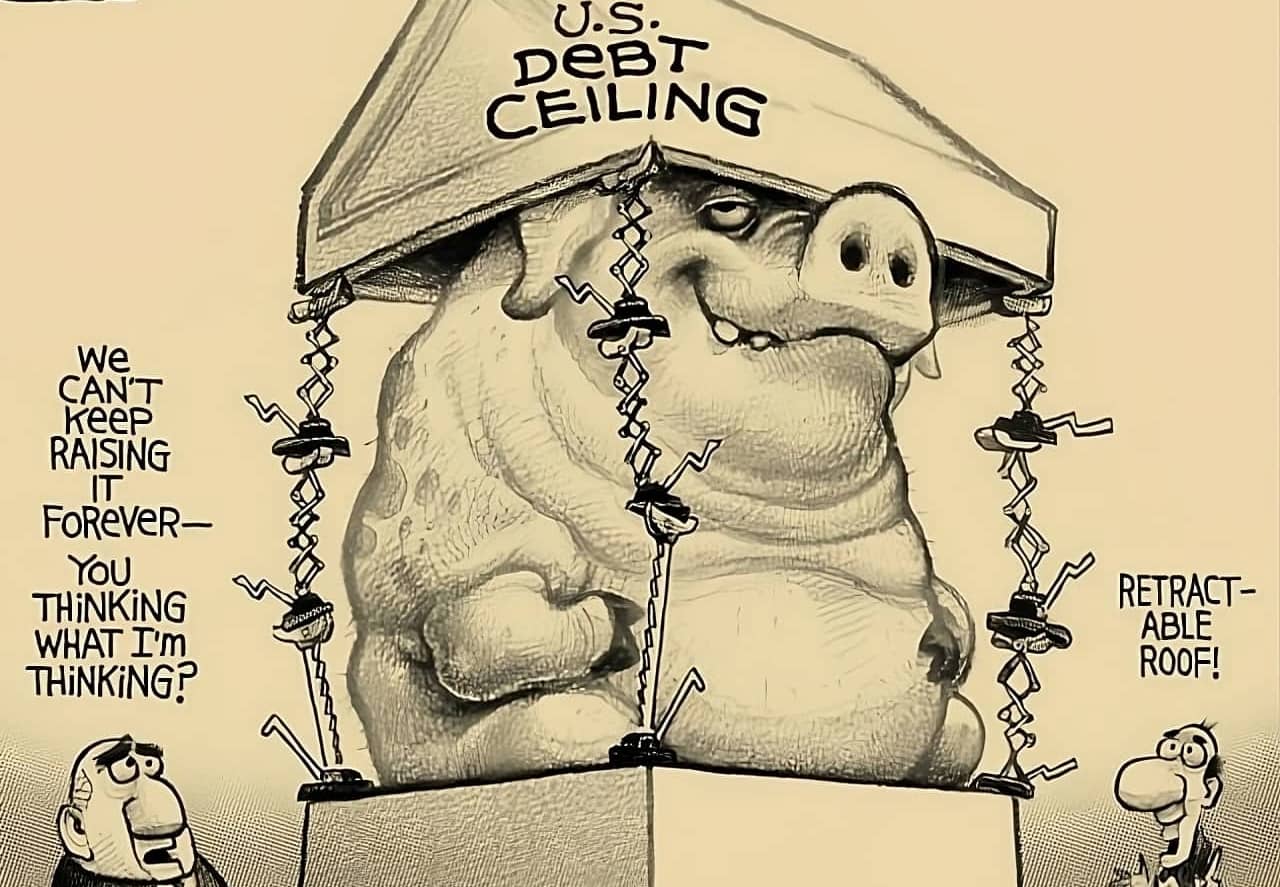

The debt bomb of the different countries is there—a bomb whose explosion is a matter of time. German economist Wolfgang Streeck summed it up in the title of his most successful book, Buying Time. With debt, capitalism is buying time. The uncertainty lies less in the fact of the explosion itself than in the exact timing and, above all, its consequences. The current inflationary process has primarily caused the increase in public debt experienced by states to cope with the economic effects of the COVID-19 pandemic.

The world is living economically, financially, and environmentally beyond its means. Some countries are indeed more than others. The Spanish State has been living on credit since November 30. Everything the Spanish State spends after this date generates deficit and debt. If it could only count on the resources developed, hospitals, schools, and the extensive state extension in the different daily areas would be closed today. Fortunately, there is the possibility of debt! But then the question is how long.

Debt Capitalism and Cryptocurrencies

Debt capitalism is not what sociologist Max Weber aimed at in the texts constituting The Protestant Ethic and the Spirit of Capitalism. Debt-based capitalism was not in that spirit. Among other things, because it was a forward-looking spirit. Capitalism is finding it increasingly difficult to look to the future. Above all, there is a succession of regular debt payments on the horizon. The future of capitalism, based on the Protestant ethic, is intertwined with sovereign debt capitalism, as investors primarily fuel this debt.

The most striking thing is how society, embodied in the expression of citizens when voting, leaves aside the problem of public debt. At the end of 2022, each Spaniard owed €31,280. Almost two and a half times the average annual income on that same date. A figure higher than the yearly income of nine out of ten Spaniards.

Minimum Living Income

By the end of 2023, this figure owed by each Spaniard will be substantially higher. But it is not seen as a problem for the future of this society. No. In everyday conversations, it tends to appear as someone else’s problem. Someone else’s, the State’s. As long as everything remains the same in the present, why worry? As long as hospitals continue to function, schools open their doors every morning, civil servants receive their salaries, and recipients of subsidies, benefits, grants, and other transfers receive their income, why worry?

Well, it does worry some people. Especially those who most need to have expectations for the future, such as young people. Those who resist conceiving a non-future rooted in subsistence welfare because they are vitalists. Thus, it is unsurprising that Spain is the third country possessing cryptocurrencies in Western Europe. According to the results of the ECF (Financial Competence Survey 2021), conducted by the Bank of Spain, 5.22% of Spaniards over 18 years of age have acquired cryptocurrencies, and 4.81% still hold them.