Ethereum leads the cryptocurrency market, surpassing Bitcoin in several aspects.

In Short

- Bitcoin typically leads cryptocurrency trading but has been dethroned in some respects.

- Ethereum surpassed Bitcoin in settlements and options open interest.

Ethereum Outperforms Bitcoin Trading Operations. Expectations that Ethereum will merge in September 2022 have increased traders’ demand. Ether (ETH) trading has grown to such an extent that it has surpassed bitcoin (BTC) in several aspects, managing to lead the cryptocurrency market.

You can see the effect in the number of settlements both cryptocurrencies achieved in the last 24 hours. While BTC settled some USD 23.32 million, ETH doubled that amount for a total of $48 million, according to Coinglass. It is usual for more bitcoin trades to settle because it has more trading, so its dethronement in this period is striking.

However, you can appreciate the most exciting metric regarding trading volume for the Ethereum cryptocurrency in options contracts. In particular, ether outperformed BTC in options open interest. In other words, it has a more significant number of open positions in this derivative than those also trading in the BTC market.

ETH outperforms BTC’s open interest

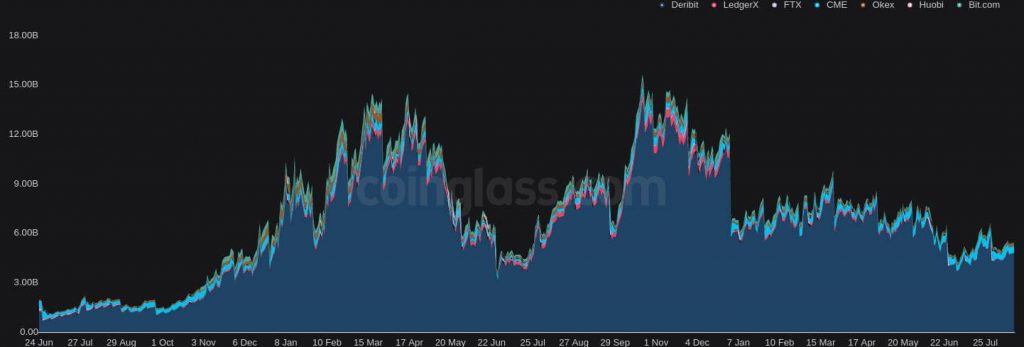

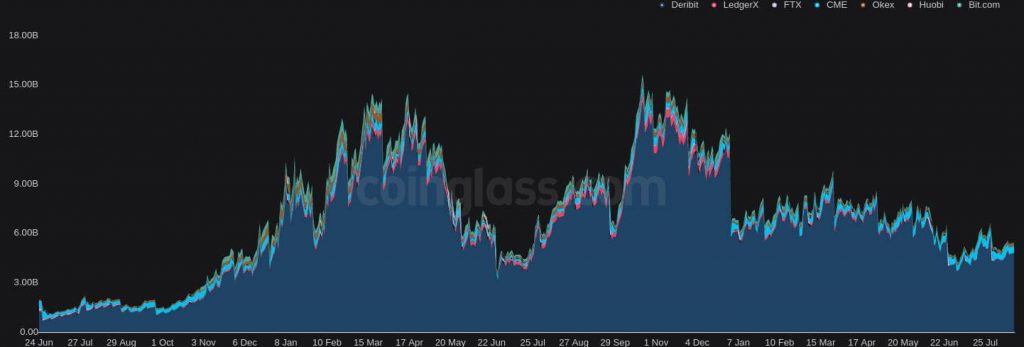

Ethereum options open interest reached $8 billion on major exchanges, an all-time high, according to explorer Coinglass.

In stark contrast, Bitcoin’s open interest is below with a total of $5.4 billion. Bitcoin achieved its all-time high in options open interest almost a year ago, at the end of October 2021, for $15.6 billion.

ETH thus continues to outperform BTC in this metric, a milestone it first achieved in late July 2022, driven by expectations for the Ethereum network upgrade. ETH options open interest hit an all-time high, surpassing BTC volume, below its highest peak touched nearly one year ago, according to this on-chain analysis. Ethereum options open interest hit $8 billion on major exchanges, an all-time high.

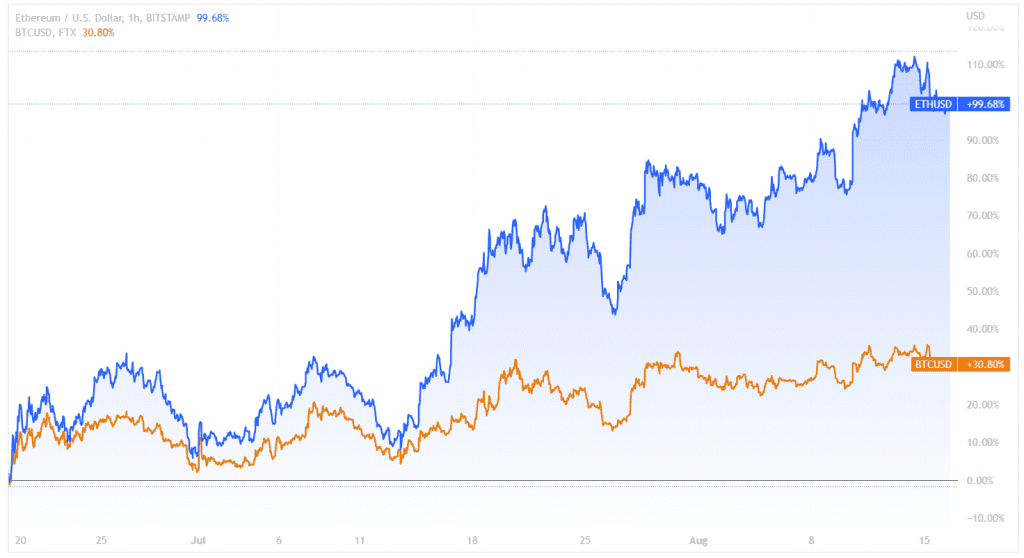

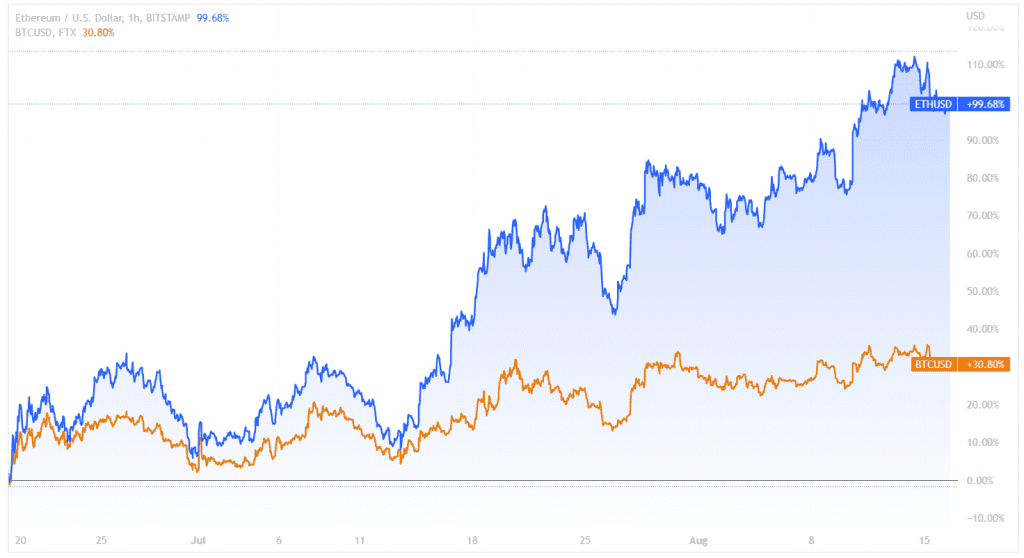

In addition, some on-chain explorers recorded that Ethereum surpassed its all-time high last week for the number of addresses with more than 10 ETH. The numbers reflect the increased activity in the spot market from traders looping the cryptocurrency. Something that has been seen in the price rise is that ETH has had three times higher than BTC since its annual low.

The price of ETH has increased more than 100% since its annual low occurred in June, which means a rise three times higher than BTC in this period.