People in regions such as Latin America or Africa are impacted by inflation and expressing greater interest in Bitcoin and other cryptocurrencies.

In Short

- People in Mexico and Brazil express great interest in adopting cryptocurrencies.

- People have started to recognize crypto-assets as a haven asset in Latin America.

This report shows why you need Bitcoin. Inflation drives the global population’s adoption of Bitcoin (BTC) and other cryptocurrencies. That’s the conclusion of a U.S.-based crypto-asset exchange Gemini study conducted to understand how the planet is approaching digital assets.

After surveying nearly 30,000 people in 20 countries, the team behind Gemini found that populations most impacted by inflation are five times more likely to buy cryptocurrencies in the coming months than those living in regions with a lower cost of living, as the report notes.

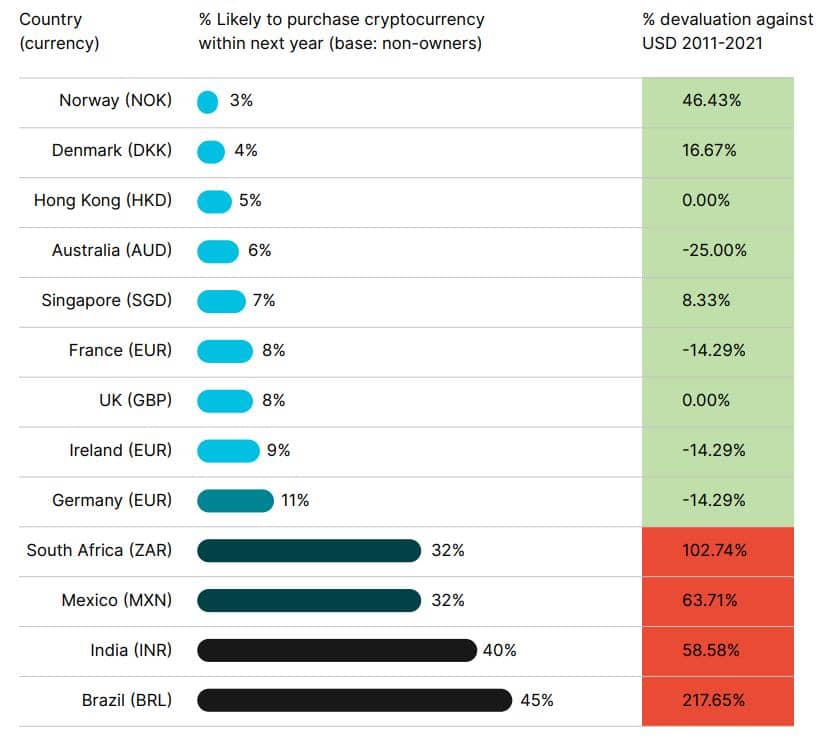

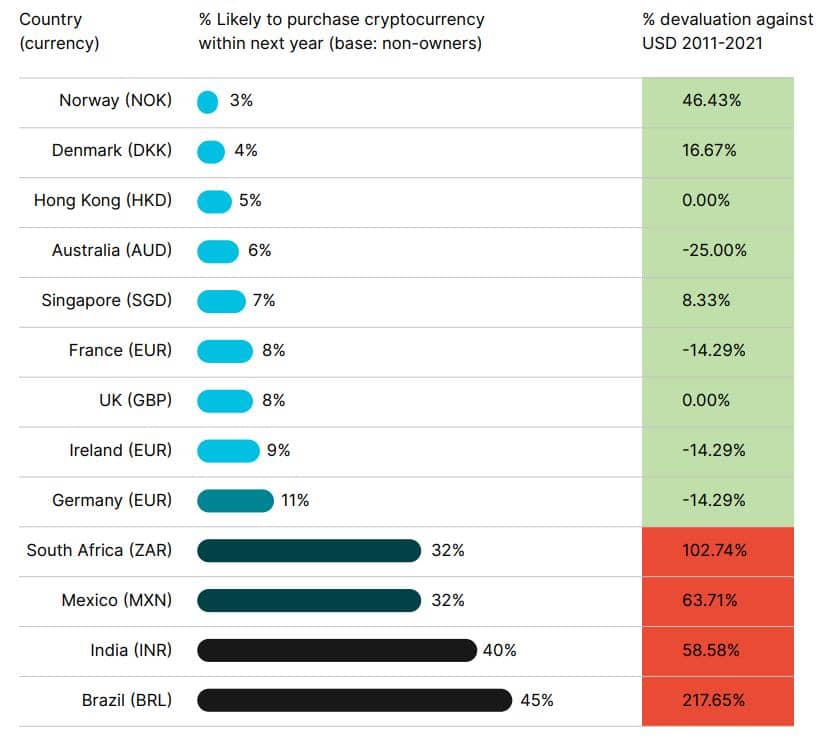

The document includes a list of countries with the most significant devaluation of their currency, listed in red in the graphic below. Therefore, these are the areas where the population is more likely to acquire Bitcoin or other crypto assets.

For example, in Latin American countries such as Mexico and Brazil, whose currency has lost 60% of its value against the dollar, the interest in acquiring BTC is above 32%. Buying intention is much higher in these high-inflation countries than that expressed by the inhabitants of other areas, such as Singapore, whose currency only lost 8.33% of its value against the dollar in 10 years.

The inhabitants of Brazil, whose currency has devalued by more than 200% in 10 years, are five times as likely to buy Bitcoin as Ireland, where the intention to buy cryptocurrencies is at 9%.

Inflation, a driver of Bitcoin adoption in LatAm and Africa

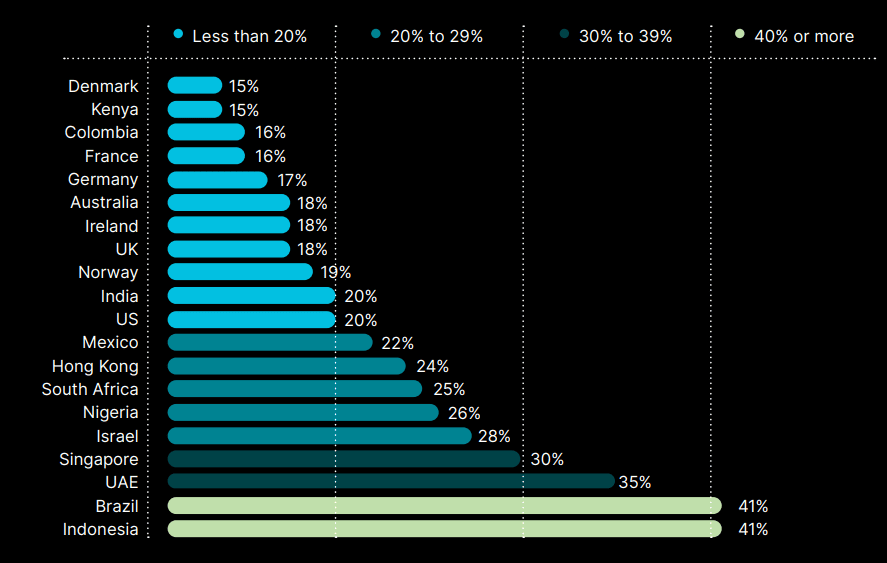

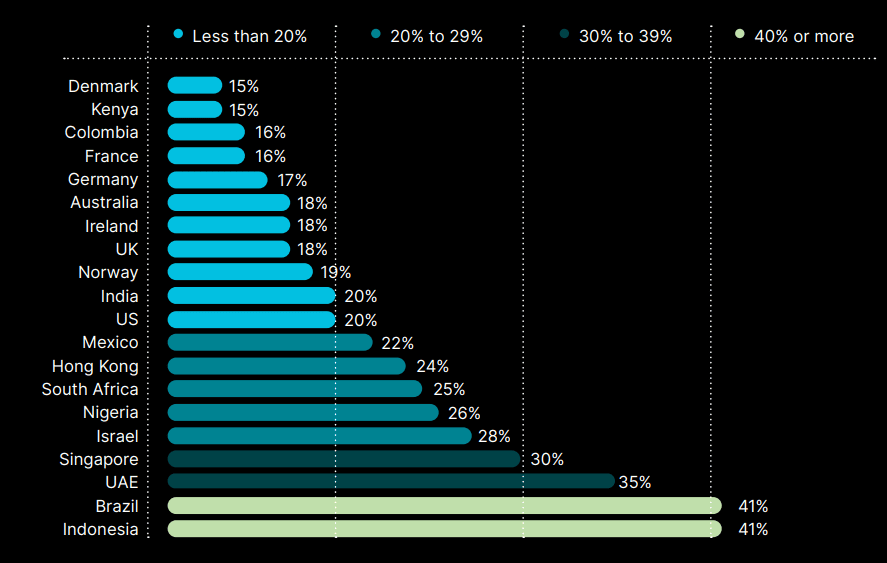

Nearly half (46%) of Latin America and African respondents note that cryptocurrencies, such as Bitcoin, are a perfect way to hedge against inflation. However, the report adds that in regions where the national currency has not experienced long-term changes, respondents were much less likely to recognize Bitcoin as a safe-haven asset.

“Most cryptocurrency owners in almost all regions said that owning crypto assets is a good way to diversify their assets. 3 out of 4 people (78% of respondents) expressed this opinion in Latin America,” Gemini team.

“Other parts of the world are much more affected by inflation and loss of investment opportunities than we are,” said Patrick Hansen, a member of Europe’s cryptocurrency community, commenting on Twitter on the Gemini report.

The report warns that Latin America, Africa, Asia, and the Middle East, are regions more affected by inflation than Europe and the United States. Another user of the micro-messaging network joined the thread, warning that people in the areas most affected by inflation are turning to cryptocurrencies because they can no longer take refuge in the U.S. dollar or the Euro.

“If they could use EUR and USD as an inflation hedge, that might mean that cryptocurrencies could not be an inflation hedge after all,” he added. U.S. inflation keeps rising and breaking a 41-year record. Authorities are marking inflation as the new global pandemic.