What are Bridges, the links that enable interoperability between blockchains? In this post, we tell you about bridges’ critical role in allowing the interconnection of different blockchains.

What are Blockchain Bridges? One of the main problems with blockchains is that they work differently. This setback, which generates serious difficulties, is solved with bridges. It is worth taking a look at how they work.

Although the underlying technology is the same, the slightest change between blockchains makes them incompatible. This problem occurs, for example, with blockchains such as Bitcoin and Bitcoin Cash or Ethereum and Polygon. Examining the code of these blockchains, we can see they have many things in common. However, the smallest differences make them incompatible, causing them to be unable to interoperate.

Today, interoperability is an essential element of the digital world. Without interoperability, our digital life would be a complete disaster. Let’s imagine that an Android user takes a beautiful picture and wants to share it with his friends who have iOS. If there were no compatibility between the two systems, he would not be able to, and his friends would never be able to see the beautiful landscape captured with his mobile camera.

Interoperability and compatibility between systems allow us to do multiple tasks, from sharing an image to the Internet servers being able to offer information to whoever needs it, as long as they use the appropriate protocol. This concept, which seems so simple, was a severe problem in the early days of blockchain because it could not be executed securely and decentralized. Today, that possibility exists, thanks to bridges.

What are bridges in blockchain?

A bridge is a system that allows us to exchange information between blockchains. It is an information gateway that can operate in a centralized or decentralized way. In this way, users can pass data (tokens, NFTs, or cryptocurrencies) from blockchain A to blockchain B with a simple fee payment. Thus, the primary use case of bridges is to transfer value from one blockchain to another, applying to cryptocurrencies, tokens, or Non-Fungible Tokens (NFT).

Centralized bridges have been around for a long time and in different formats. For example, an exchange is a bridge because it allows information to pass from blockchain A to blockchain B. The problem is that intermediation requires trust and has limitations, given by the nature of the exchange itself. How can we avoid this? How to leave the centralized scheme and move to a decentralized one?

It all started with the advent of colored coins in Bitcoin. Colored coins are a “primitive” form of what we know today as tokens in networks such as Ethereum—creating them required particular transactions in Bitcoin so that modified Bitcoin nodes could detect and account for them. All of this took place on the Bitcoin blockchain, without the need for robust Smart Contracts and with much lower fees than we see in Ethereum. The problem is that creating colored coins and generating the corresponding bridges to transform Bitcoin into the desired colored coin was a complex task. However, the developers of colored coins were the first to design and test this concept. OmniLayer protocol still uses colored coins, on which a fortune in USDT tokens still rests.

Ethereum and DeFi changed the perception of bridges

The arrival of Ethereum, with a much more mature ecosystem, made it much easier to build bridges. However, it would not be until 2017, coinciding with the irruption of Decentralized Finance (DeFi), when bridges began to gain traction in the community. The reason is that the utility of bridges lies in transferring value between one chain and another. Before DeFi, people had a limited need for bridges. Centralized exchanges were the big winners. Some decentralized exchanges did not even need this type of function, as is the case of Bisq. It was the so-called decentralized finance (DeFi) that changed everything.

The need to interconnect value between Ethereum and the rest of the ecosystem drove the development of these solutions. The appearance of the first DEX and the massification of their use placed bridges in the space they occupy today. Thanks to them, we can send cryptocurrencies, tokens, or NFTs, from one blockchain to another without problems, thus solving the severe pain of blockchain interoperability and underlining the evolution of the ecosystem.

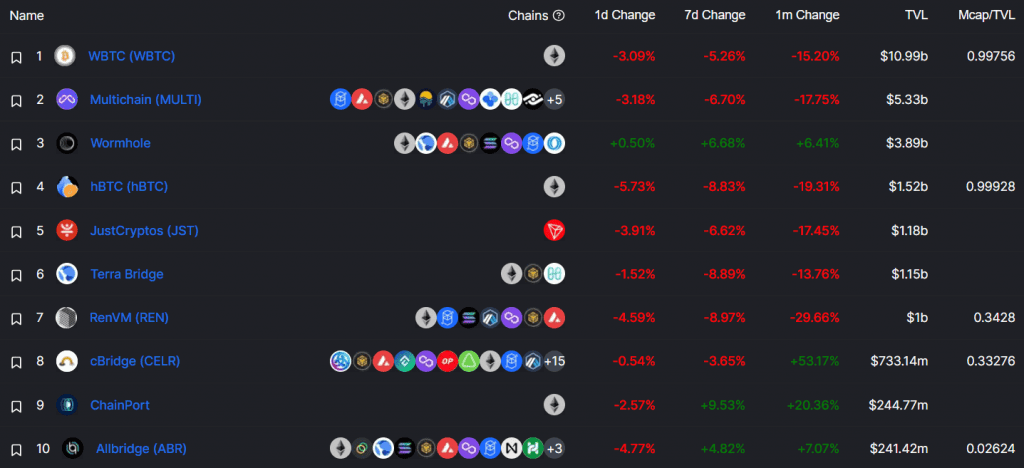

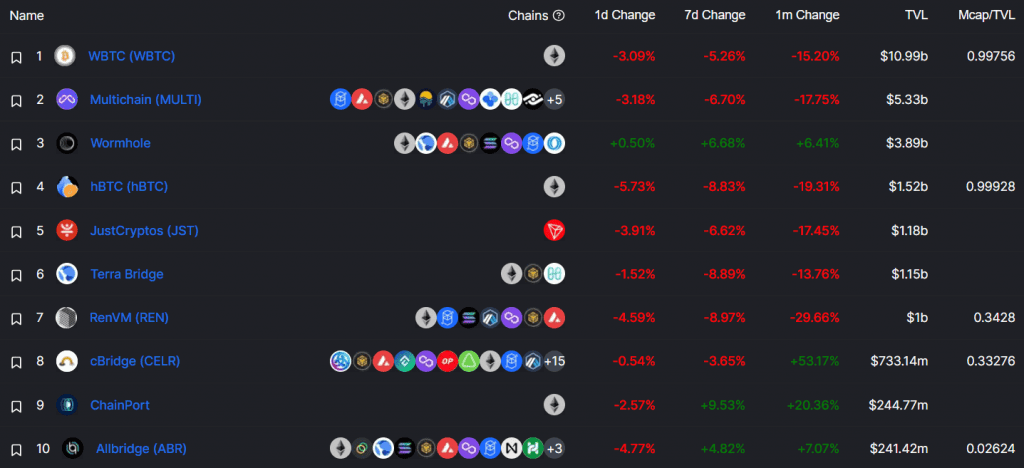

The top twenty bridge protocols in the crypto ecosystem have a blockchain value of over $25 billion. Top of the list is wBTC, Multichain, and Wormhole.

How do they work?

We can simplify bridge operations can into four points:

- The bridge is between chains A and B, creating the basic structure for its operation. The structure requires the creation of smart contracts that interconnect both chains and allow the exchange of information between them.

- If you want to pass a token from A to B, go to the bridge, indicate the number of tokens you wish to exchange in A, and provide the destination address in B. At this point, the bridge gets your money from A chain and directs it to a vault controlled by a Smart Contract. The same smart contract notifies a blockchain oracle of the action and the data to continue the process on the B blockchain.

- The smart contract in blockchain B detects the information in the oracle. It is there when it starts with the token minting process in that blockchain. Once the process finishes, it sends the tokens to the address indicated by the user.

- The tokens get blocked in A as collateral for the tokens in B, and you can only recover them by doing the opposite process.

The abovementioned process is just a primary and elementary way, but it applies to most bridges. In the end, each implementation depends on the utility and capabilities of the bridge. For example, transferring cryptocurrencies or tokens is not the same as NFTs. In the latter case, associated data must be maintained, such as the image, video, or other data interpreted as the NFT.